U.S. Personal Income underperforming Spending, Core PCE Prices maintaining trend

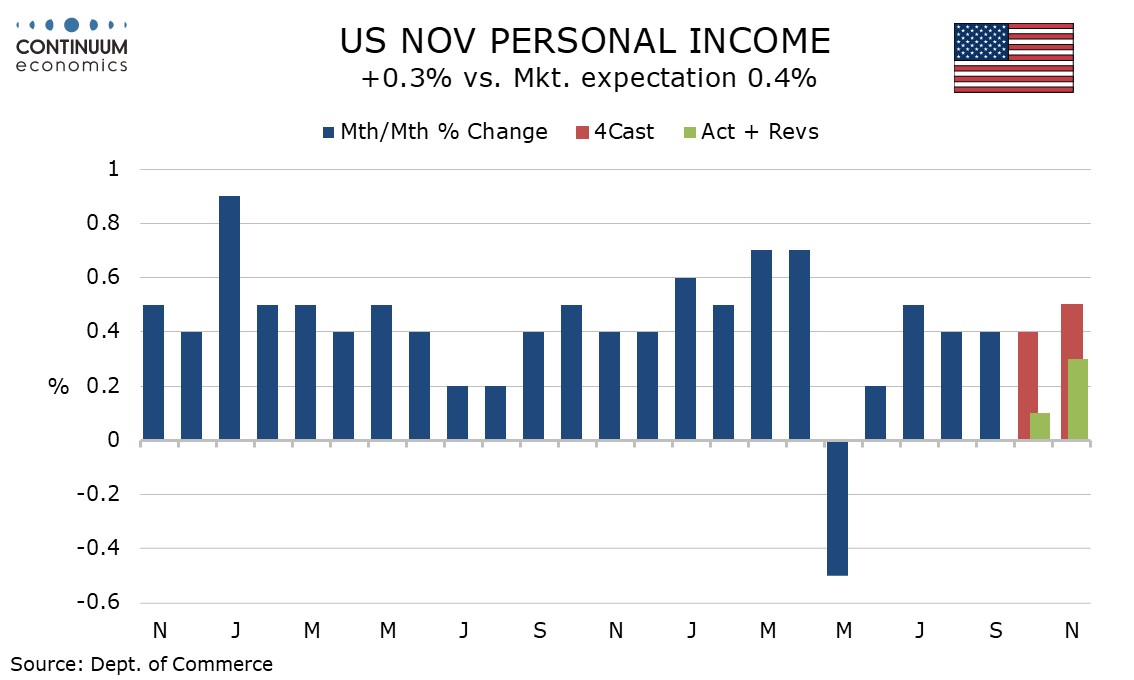

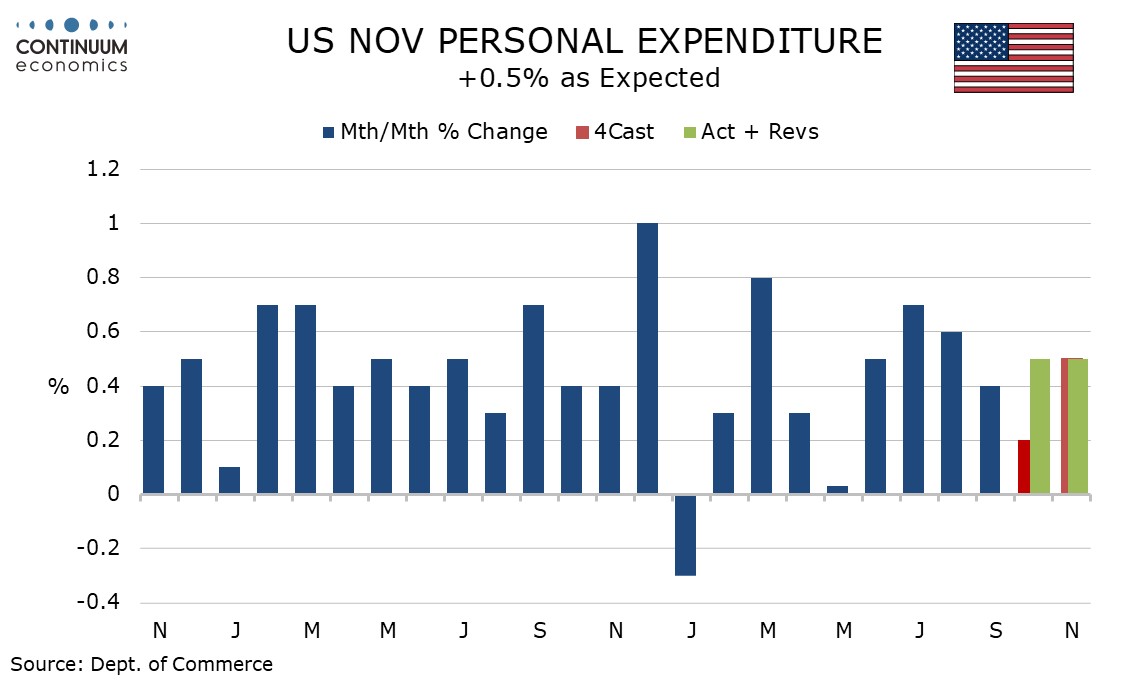

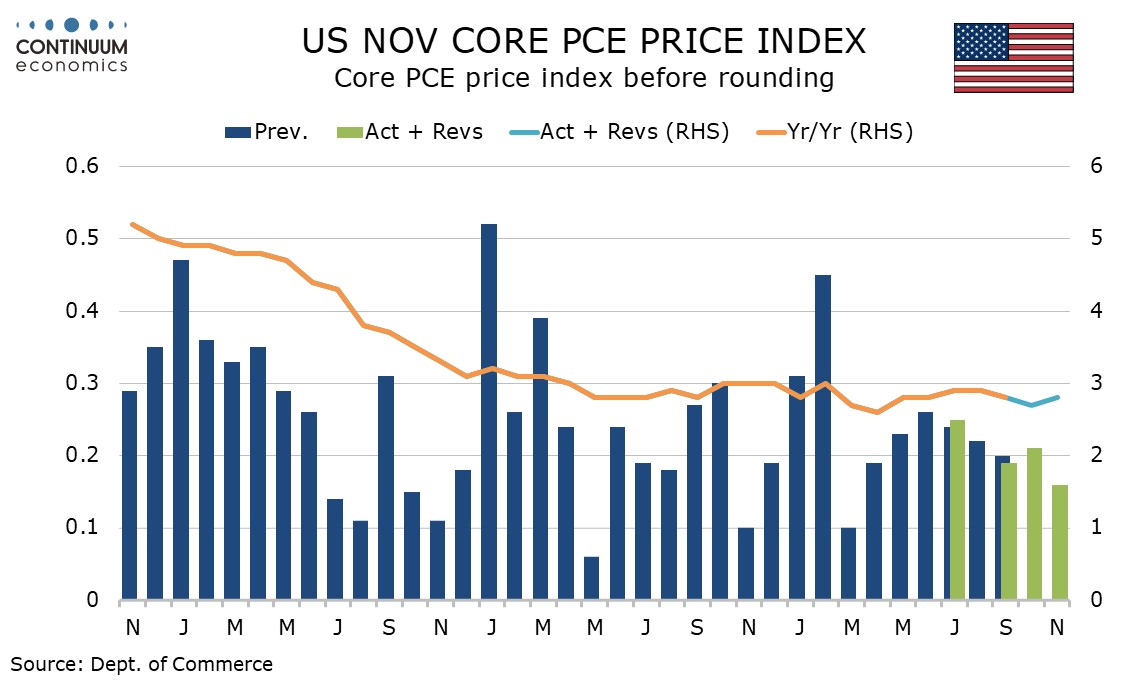

The personal income and spending report for both October and November has been released and shows healthy spending, up by 0.5% in each month outperforming income which rise by 0.1% in October and 0.3% in November. PCE prices, both overall and core, rise by 0.2% in each month, modest, but stronger than the CPI suggested.

