FX Weekly Strategy: Sep 8th-12th

Focus on CPI but employment data aftermath may dominate early part of the week

USD downside favoured, particularly against the JPY

CAD may be even more vulnerable after very weak August employment

GBP could suffer if July GDP turns out negative

Strategy for the week ahead

US CPI data will be the main data focus this week, but in the early part of the week we should see the market responding to the implications of the US and Canadian employment data from Friday and anticipating the central bank meetings later in the month.

The US employment report was clearly weaker than expected, with a net miss of around 74k in the payroll numbers, including revisions. But the earnings data and unemployment rate were as expected, although the unemployment rate did rise. 74k isn’t a huge amount in an economy with near 160 million workers, and we have seen some large revisions in recent months underlining that there is uncertainty in the data. Even so, the numbers near guarantee a Fed ease in September, with the market now pricing a small risk of a 50bp cut. This looks very unlikely at this stage with the Fed still unsure of the inflation impact of tariffs. The CPI data this week might give more of a read on this. We see some upside risk relative to consensus on the headline. If so, the market may be less gung ho in pricing in aggressive Fed easing, but the current market tone is unlikely to see higher CPI as USD positive. But lower US yields should also be negative for the USD in general, and particularly against the JPY.

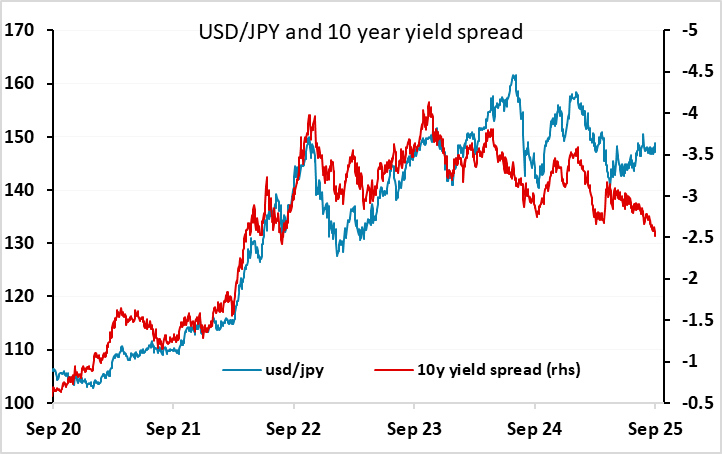

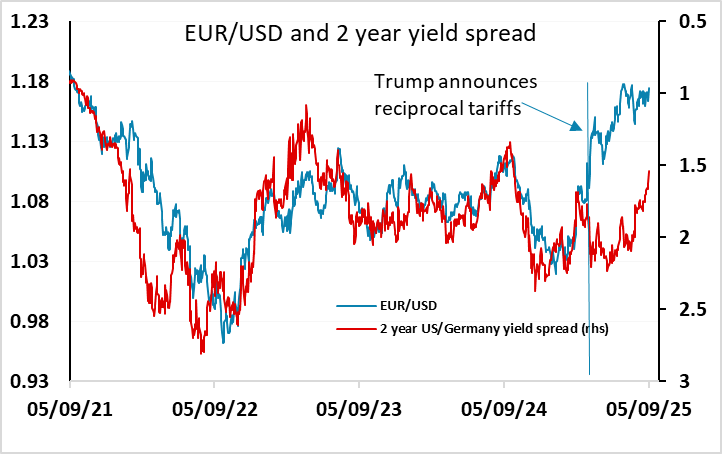

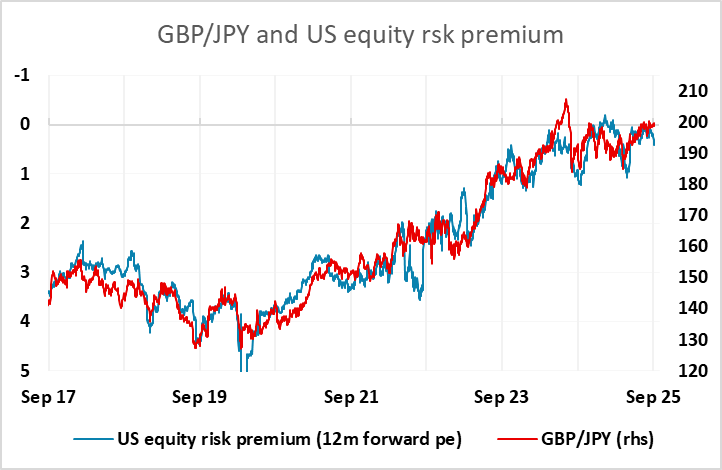

Yield spreads have not been a reliable guide to USD movements this year, certainly not in comparison to the strong correlation seen in recent years, but nevertheless spreads suggest the JPY has plenty of upside scope, while the EUR has outperformed since the April announcement of reciprocal tariffs, and looks less likely to benefit from lower US yields, not least because this also tends to mean lower yields in Europe. It also tends to mean a rise in implied equity risk premia, especially when the decline in yields is due to concerns about weaker growth, as here. These risk