Preview: Due March 14 - U.S. February Retail Sales - Reversing January's weather-depressed decline

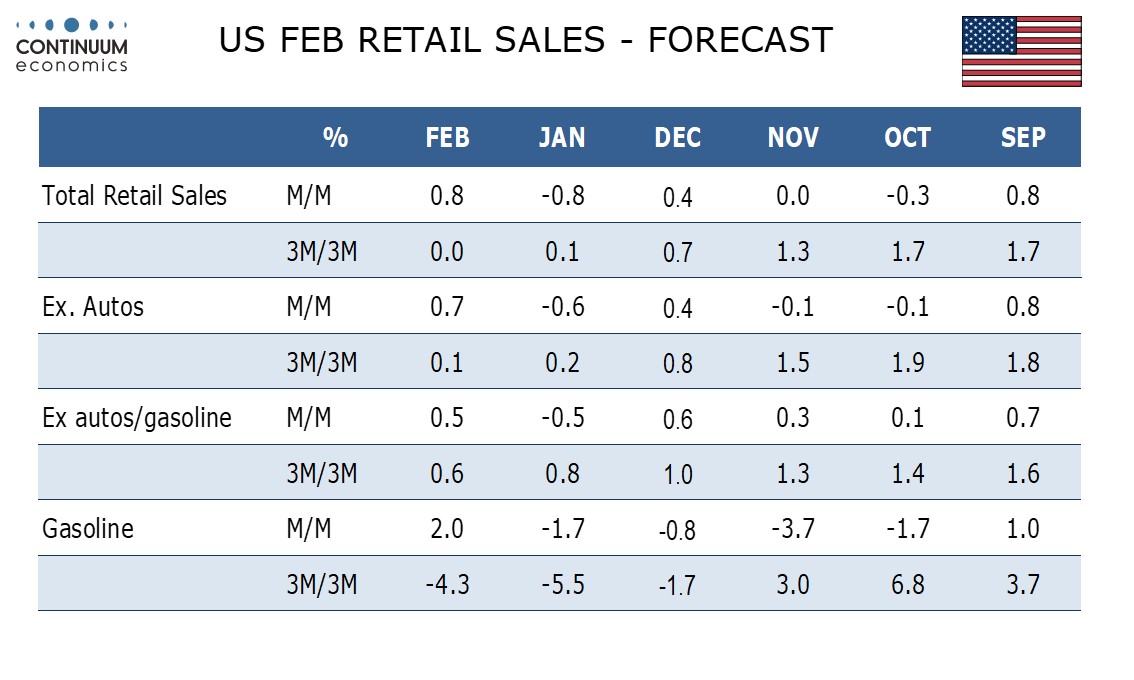

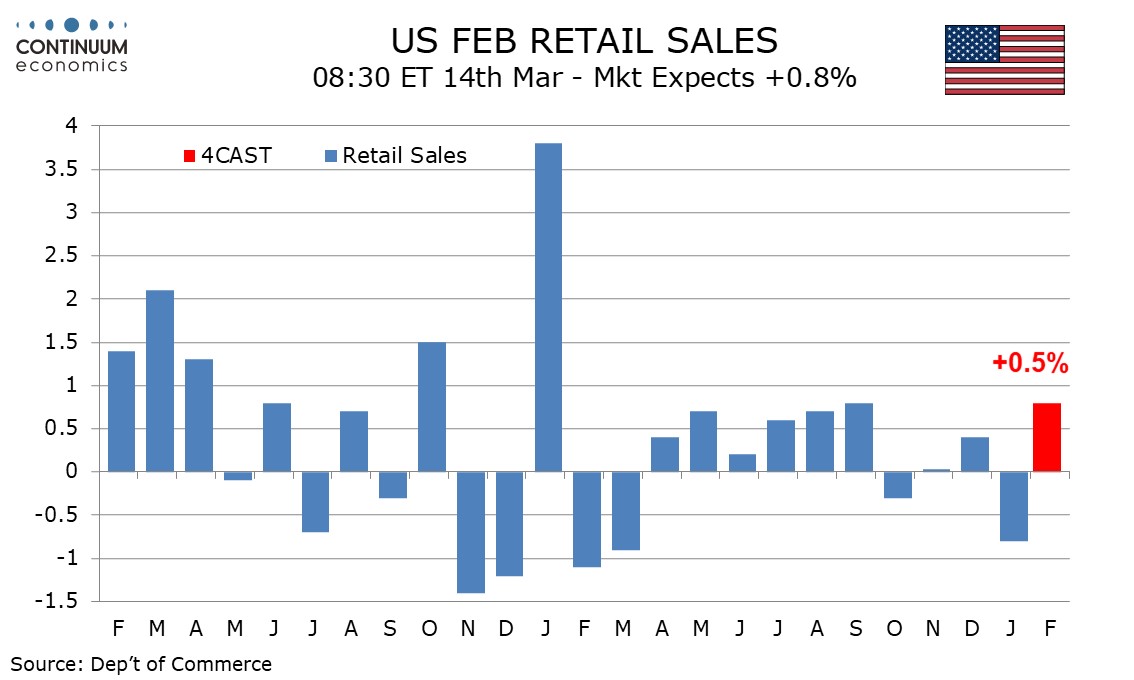

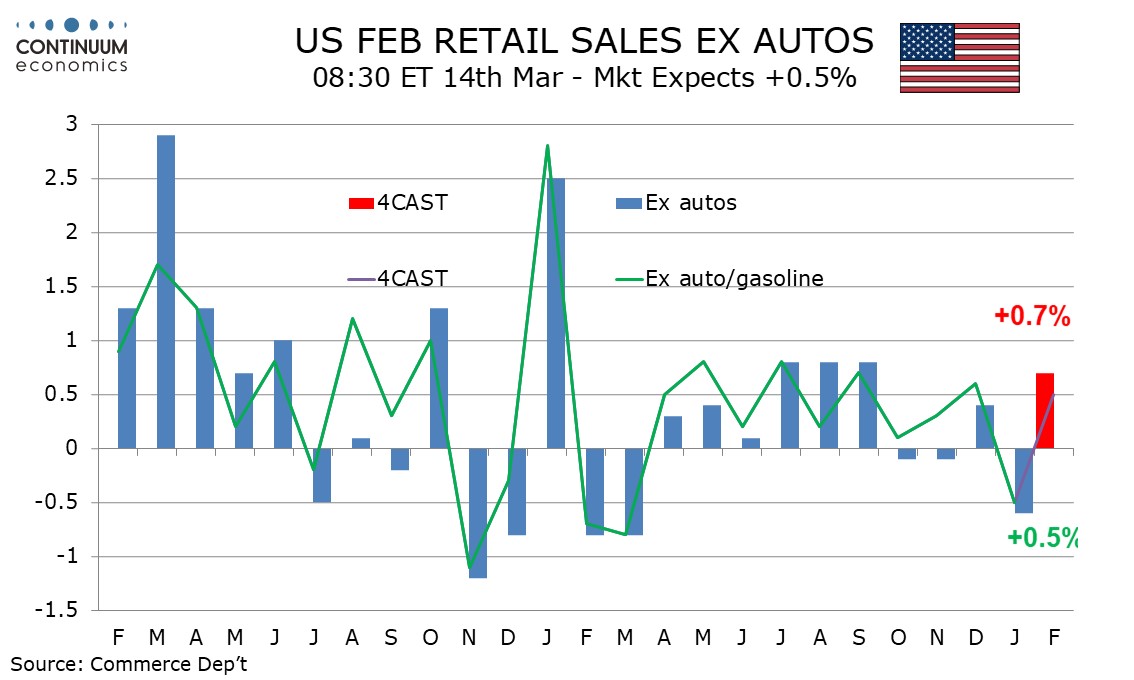

We expect a 0.8% increase in February retail sales, fully reversing January’s 0.8% decline where weather probably depressed sales. Ex autos we expect a 0.7% increase to follow a 0.6% January decline, while ex autos and gasoline we expect a 0.5% increase to follow a 0.5% January decline.

January’s decline was the first since October and the steepest since March when a second straight decline followed a very strong January of 2023. The January 2023 strength was inflated by mild weather and it is likely that the January 2024 weakness was influenced by bad weather. This gives scope for a bounce in February, though February did see a spell of bad weather too.

