This week's five highlights

Trump Keep the Ball Rolling

U.S. August Non-Farm Payrolls Similar to July's

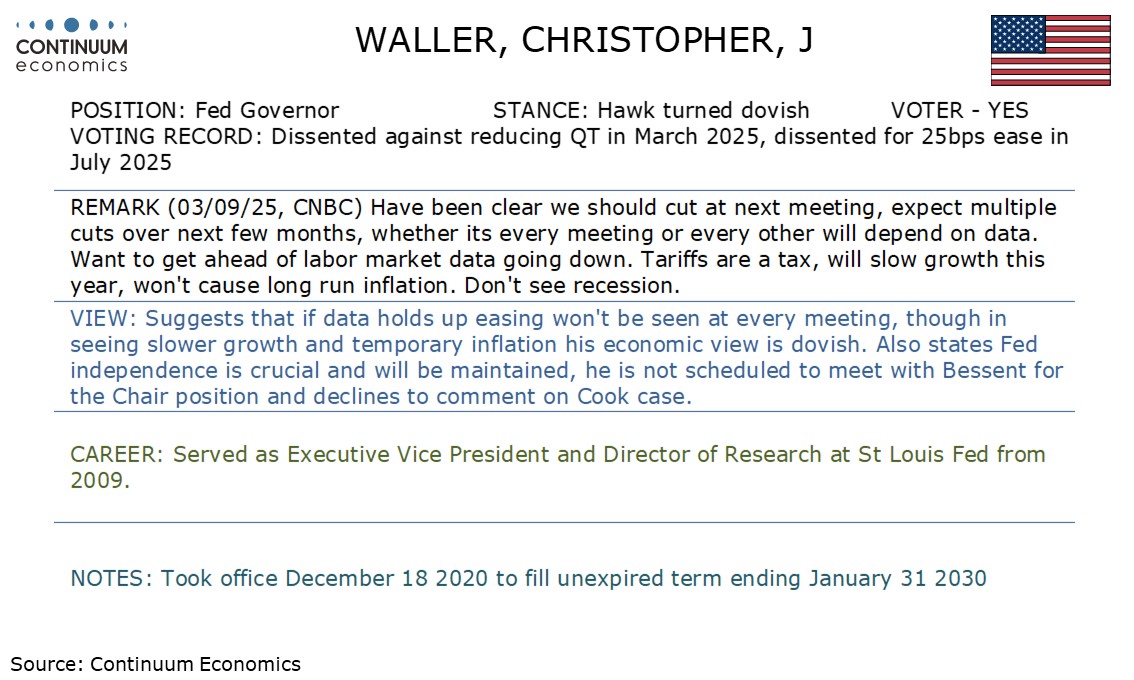

This Week's Fed Speakers

More consolidation for DXY

EZ HICP Headline Inflation Edges Higher

Trump is keeping the ball rolling this week. He mentioned 100% tariff on semiconductor again, signed an executive order to cap Japanese tariff to 15% and says he is ready to negotiate for a North America Trade agreement. There is no doubt Trump kept things dynamic despite the legality of his tariff are being challenged currently. While there maybe a blow to his tariff policy, it looks like the impact maybe minimal as most trade deals are either done or in progress.

