FX Daily Strategy: N America, July 18th

ECB Policy to Pause Amid Mixed Data

GBP steady after UK labour market data

AUD traded higher after strong employment report

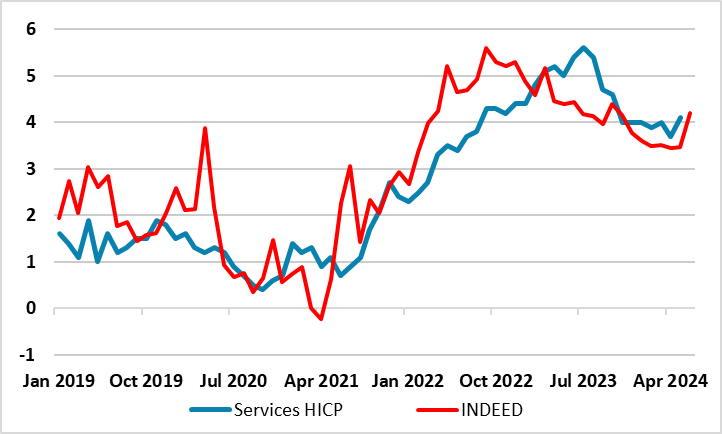

Figure: Wage Pressure Easing Far From Smooth

ECB thinking comes backs onto the radar screen today. Given the hints from Council members, all policy rates will be held this time around. But markets will be more focused on hints on the speed and timing of further moves, not least after what was one formal dissent last time, and amid wider reservations. A key ingredient will be recent (mixed) economy data but with fresh hints of higher wage pressure (Figure) cementing the anticipated stable policy decision. There may also be some retort to German Finance Minister Christian Lindner’s publicly aired doubts this week about the legality of potential ECB crisis aid tools ostensibly for France. But perhaps the key matter will be the still soft credit backdrop, with fresh and potentially very influential insight into the supply side coming from the next Bank Lending Survey due on Tuesday. Overall, the easing window will be left open but far from decisively so.

At the last meeting, all policy rates were cut by the expected 25 bp, with the key deposit rate falling from at an unprecedented 4.0% for the first reduction since 2019. Given splits within the ECB Council, it was no surprise that no formal guidance as to future policy was forthcoming, save to underline that policy will be data dependent and clearly not pre-committing to a particular rate path not least alongside upgraded forecasts for this year and next and to ‘keep policy rates sufficiently restrictive for as long as necessary’.

It remains the case that the ECB is not in the process of making policy expansionary, instead just making it less restrictive; it was suggested in June that it was (then) appropriate to ‘moderate’ the current level of monetary policy restriction. But policy is biting and has more impact to come. Underlying inflation is buckling as the ECB’s persistent price gauges are all under 2% and actually just a couple of notches above the 10-year average prior to the pandemic. Against this backdrop, we still see two more 25 bp moves this year and even the anticipated four further cuts in 2025 will hardly take policy out of a restrictive stance.

Admittedly, the decision to start easing in June came with clear reservations within parts of the Council. Indeed, there seemed to be disagreement about interpreting data; what is/was the basis for assessing how data moved relative to expectations and even an implicit objection to the ECB having a symmetric target! While such reservations may seem excessive, not least questioning the symmetry of the inflation target, aspects of recent data (while mixed) may stoke further caution among the hawks. In this regard, will be the slight pickup in wage pressures (as presented by the monthly Indeed tracker, Figure 1). As such, this may accentuate worries about services price resilience, particularly as official output data for the sector shows y/y growth running near 5%, this implying a solid q/q rate for the last quarter

Even so, there is probably still a view that policy has been hiked relatively aggressively in both speed and extent in what Lagarde in June referred as the first policy phase. This is something we have underlined by suggesting that recent monetary tightening (which also encompasses unconventional moves) has not only been extensive, but possibly excessive. Supporting this notion is the continued weakness in monetary data, especially credit which is barely rising and is very negative in real terms. The question is the extent to which reflects supply weakness or fragility in demand. Recent bank lending surveys suggest both but the last such numbers in April very much suggested fresh and sizeable weakness in credit demand by firms (Figure 2). This makes the next such survey due on Tuesday all the more important but also for other reasons. It is noteworthy that the ECB cites the transmission mechanism as a downside risk to its outlook and this risks continues, if not grows not least given the negative impact from the ECB balance sheet reduction on credit dynamics was very much underscored in the last bank lending survey. This is all the more important as the ECB has no plans (yet) to slow, let alone stop, its unconventional tightening regardless of what and when its reduces official rates. It could be argued that if the ECB purses further balance sheet reduction, then larger/faster conventional easing may be needed!

