Brazil CPI Review: 0.5% Rise in May and Worsening Conditions

Brazil’s CPI grew by 0.46% in May, exceeding expectations. Year-over-year CPI rose to 3.9%, driven by significant increases in food and beverage prices. Services inflation also increased. Strong labor market demand and supply disruptions from floods are pushing prices up. With the BRL devaluation and rising fiscal risks, inflationary pressures are mounting. The BCB may likely pause rate cuts in June as it faces a challenging inflation outlook.

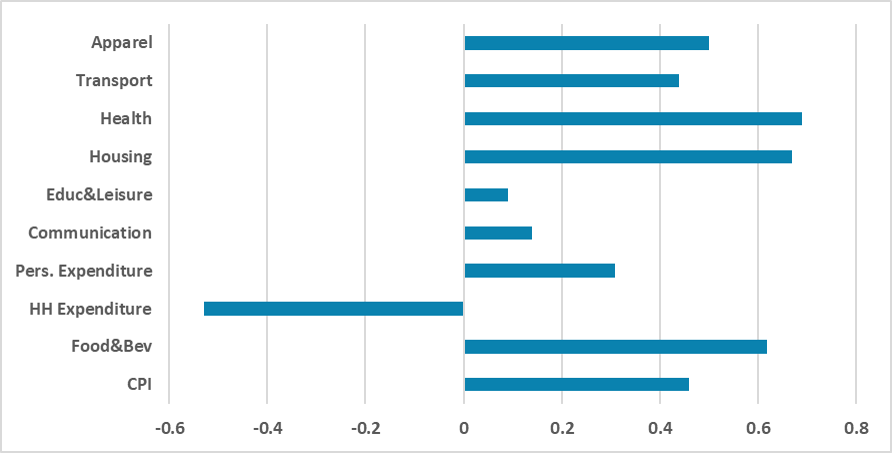

Figure 1: Brazil’s CPY by Group (%, m/m)

Source: IBGE

The Brazilian National Statistics Institute has released the CPI figures for May. The data show that the CPI grew by 0.46% during May, slightly above market expectations of 0.42% according to the Bloomberg Survey. Therefore, year-over-year CPI has risen to 3.9% from 3.6% in April. The biggest impact on CPI growth during the month was the rise in the Food and Beverages group (0.6% month-over-month), influenced strongly by the increase in the prices of potatoes (20.6%), onions (7.9%), and milk (5.4%). Housing grew by 0.5% due to rises in the electricity bill (+0.9%) and sewerage services (0.7%). Health grew by 1.1%, influenced by the authorized rise in healthcare plans. The good news during the month came from household goods, which contracted by 0.3%.

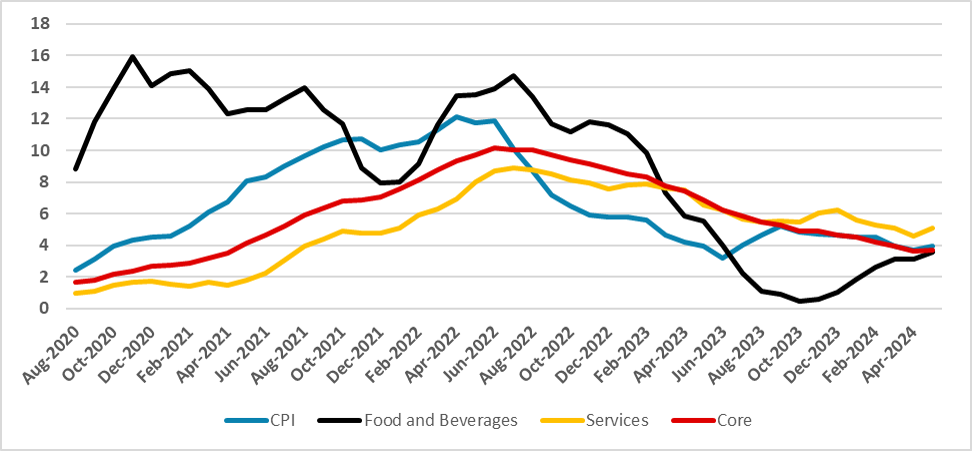

Figure 2: Brazil’s CPY by Group (%, Y/Y)

Source: IBGE

Looking at the core groups, Services inflation grew by 0.4% during the month, and its year-over-year index grew by 5.0%, rising from 4.6% in April. The average of the BCB Core measures grew by 0.42%, and in annual terms, grew by 3.9%, which is still misaligned with the BCB target of 3.0%.

We believe the increase in the CPI is likely affected by both demand and supply pressures. On the demand side, the labor market is performing strongly with rises in salaries and, consequently, an uptick in the mass of salaries. We believe this will likely pressure prices, especially for goods. On the supply side, the severe floods in the southern region of the country will likely restrict agricultural output, causing the Food and Beverages group to increase, possibly spreading to other groups.

The inflationary outlook is becoming more challenging. The recent devaluation of the BRL will likely put some pressure on prices in June and July, and fiscal risks are increasing long-term expectations. We believe this change in the outlook will be appealing for the hawkish BCB members who switched the strategy to a 25 bps cut from the 50 bps cut in the last meeting. Although the BCB is divided regarding inflation, it is very likely that the hawks in the BCB will switch from cutting to pausing in June.