premia have been a guide to JPY cross performance in recent years, and this correlation has persisted this year even as correlations with yield spreads have faded. Lower yields combined with stable equities will point to a lower EUR/JPY and GBP/JPY. This will most likely be achieved by a lower USD/JPY in a weaker US economy scenario, but severe risk weakness often sees the USD benefit against the riskier currencies, so may not mean USD weakness across the board. However, at this stage, the rise in risk premia has been relatively modest, so is unlikely to see USD gains against the EUR.

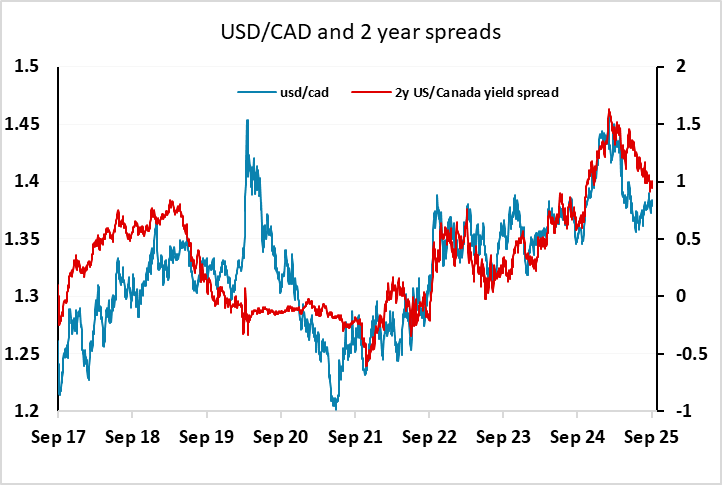

After the very weak Canadian employment numbers on Friday, markets are now pricing in a 90% chance of a BoC easing at the September 17th meeting, against a 70% chance before. However, there is still only a total of 50bps of further easing priced by the end of 2026. This reflects the relatively low starting point for rates and the still higher than desired inflation rate, with core measures still mostly near 3%. But the two sharp declines in employment recorded in the last two months, even before the main impact of tariffs has hit the economy, suggest Canada is heading for a sharp downturn in the coming months. USD/CAD is still a little below the level normally associated with current yield spreads, and there is also a case for the CAD to fall as a direct consequence of tariffs, as this would ensure export prices to the US didn’t rise too much. Risks for the CAD therefore should be to the downside, but this may be clearer on the crosses than against the USD if the USD also suffers weakness.

As far as this week’s other data is concerned, UK July GDP on Friday may have the most potential to trigger a reaction. We are looking for a flat month, which won’t be too terrible a result after a 0.4% gain in June. But anything negative could pit pressure on GBP and threaten a EUR/GBP break to the upside of the 0.86-0.87 range.

Data and events for the week ahead

USA

Monday sees July consumer credit data and Tuesday sees August’s NFIB survey on small business optimism. More importantly on Tuesday is the preliminary estimate for the revision to the March 2025 non-farm payroll benchmark, which is likely to be significantly lower.