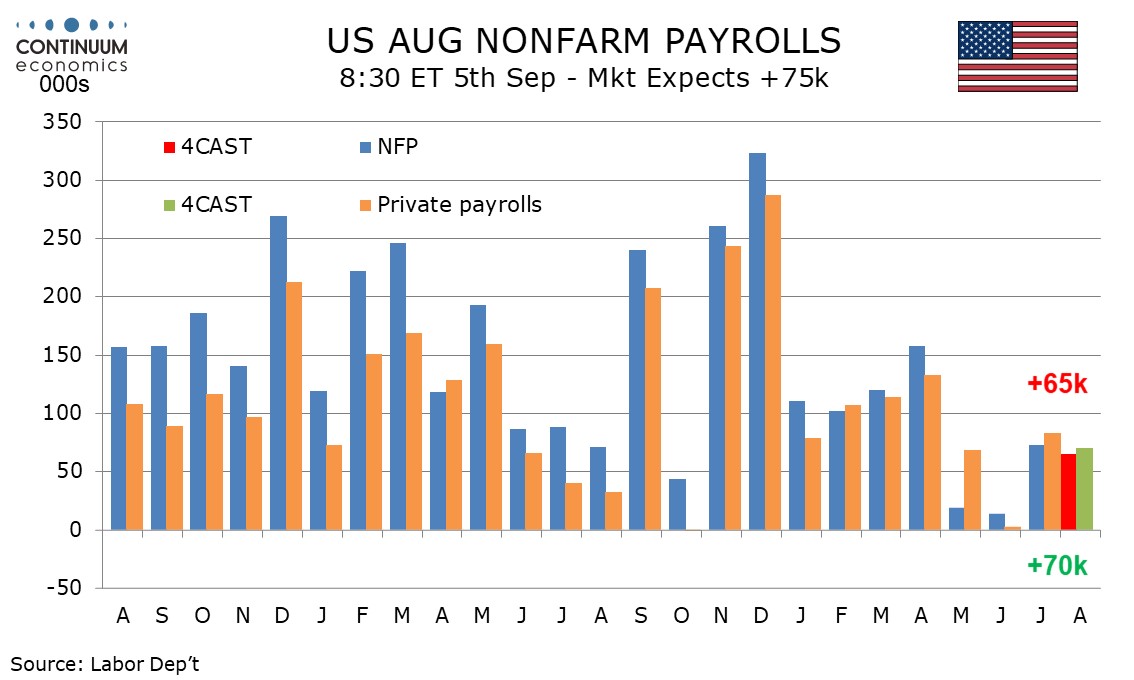

We expect August’s non-farm payroll to look similar to July’s, with a rise of 65k versus 73k in July, above the 14k rise of June and the 19k rise of May but well below the trend that was running above 100k through April. We also expect unemployment to remain at July’s 4.2% rate and a second straight 0.3% increase in average hourly earnings. July’s data was most notable for the dramatic downward revisions to May and June. We are assuming limited revisions this time with the recent payroll data looking fairly consistent with initial claims. The 4-week average for initial claims slipped in July and further into August’s survey week, though the weekly number did increase in August’s survey week.

This suggests an August outcome similar to July’s and stronger than those of May and June. Tariff fears have eased somewhat since the initial shock that followed April’s announcement, while seasonal adjustments assume less hiring in July and August than is the case in May and June. This gives payrolls a smaller hurdle to clear, significant when labor supply is limited by immigration policy.