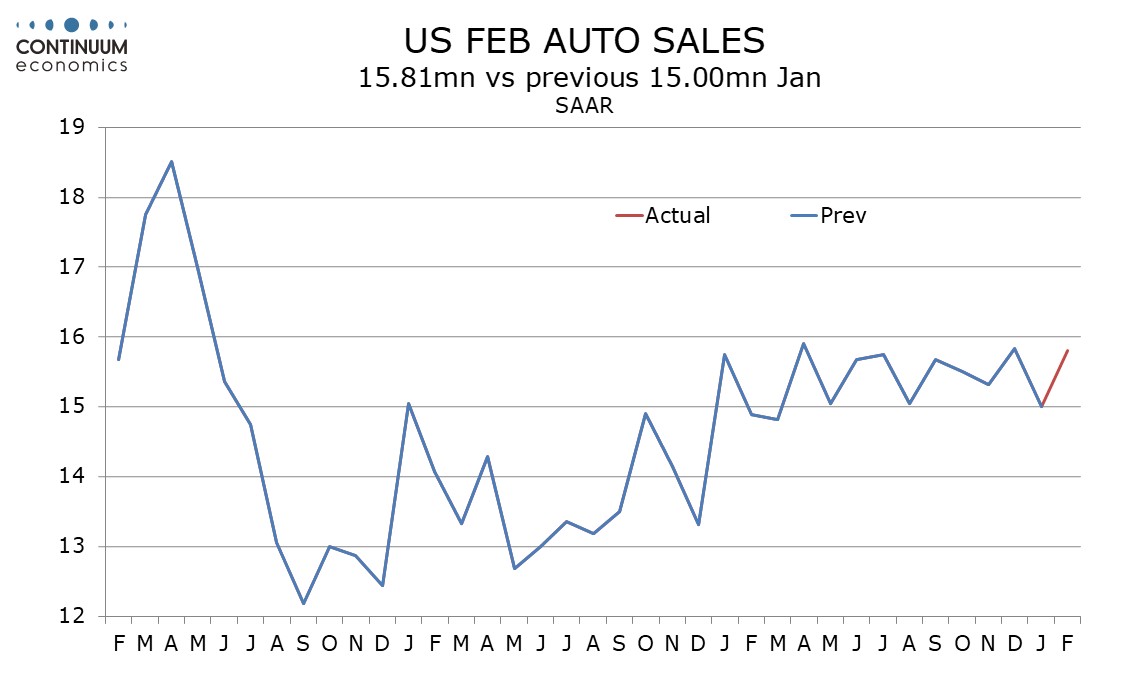

Data from the auto industry shows that auto sales reversed a dip seen in January. Gasoline price data also shows a reversal of a January decline and will provide a further boost to February sales values.

January’s decline ex auto and gasoline was the first since February and March corrected the strong rise of January 2023. Between then and January 2024 a positive trend was seen though frequently sales alternated between strong monthly gains and marginal ones.

December data saw 2023 end on a strong note and consider fundamentals still look healthy, though Redbook data in February was subdued, suggesting momentum may be starting to slow, or weather continues to weigh. Simply reversing January’s decline but no more would be consistent with this.