JPY, EUR, USD flows: JPY still weak after softer US CPI

Lower US yields ought to be JPY supportive, but sentiment remains negative. USD otherwise softer versus AUD

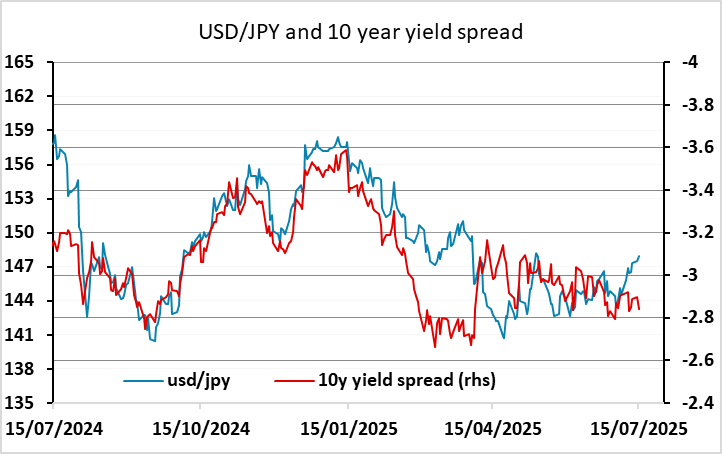

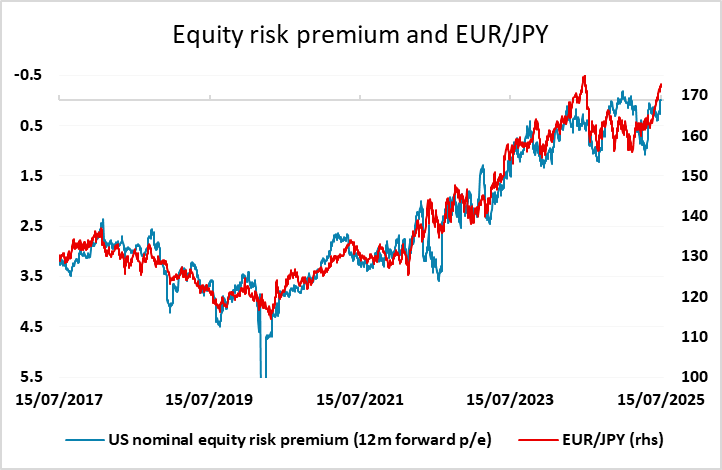

With US CPI coming in a little lower than expected yields are generally lower and equities modestly higher. The immediate impact on USD/JPY was positive but this has now settled back to trade slightly below pre-data levels while EUR/USD has edged a little higher. We have traded a new 1 year high in EUR/JPY and a new all time high in CHF/JPY. The data is generally seen as risk positive and AUD and CAD are both higher, helped by both the lower US yields and positive equity market reaction.

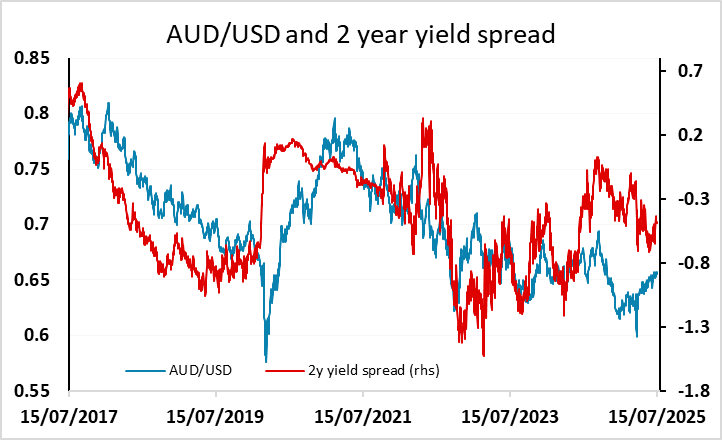

With US yields a little lower the implications ought to be positive for the JPY both against the USD and on the crosses, as spreads have moved in the JPYs favour and the implied equity risk premium has risen slightly with the equity gains not quite offsetting the decline in bond yields. However, n=momentum is clearly JPY negative, and it might take more than this to change the direction, especially with the JPY also suffering a little form political uncertainty ahead of the Upper House elections. All in all, the data isn’t having a major FX impact, but AUD gains are perhaps the most reliable reaction.