USD flows: USD recovered after PMIs

USD recovered post-CPI losses helped by strong PMI

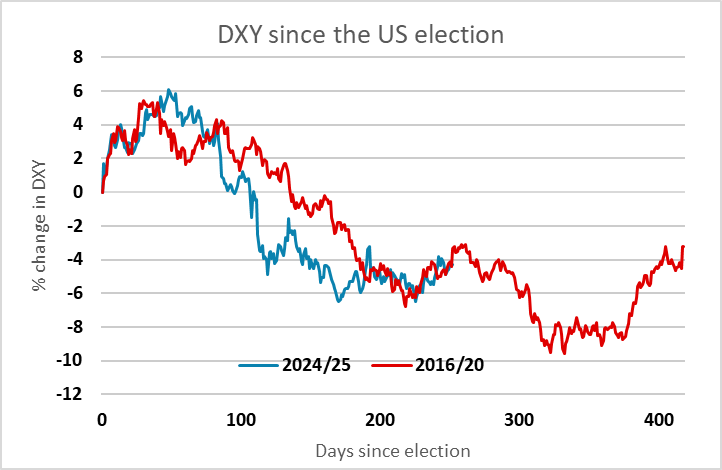

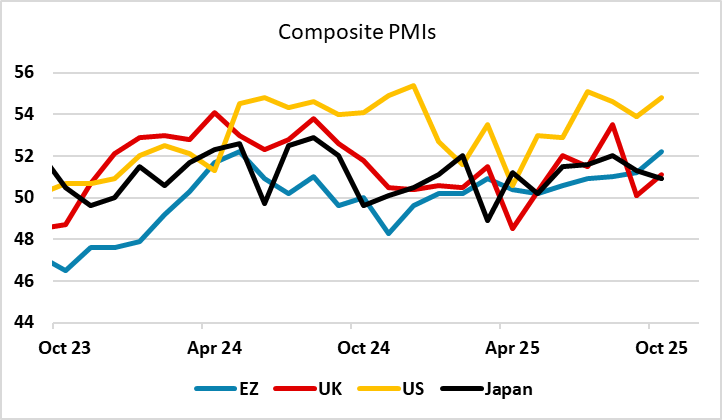

The USD has nearly fully recovered the ground lost after the weaker than expected CPI helped by the stronger than expected S&P PMIs just released. The composite US PMI rose to 54.8 – the highest since July and the second highest since the pandemic. While the S&P PMI is taken with a pinch of salt, as it has a poor correlation with the ISM data, it will nevertheless be seen as an indication that the US economy is holding up well under the pressure from tariffs. While a stronger economy will not prevent initial Fed easing, it limits the risk of a substantial easing being required, and some of the Fed easing projected over the next year reflects risks of a sharp downturn rather than being a central view. Going into next week, the USD remains generally well supported, with the JPY still particularly weak.