EUR, USD flows: German sales weaker, EUR a little stretched

German retail sales disappoint, FX market generally steady but some risk of EUR/USD correcting lower

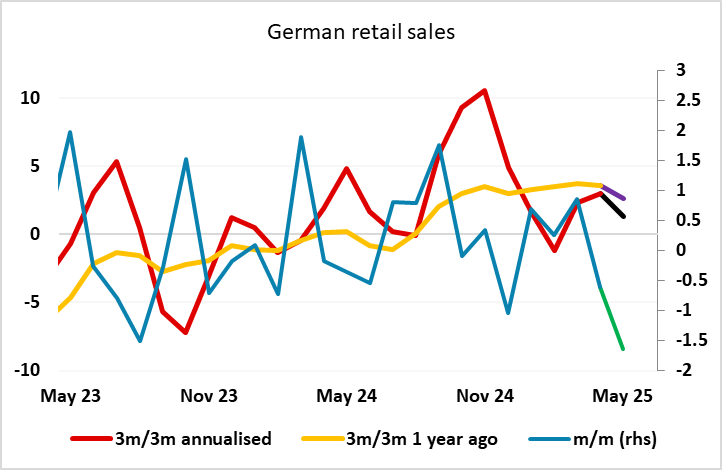

A fairly quiet start to what looks likely to be a quiet day, with no US data of note and German CPI providing the main data focus in Europe. However, the German retail sales data released this morning does provide a mild negative view of the German consumer, with the 1.6% decline in May well below market consensus and the weakest monthly outcome since October 2022. The underlying trend still looks reasonable, but this number does weaken the picture and some recovery will be needed in the next couple of months if the improvement in trend seen since mid 2024 is not to be reversed.

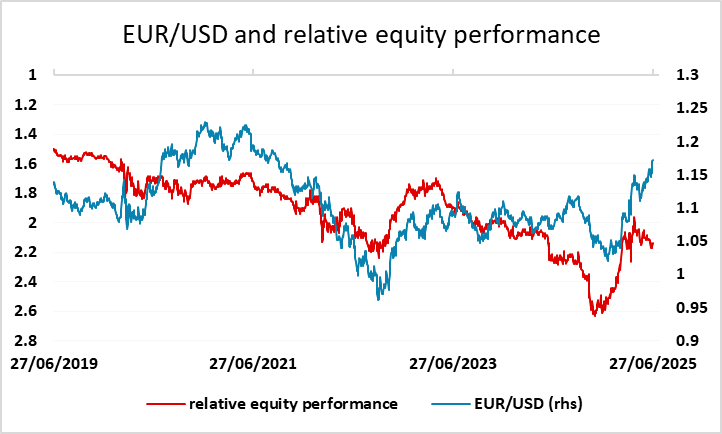

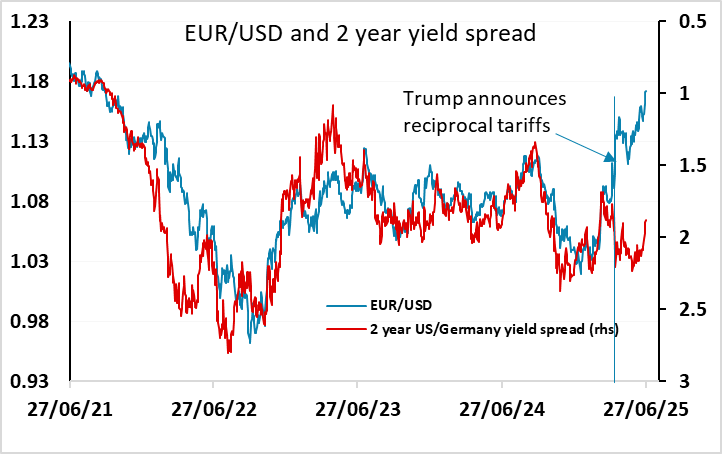

In general, EUR/USD continues to look a little stretched, with the rise in the S&P 500 to a new all time high last week undermining the case for a weaker USD due to concerns about an overvalued equity market. USD weakness still looks to be based on concerns about US tariff policy, judging by the break in the relationship with both yield spreads and relative equity performance in early April, so there will be some focus on any announcements made in the next couple of weeks, with the July 9th deadline for the tariff decisions still live at this point. But softer German sales data and the strength of US equities suggest we may see some downward pressure on EUR/USD today, with the German CPI data unlikely to significantly alter expectations of ECB policy.