USD, JPY, EUR, AUD flows: Tariffs awaited, markets uncertain

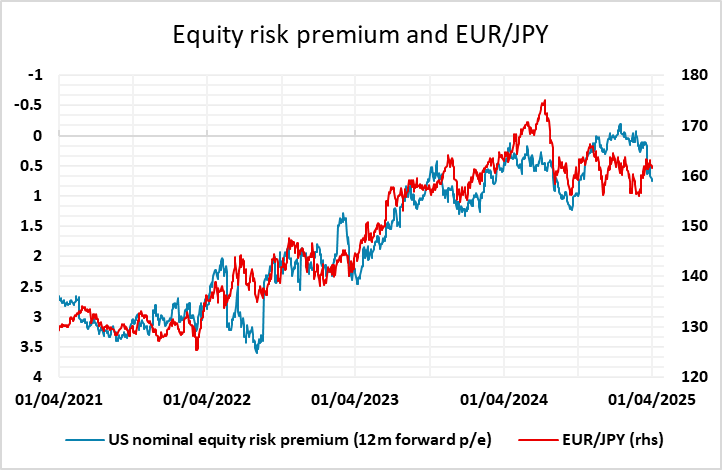

From a big picture perspective US equities still look expensive and tariff increases suggest further downside for equities and USD/JPY. But in the short term the makret may perceive the risks to have been priced in by the 10% decline in the S&P from the highs, so there is a risk of a "buy on the news" reaction

It looks set to be a quiet but nervous day in Europe with no data of significance and the US tariff announcement not expected until 20:00 GMT. The US ADP data at 12:15 GMT will attract some interest, but seems unlikely to significantly change sentiment ahead of the tariff announcement.

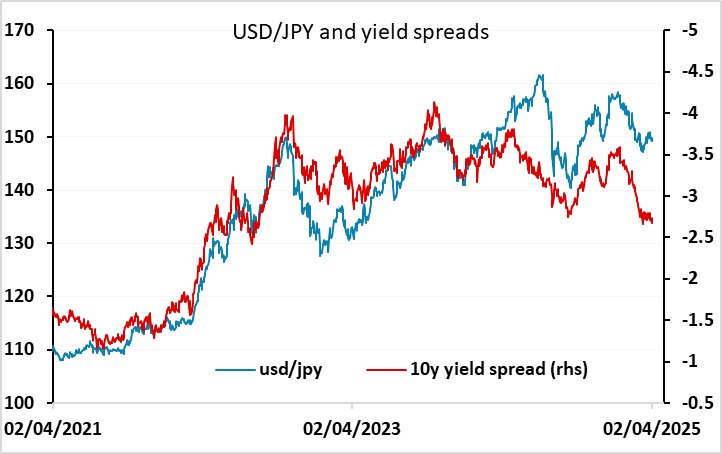

Overnight, equities have continued to edge a little higher after the drop in the S&P to new lows for the year on Monday. There is a case for saying that the bad news on tariffs has been anticipated with the 10% decline in the S&P from the highs, and this may mean that the reaction this evening isn’t particularly negative. But US equity valuations remain very high both relative to bond yields and on a simple p/e basis, and these valuations remain hard to justify as the evidence of a slowing US economy mounts. We therefore still see major medium and long term upside risks for the JPY, which will tend to benefit from any rise in risk premia, with USD/JPY already way above levels suggested by recent correlations with yield spreads.

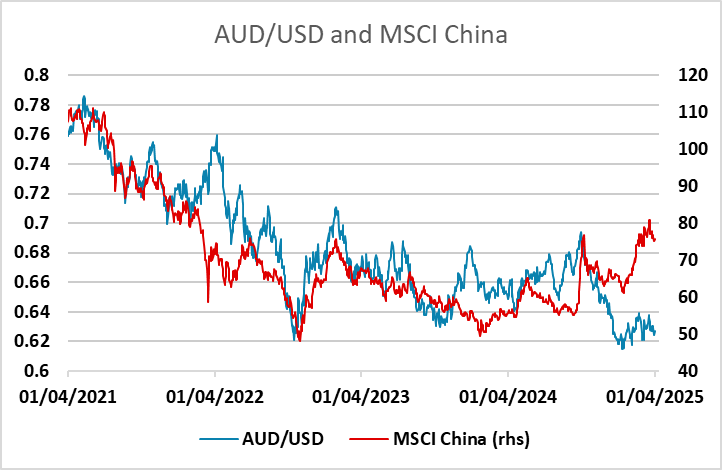

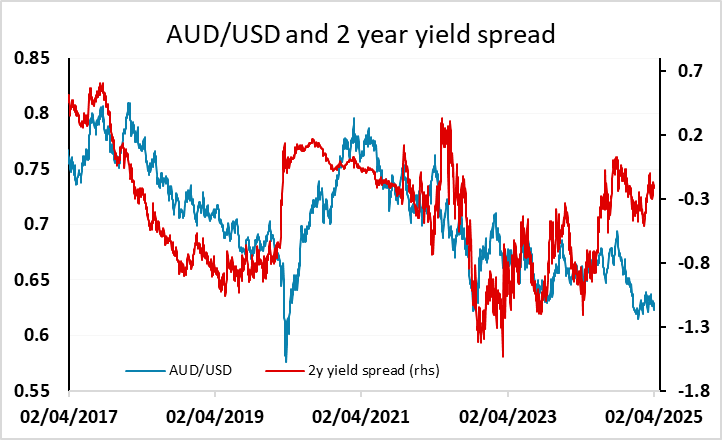

But for today, it would be no surprise to see a “buy on the news” reaction in equities when details of tariffs are announced, with the decline in equities seen in the last two months being seen as the “sell on the rumour” phase. This could favour the riskier currencies which have underperformed in recent months, with the AUD looking particularly underappreciated.