USD, JPY flows: USD down JPY up after softer PPI

USD down and JPY up across the board after softer PPI, which has had more impact than strong CPI yesterday

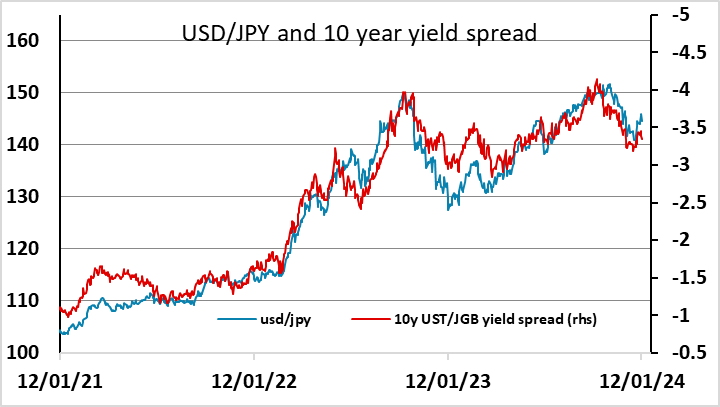

Softer PPI has had more impact on the USD and US yields than the stronger CPI did yesterday, pushing both significantly lower. The JPY has been the main beneficiary, with USD/JPY a figure lower, while EUR/USD has gained only around 30 pips. The AUD and CHF have outperformed the EUR, though both have lost a little ground against the JPY.

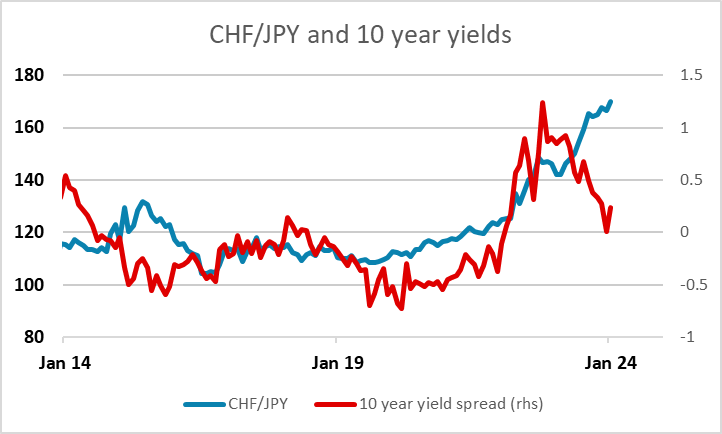

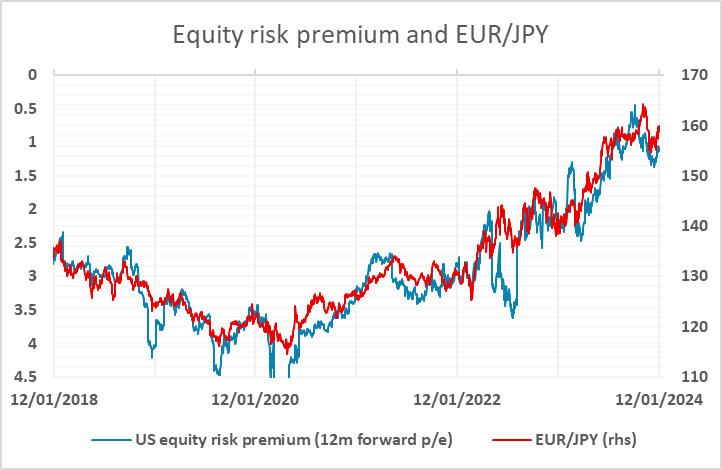

That the reaction to PPI was so much larger than the reaction to CPI likely says more about market positioning than the significance of the data. Nevertheless, we do favour the JPY upside, and the dip in yields does suggest that we may have seen the JPY bottom, with Japanese yields likely to rise more than yields elsewhere going forward. Most European yields have fallen with US yields, despite the comments from ECB chief economist Lane earlier indicating that ECB rate cuts were not a “near term topic”, so there hasn’t been much movement in US/Europe spreads, and the decline in yields should consequently favour the JPY across the board. However, the JPY crosses continue to be more correlated with equity risk premia than yield spreads, so if equities continue to rise, as they have done following PPI, JPY gains on the crosses are unlikely to be large. Nevertheless, we favour CHF/JPY as the best value play.