FX Daily Strategy: N America, July 16th

Retail sales to keep the USD on the back foot

JPY still has most potential for gains, but technical support can hold

CAD has mild upside risks on CPI

GBP strength starting to look a bit excessive

Retail sales to keep the USD on the back foot

JPY still has most potential for gains, but technical support can hold

CAD has mild upside risks on CPI

GBP strength starting to look a bit excessive

Tuesday sees US retail sales and Canadian CPI data, preceded by the ZEW survey in Germany. The USD has been under pressure since the CPI data, and we don’t expect anything in the retail sale sdata to curtail this. We expect a weak end to Q2 from US retail sales, with a 0.6% decline in June, and a 0.3% decline ex autos. While a weak month for autos and lower gasoline prices will lead the dip, we also expect a marginal 0.1% decline ex autos and gasoline. Our forecasts are notably below the market projections of -0.2% headline and 0.1% ex autos, suggesting the downward pressure on the USD will continue. However, a September Fed rate cut is already fully priced in, so there is limited scope for more declines in front end rates. This suggests to us that EUR/USD will struggle to advance to test 1.10, and should hold sub-1.0950, with the pair still glued closely to front end yield spreads.

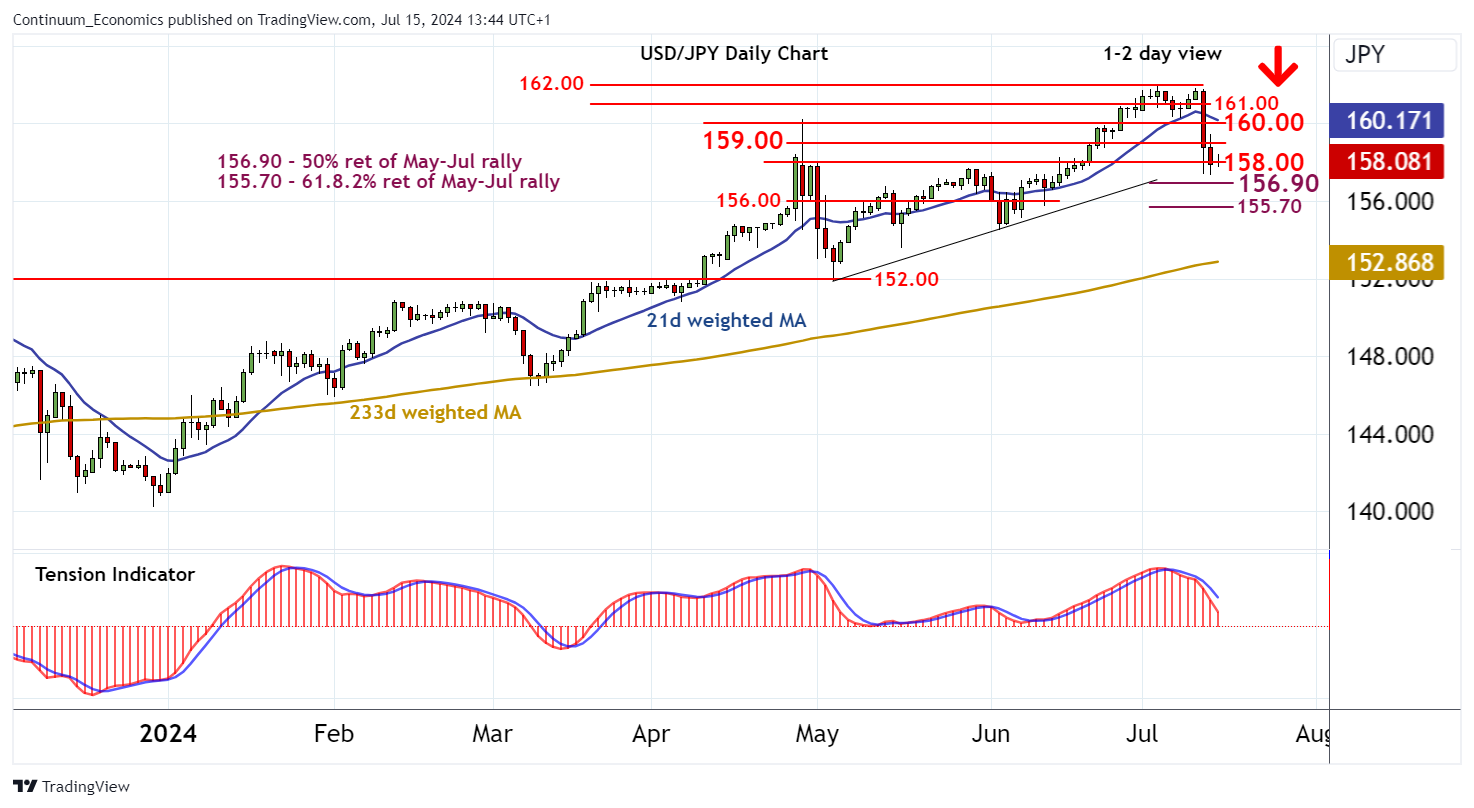

USD/JPY is a different kettle of fish, with yields spreads already suggesting a lot of potential for decline. But the trendline support around 1.0740 is currently limiting the decline. It is unclear whether or how much the BoJ were involved in the USD/JPY decline last week, but if they so wished thy could likely cause a break below this trendline and a further sharp move lower would likely follow as stops were triggered. Whether the Japanese authorities really want a sharp decline at this point is, however, unclear. We don’t this they will tolerate further moves back to 160 and above, but may prefer a period of stability, as a USD/JPY decline is likely to come organically in the coming months as US rates decline and, possibly, Japanese rates rise. Nevertheless, a break lower and further sharp USD/JPY declines are possible if the retail sales data are as weak as we expect.