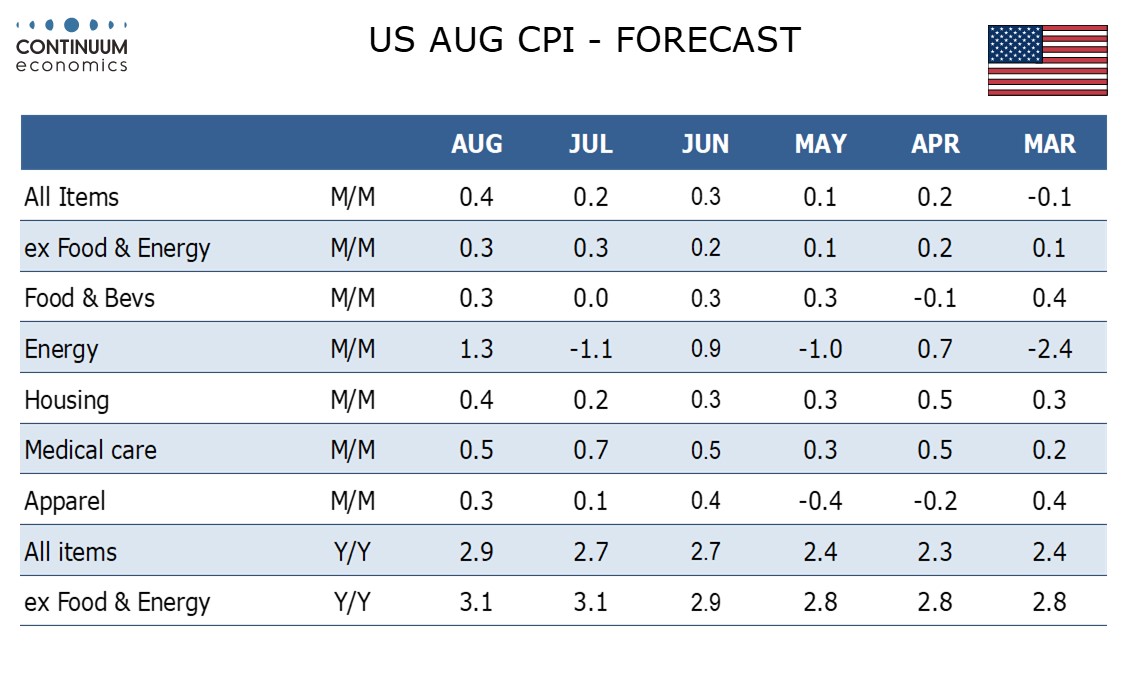

Focus will then turn to inflation. On Wednesday we expect a 0.3% rise in August’s PPI, with a 0.2% increase ex food and energy, both slowing from strong 0.9% gains in July. Thursday’s CPI release is the most significant of the week. We expect a rise of 0.4%, with a 0.3% increase ex food and energy, with the latter slightly above 0.3% before rounding, as tariffs continue to feed through. Thursday also sees weekly initial claims and later August budget data. The preliminary September Michigan CSI follows on Friday.

Canada

It is a quiet week for Canadian data but July building permits and Q2 capacity utilization are due on Friday.

UK

The week ends with a bang with BoE-compiled household price expectations on Friday preceded by GDP, trade and output data earlier in the day. Although we are pointing to a flat m/m GDP outcome for the looming July data, the projection is more precarious than hitherto. There are some better signs in terms of July car production and real estate activity but these are far from authoritative not least against a weak business survey backdrop, albeit with some such indicators much weaker than others. Earlier in the week, sees RICS housing survey numbers (Thu), again likely to show some overall softening.

Eurozone

The week starts with what may be a bounce in German Industrial production (Mon) but very much the stand-out is the ECB decision on Thursday. A second successive stable policy decision is very likely resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. We see the ECB offering little in terms of policy guidance; after all, in July the Council suggested it would be ‘deliberately uninformative about future interest rate decisions’. Little may be gleaned either from updated economic projections which may see little impact from what has been both a higher tariff outcome than was assumed three months ago and what are still tight, if not tighter, financial conditions. Instead, data dependence will remain the main message. Otherwise, French markets will await the Fitch ratings decision on Friday with some trepidation.

Rest of Western Europe

There are quite a few key events in Sweden, most notably final CPI data for August (Thu) important to see the details of the flash outcome. Wednesday sees output/orders numbers and the monthly GDP indicator, the latter having proved far from authoritative of late. Otherwise, in Switzerland, come comments from SNB President Schlegel (Tue & Wed) probably giving an update on SNB thinking ahead of its next policy assessment later this month. And in Norway August CPI data (Wed) may see little change from the CPI-ATE 3.1% July outcome.

Japan

Kickstarting the week with official GDP on Monday. Preliminary data suggest a favourable growth and would be interesting to see if there is any revision. We feel the risk are balanced but have some potential upside. Else, PPI on Thursday would carry more weight than other tier 2 data.

Australia

Only consumer confidence, business condition and confidence on Tuesday.

NZ

Business PMI On Friday, so as electric card retail sales.