U.S. April Trade Deficit falls sharply after tariffs imposed, Personal Income strong, Spending and Core PCE Prices subdued

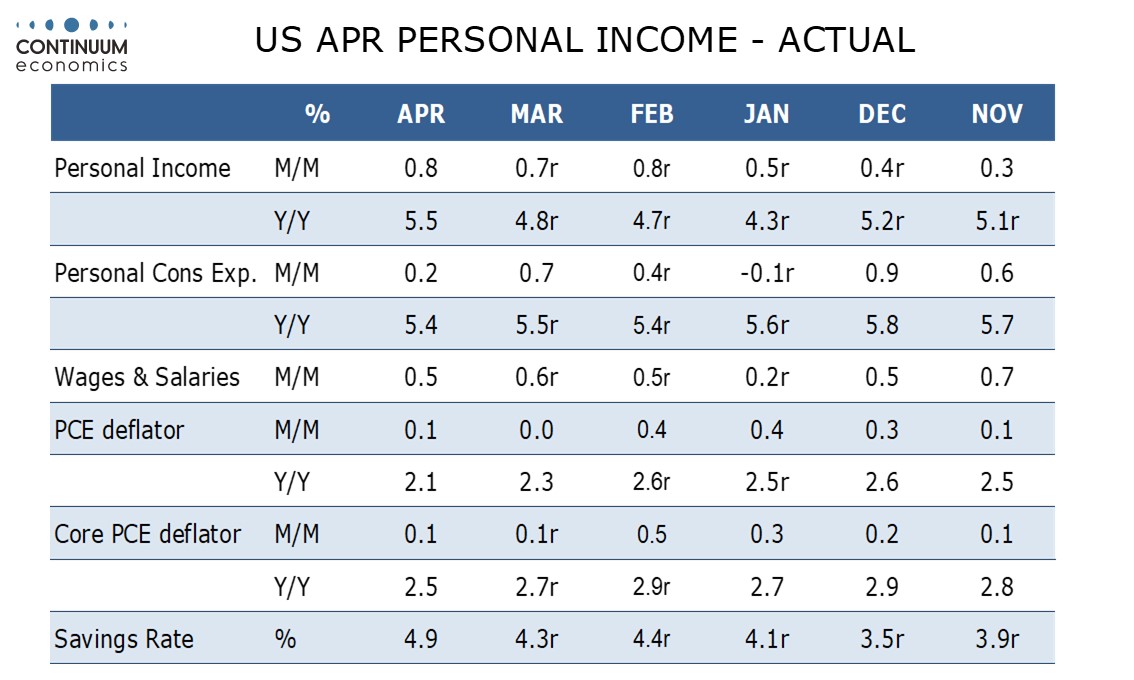

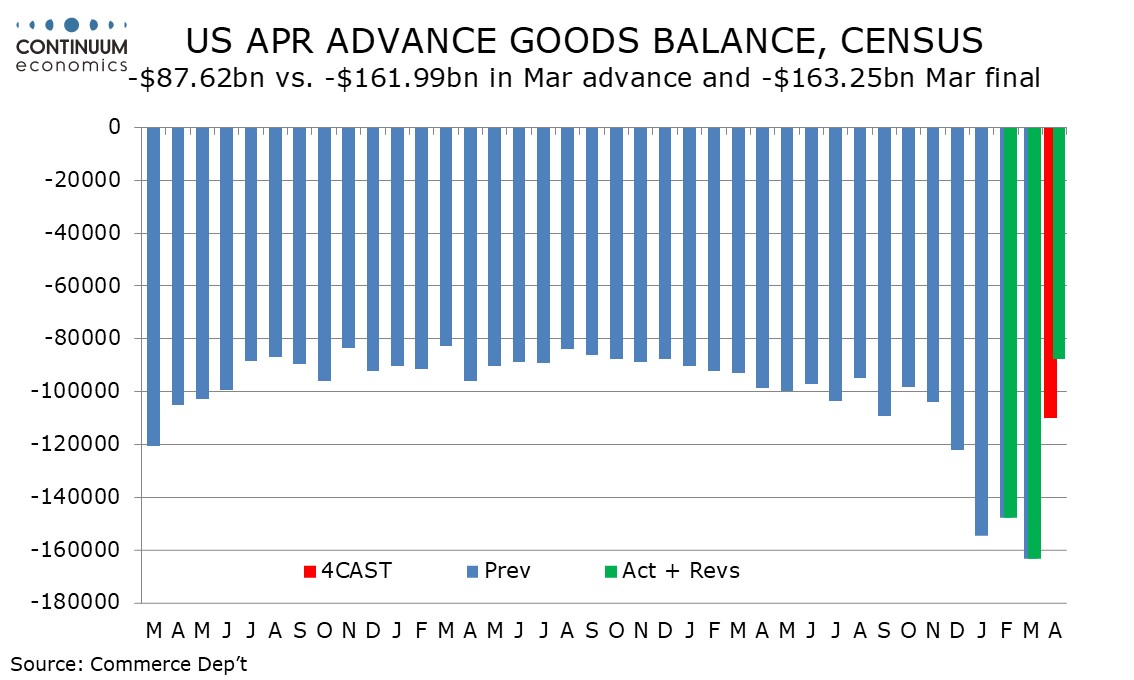

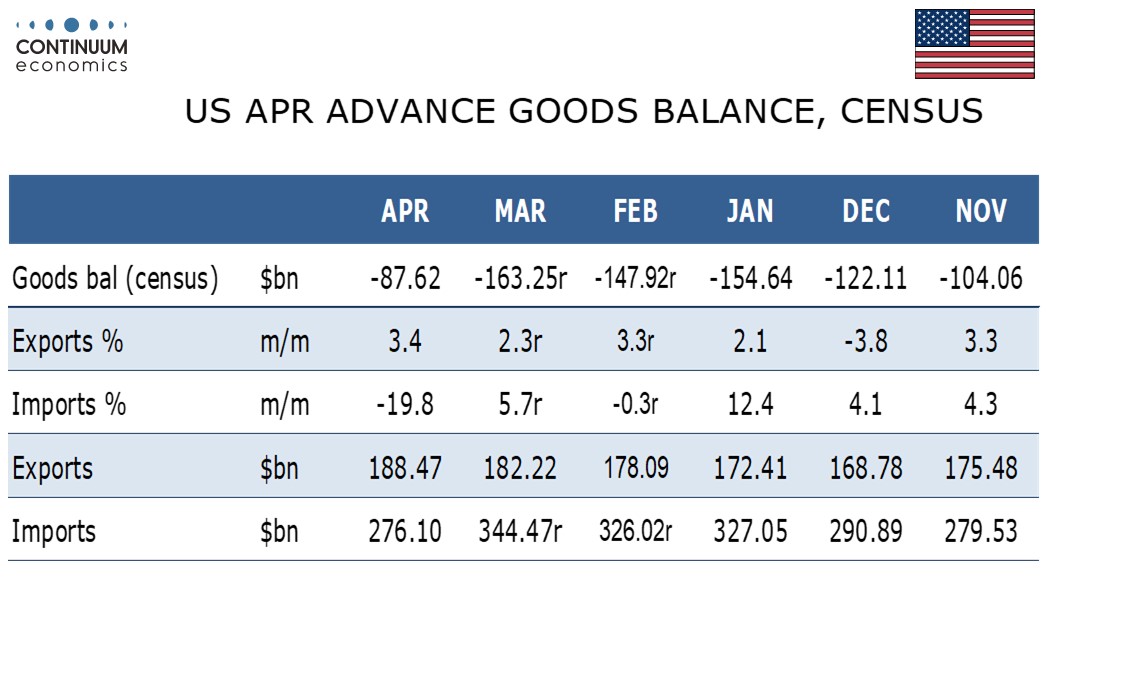

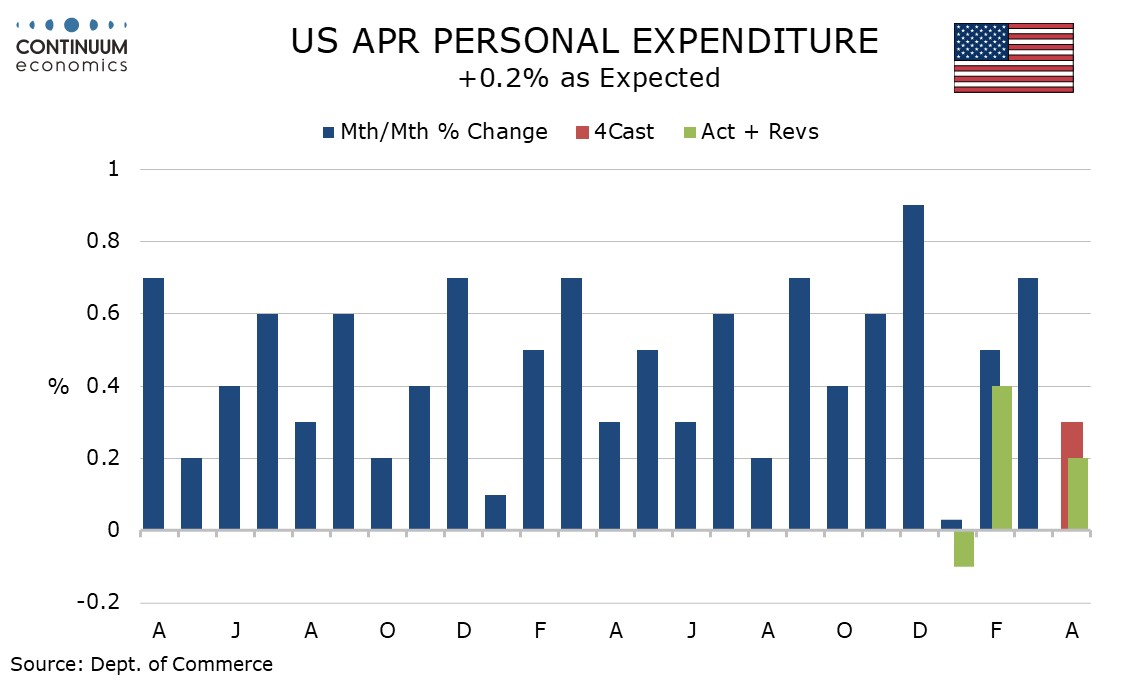

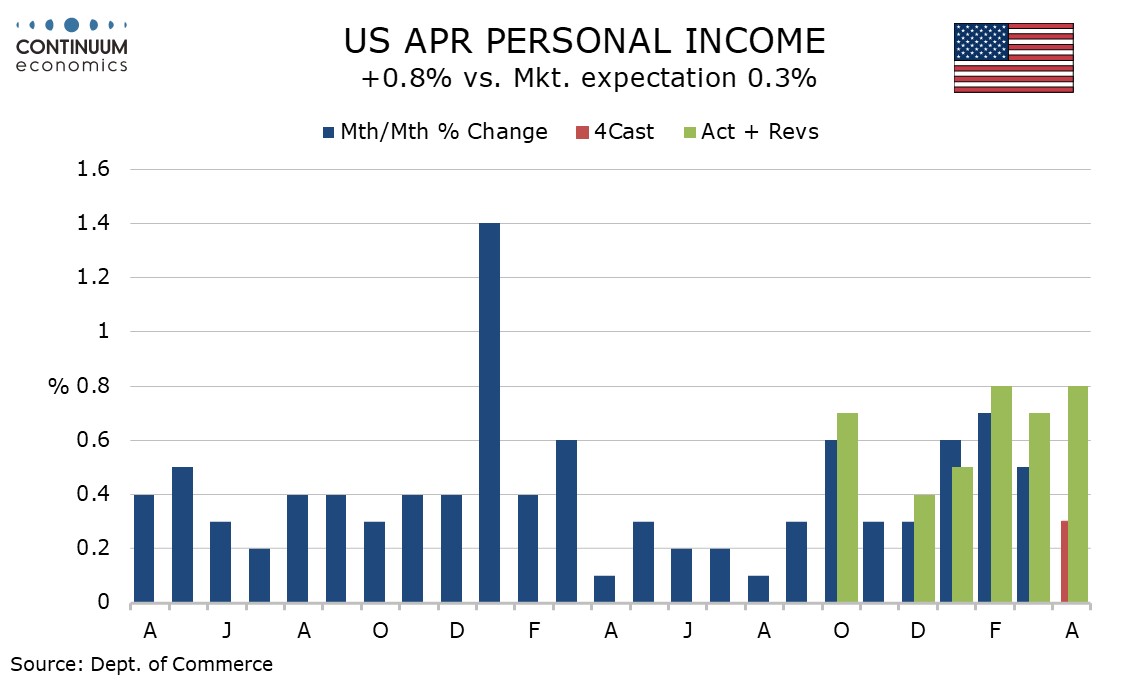

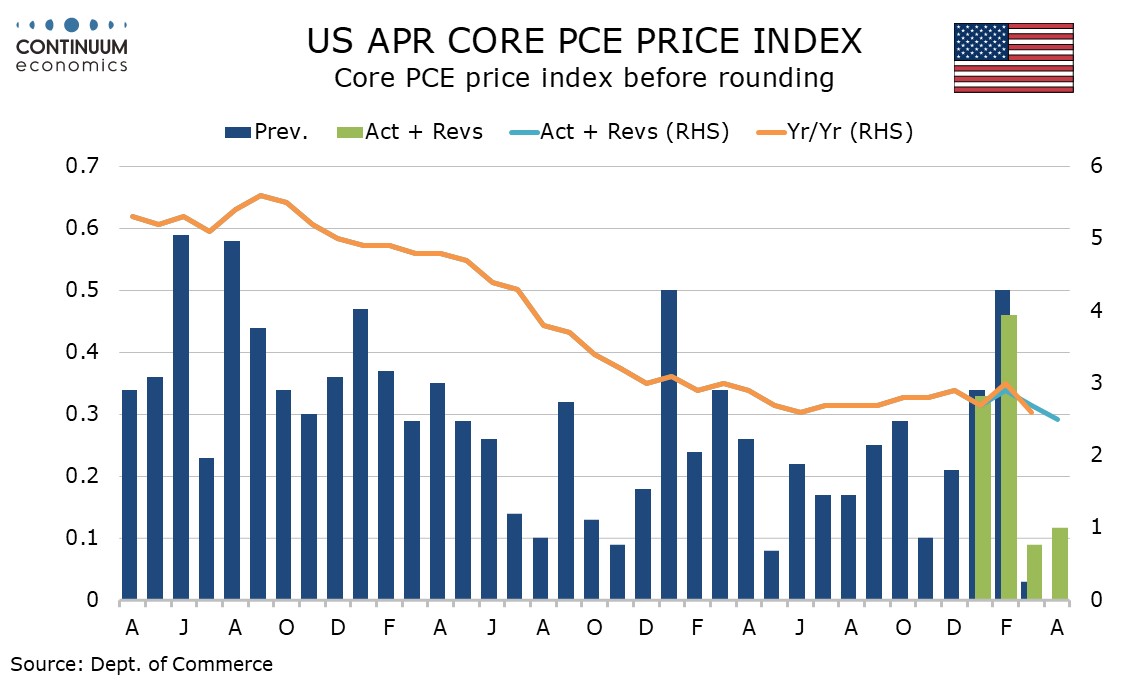

While March personal spending is subdued as expected with a 0.2% rise, personal income shows surprising strength with a rise of 0.8%, while core PCE prices are subdued as expected, up 0.1%, underperforming a 0.2% core CPI. A much smaller than expected advance April trade deficit of $87.6bn is supportive for Q2 GDP, correcting from a pre-tariff record of $162.3bn in March.