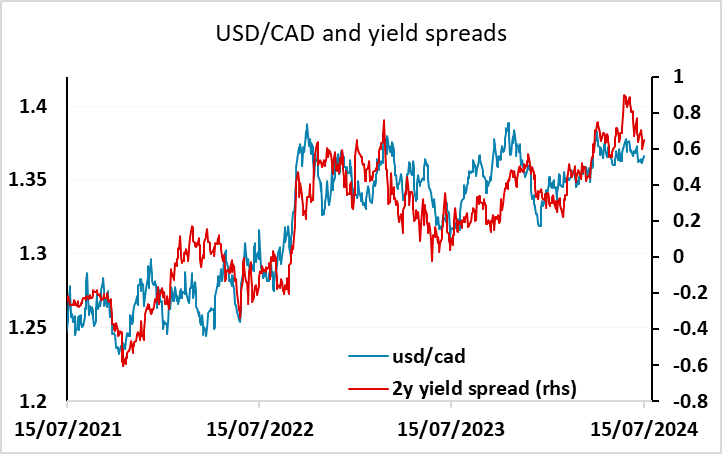

In Canada, we expect June CPI to slip to 2.7% yr/yr from 2.9%, reversing a disappointing uptick seen in May, with the Bank of Canada’s core rates also likely to correct from disappointing data in May that was on balance firmer. But if the picture over two months is little changed, the BoC may decide to pause at its July 24 meeting. Currently the market is pricing a cut at the July meeting as near an 80% chance, so the risks do look to be towards CAD gains. Yield spreads have moved in the CAD’s favour in the last couple of weeks, and while they still don’t suggest potential for significant CAD gains, there is scope for a move sub-1.36 if the market moves away from expecting a July cut.

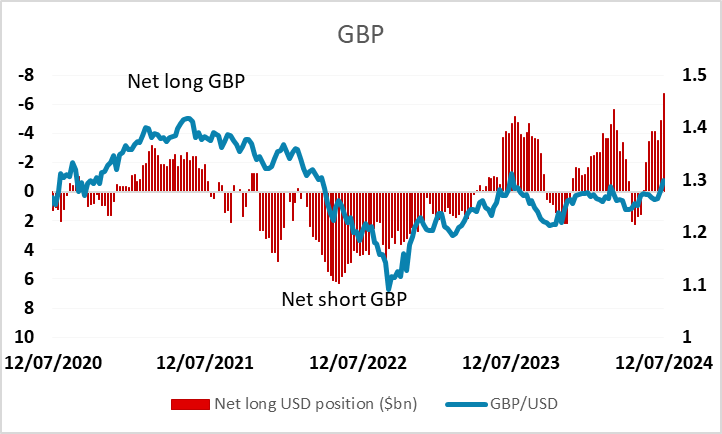

GBP IMM speculative positioning

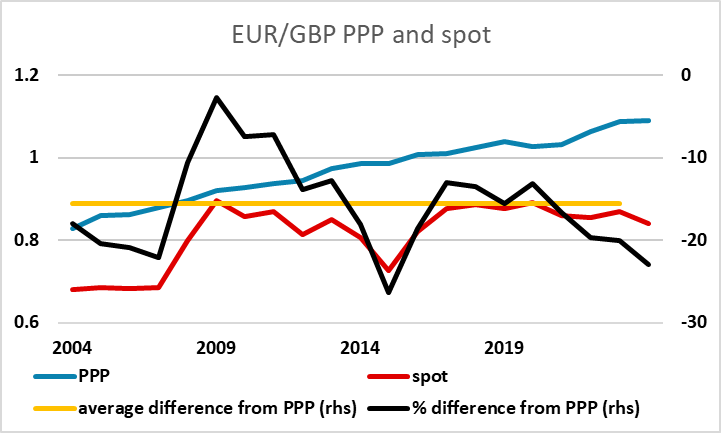

The ZEW survey is unlikely to move the EUR much ,and the European focus may be more on GBP, with EUR/GBP having hit a 2 year low on Monday at 0.8387. The strength of the pound appears to be due to a combination of a relatively hawkish Bank of England and some optimism about growth prospects under the new Labour government. But EIUR/GBP bounced from below 0.84, and positioning in GBP is looking extended, with the CFTC data showing net long speculative positioning at record levels. GBP is not cheap here either, with EUR/GBP some 235 below PPP, approaching the levels seen in 2015 before Brexit. In other words, there is a lot of good news priced in, so we would be wary of looking for a EUR/GBP break lower.