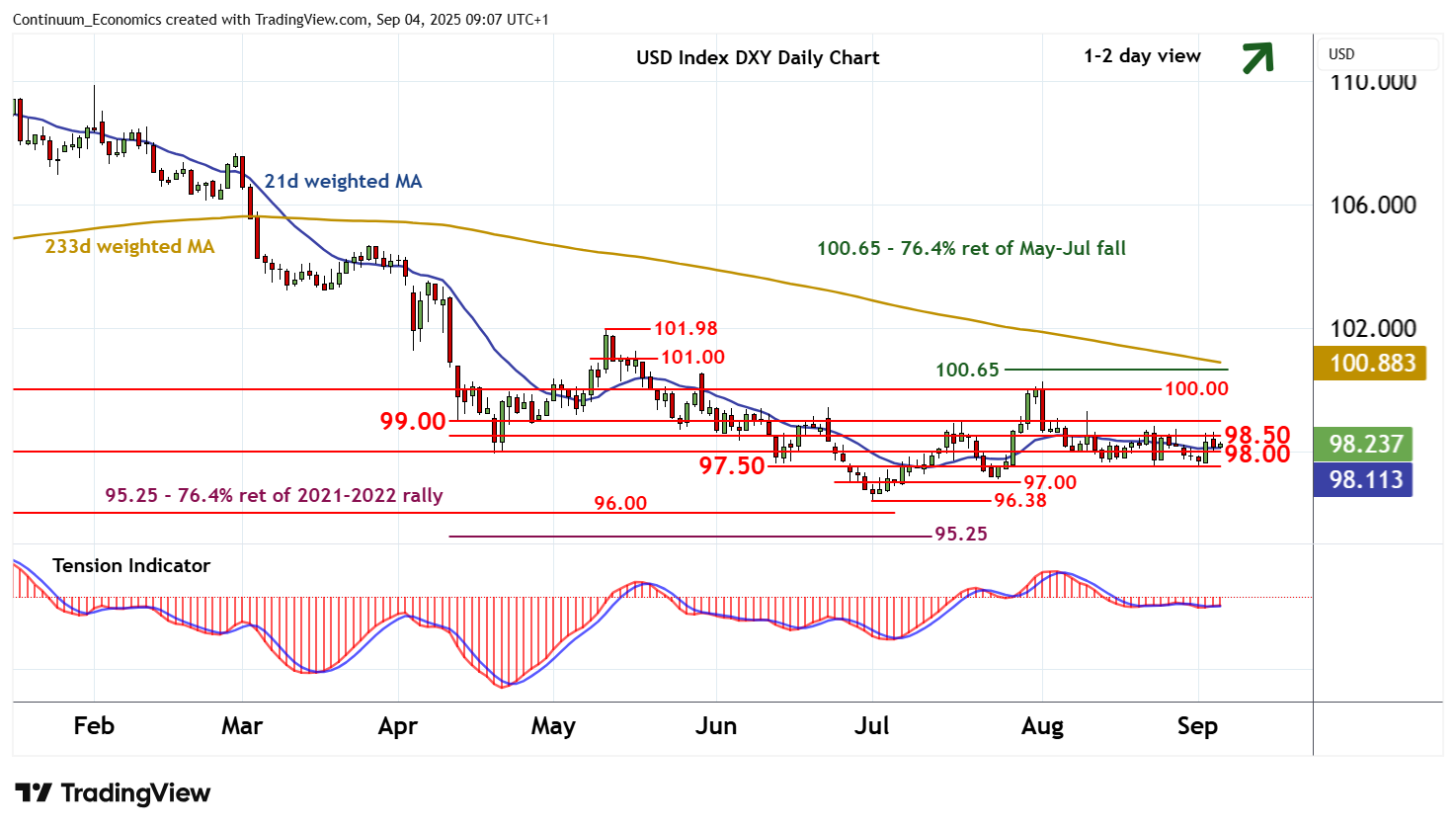

With Trump being dynamic, the greenback keep going back and forth but has seen some consolidation. Market participants are bracing for the potential lively September FOMC meeting. Even when most are anticipating more easing, they would not like to caught wrong footed as there maybe details in the coming forward guidance.

On the chart, there is still little change, as mixed intraday studies keep near-term sentiment cautious and prompt consolidation around congestion resistance at 98.50. Daily readings are rising and broader weekly charts are also showing signs of improvement, suggesting room for a later break above 98.50 towards 99.00. However, already overbought weekly stochastics should limit any continuation beyond here in selling interest towards critical resistance at congestion around 100.00. Meanwhile, support remains at congestion around 98.00 and extends to 97.50. This range should underpin any immediate setbacks.