The advance trade data shows a healthy 3.4% increase in exports, led by a 15.5% rise in industrial supplies, and a 19.8% plunge in imports led by falls of 31.1% in industrial supplies and a 32.3% fall in consumer goods. The deficit is the lowest since December 2023 but the imports level is not far from where trend was before imports started to pick up in December of 2024, and even more so in Q1, due to tariff concerns. Imports could fall still further. Compared with a year ago, exports are up 9.6% and imports are up 2.6%.

This suggests that after net exports were a sharp negative to GDP in Q1 they will be a similarly sharp positive in Q2. Advance inventory data, wholesale unchanged and retail at -0.1% is subdued in April, but will not provide much offset to the positive from net exports in the GDP arithmetic. Unless we see sharp weakness in consumption or investment, the weak Q1 GDP could be followed by an above trend Q2. There may be some problems in accurate measurement given the exceptional circumstances.

Consumer spending has got off to a subdued start to Q2 after what was a subdued Q1 particularly after downward revisions seen with the GDP report, but is still increasing, albeit slowly. Detail shows durables partially correcting from a strong March that was led by autos, flat non-durables and a healthy 0.4% rise in services (0.3% in real terms).

The personal income data shows a third straight 0.5% increase in wages and salaries, implying a still healthy labor market, with the overall gain inflated by an unusually strong rise in Social Security benefits, reflecting payments with the Social Security Fairness Act. This is likely to be a one-time lift, legislated for public sector retirees in the final days of Biden’s term. Still, it will provide some support to spending.

Core PCE prices rose by 0.116% before rounding after a 0.09% rise in March, a second straight subdued month after above trend data in January and February, and showing that tariffs did not bring an instant surge in prices. A 0.5% rise in durables may be tariff-influenced but non-durable prices fell by 0.1% and services were unusually subdued with a rise of only 0.1%. Reduced tourism demand as a consequence of the trade wards has had a restraining impact on prices of air fares and hotels.

Yr/yr core PCE prices fell to 2.5% from 2.7% and this is the slowest since March 2021. Overall PCE prices also rise by 0.1% on the month, and here yr/yr growth fell to 2.1% from 2.3%, not far above the 2.0% Fed target for the core rate.