GBP flows: GBP benefiting from risk positive tone

GBP rising this morning in general risk positive market. BHP-Anglo takeover deal unlikely to be relevant

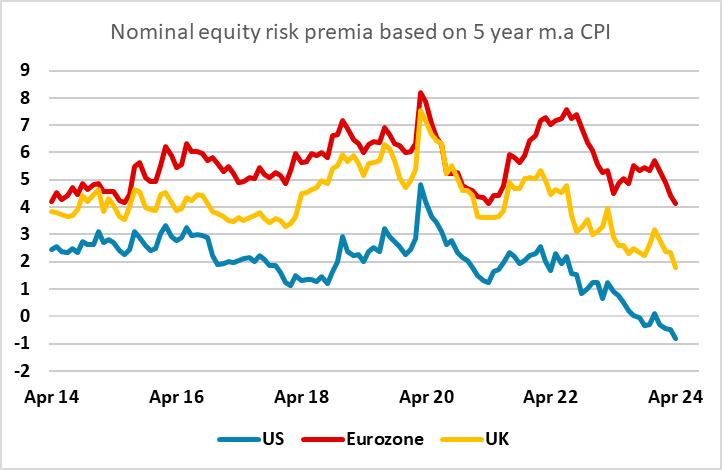

GBP has gained strongly this morning without an obvious trigger, although many are citing the proposed BHP-Anglo American takeover as a factor. It is very unlikely that there are actual flows relating directly to the transaction at this stage, and it is in any case usually unclear what the FX impact will be in these cases, as it depends on the structure of the deal and the financing position of the buyer. In reality, this looks more like general risk positive trading, with the AUD also rising strongly against the EUR and USD this morning, while the NOK has also made good gains. This also conforms with the weak tone in the JPY and CHF, which is also a risk story. However, there may be an equity angle here, as it is certainly true that UK equities look cheap by international standards, albeit not as cheap as the Euozone. While this deal may not specifically be creating flow into GBP at this point, there is a sense that the UK could attract takeover i nterest benefiting GBP, especially if the recent strong PMI evidence is seen as offering prospects for UK equity gains.

nterest benefiting GBP, especially if the recent strong PMI evidence is seen as offering prospects for UK equity gains.