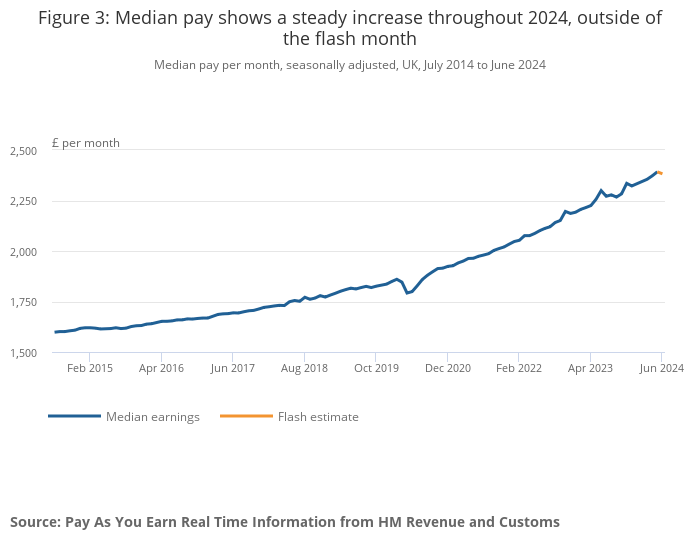

UK HMRC pay data

UK labour market data was essentially in line with expectations, with the official ONS May average earnings data at 5.7% and employment up 19k in the 3 months to May. There was a sharp drop in the y/y growth in the June average earnings data based on the HMRC data, but this related mostly to a base effect form June 2023. Even so, there was a m/m decline of 0.4% in June, which suggests some softening. Against this, the HMRC employment data for May was revised up significantly from a decline of 3k to a rise of 54k, while June provisionally showed a 16k increase. The data is consequently much as expected, but with earnings growth still on the high side y/y, the prospect of an August BoE rate cut remains in the balance. The market currently prices a cut as a 40% chance.

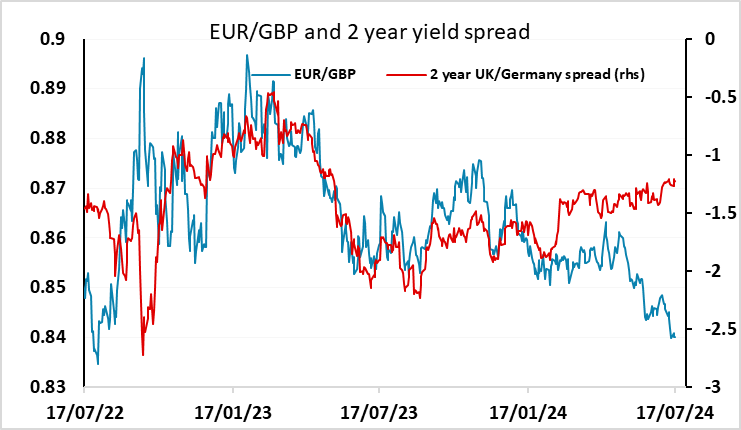

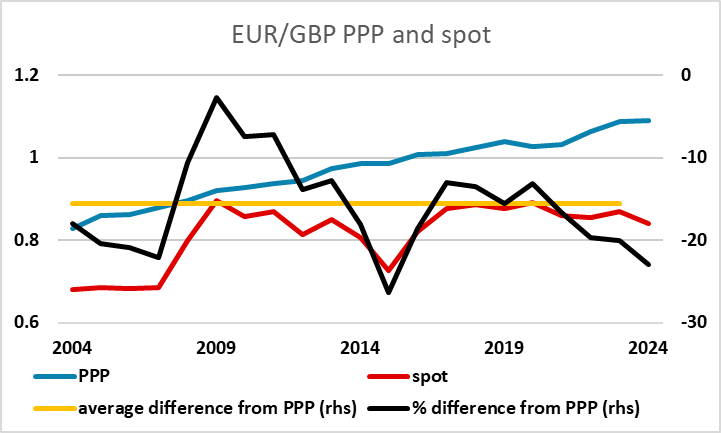

EUR/GBP is a little higher after the data, having bounced strongly after the initial dip on the CPI data on Wednesday. As we have noted before, it may be that UK rates stay higher for longer than rates in the Eurozone (or the US), but GBP is already priced for significantly higher yields than we have now, and is at significantly strong levels relative to long term valuation. Additionally, speculative positioning looks extended judging by the CFTC data. So while a EUR/GBP dip below 0.84 remains possible if the market further reduces its expectation of an August BoE rate cut, significant progress below this level remains hard to justify.

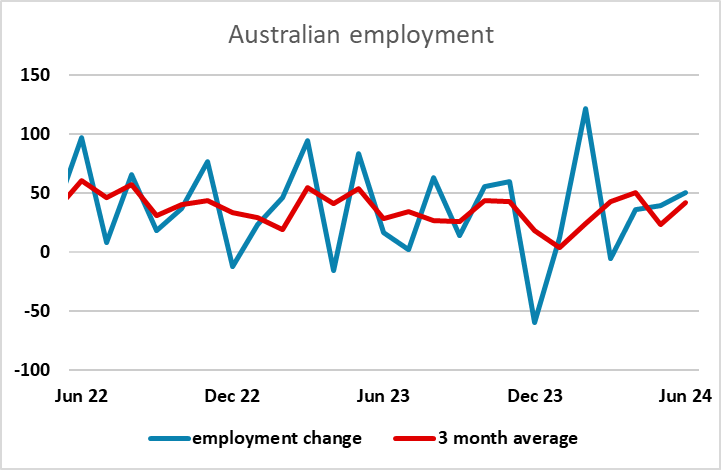

Another strong labor report for Australia in June, employment change came in stronger at 50.2k while unemployment rate ticked up 4.1% but participation rate also rose to 66.9%. This continues to point towards a solid employment market in Australia and reinforces RBA's latest view in pushing back any early easing speculation. AUD/USD traded a little higher but remains stuck in a 0.67-0.68 range