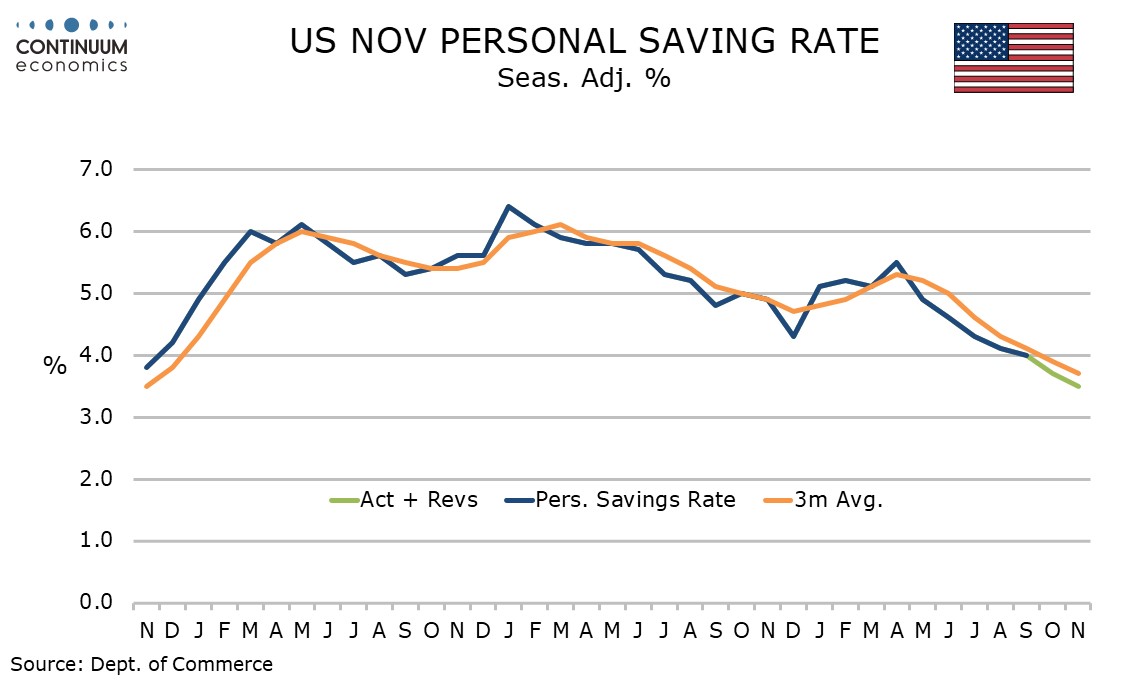

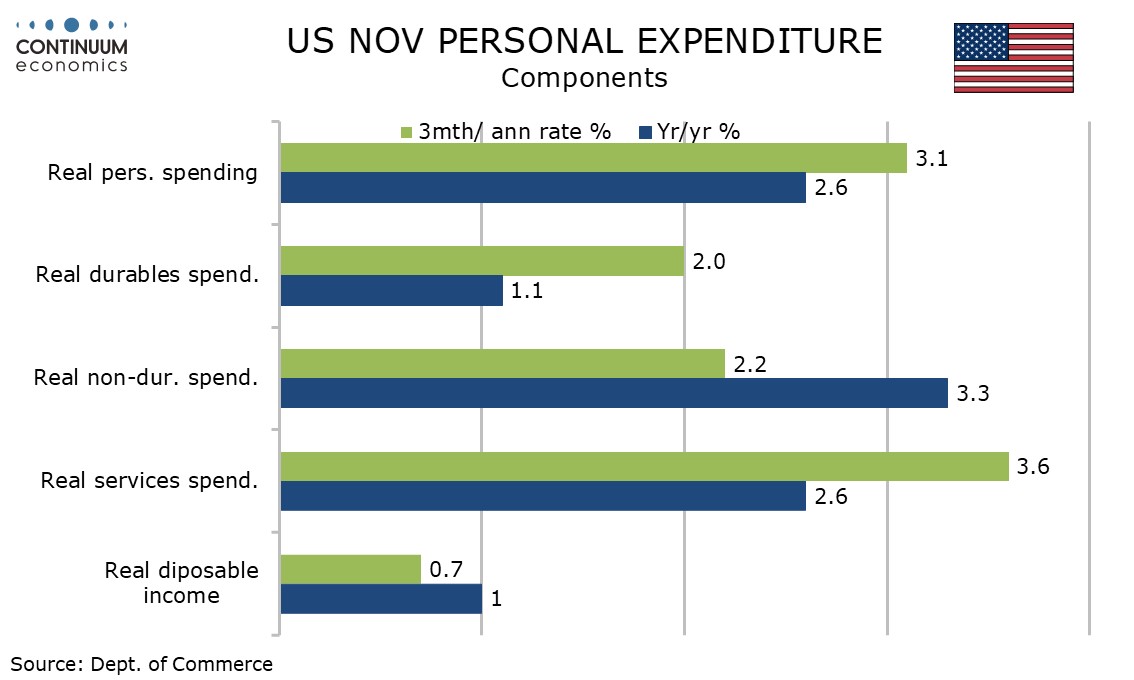

As a consequence of spending outperforming income, the savings rate at 3.5%, down from 3.7% in October and 4.0% in September is the lowest since October 2022. Real disposable income is up only 1.0% yr/yr, compared with 2.6% for real spending, suggesting some consumer vulnerability entering 2026.

Wages and salaries outperformed personal income, rising by 0.3% in October and 0.4% in November. Farm and dividend income were particularly weak in October. Retail sales saw stronger gains in November than October but services saw the stronger rise in October.

Before rounding core PCE prices rise by6 0.21% in October and 0.16% in November. Yr/yr growth at 2.8% in October and 2.7% in November looks fairly stable.

If December is unchanged real disposable income would be flat for a second straight quarter while real personal spending would be up by 2.7% annualized. Gains of 0.2% in each series in December would leave Q4 income at 0.3% and spending at 3.0%.

If core PCE prices rise by 0.2% in December it would be a sixth straight such gain, and leave the quarterly annualized pace at 2.4%, which would be the slowest since a matching Q3 2024.