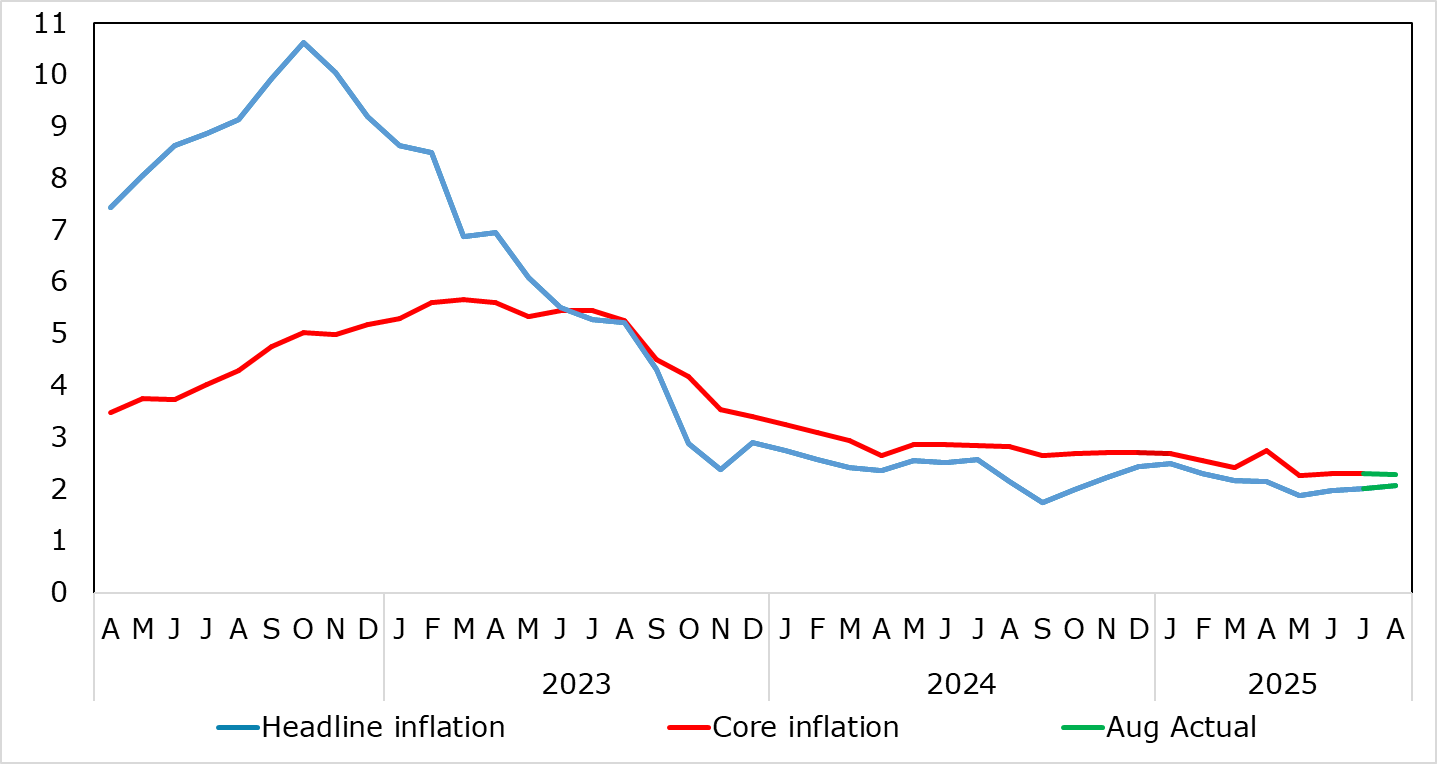

Figure: Headline Edges Above Target as Core and Services Hit Cycle-Low

As we repeated again, HICP inflation – even now a notch above target – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not have been altered by the flash HICP data for August even given the 0.1 ppt rise in the headline to 2.1%, hinting that the ECB’s Q3 projection could be overshot, especially given the possible further rise that could occur in September. But this is largely food and energy base effect driven as the core rate in August stayed at 2.3% (Figure), chiming with the ECB underlying inflation forecast for Q3, something already evident in adjusted m/m data and where services dipped a notch to new cycle low of 3.1%.

Indeed, services inflation, at 3.1%, is now the lowest since March 2022 and does seem to be belatedly following in the footsteps of lower wage pressures. As a result, this trend and noise could bring the headline and core rate could both dip below 2% in Q4 with base effects pulling the headline down to around 1.5% in Q1, especially if demand weakness starts to accentuate what have largely been supply factors driving the disinflation process hitherto. However, the risks of a further (short-lived) 0.1 ppt rise in the headline is a distinct likelihood for September numbers, albeit again very much energy base effect (and perhaps food) driven. Moreover, as recent calendar distortions unwind, what has looked like fresh price pressures in seasonally adjusted short-term m/m movements for core have reversed and are consistent with on-target inflation.