Sweden Riksbank Preview: Early Easing Discussion Clearer But Nothing Definitive

It is ever clearer that the Riksbank has accepted that it can and should make its policy stance less contractionary, at least in conventional terms. In its last decision, at the start of February, keeping policy at 4%, albeit increasing the pace of bond sales from SEK 5 billion to 6.5 billion per month, it noted that the possibility of the policy rate being cut during the first half of the year cannot be ruled out. Surely this possibility has risen given the further downside inflation surprise seen in February data which undershot Riksbank thinking of CPIF inflation, at 2.5%, by 0.4 ppt and added to signs of clearly softer underlying price dynamics (Figure 1) that imply y/y CPIF inflation could be below target in Q2. A June cut has long been our view, the question being whether this is formally flagged by the Riksbank in its updated projection due alongside the almost-certain stable decision due on Mar 27. More likely, the Board may wait to the May 8 verdict to offer any formal signal.

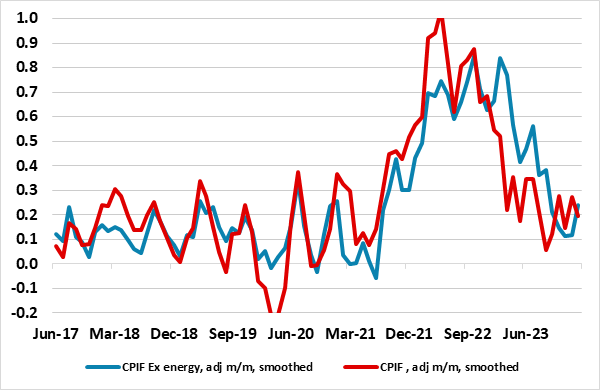

Figure 1: Underlying Adjusted inflation Down Markedly

Source: Stats Sweden with seasonal adjustment made by CE and smoothed is 3 mth mov avg

While this hint of earlier rate cuts is from a Riksbank commitment, it contrasts to the H1 2025 schedule in its last set of formal forecasts released last November, which implied no move before Q2 next year. This is a reflection of easing worries about the krona, an acceptance that the inflation outlook has improved durably while the economy is weak, all suggesting that the stance of policy has scope and rational to be less restrictive. The Riksbank thinking may also be by easing earlier it can ease more gradually and or with more flexibility. This change of heart chimes with our forecast anticipating rate cuts from Q2, and some 100 bp by end-year. We still think the economy will contract this year, not least as the Riksbank balance sheet shrinkage is aggravating the worrying and more intense contraction seen in bank lending (Figure 2).

Policy Biting

Otherwise, recent activity data have continued to be been mixed, with slightly perkier tones to business surveys, largely due to firm exports, but fresh hints that GDP is volatile still, albeit superimposed over weakness and with a clearly weaker labor market. But both the much weaker underlying inflation picture (Figure 1) and what may be growing Board concerns about financial stability risks inter-related with growing weakness in bank lending and deposits have argued for an easing in policy, something we think may occur in the next quarter. Notably, the Riksbank change if heart is marked as only last November it was not formally ruling out a further hike even though it then envisaged current policy inflation will return to target and stay there in the latter part of its 2-3 year forecast horizon, albeit with some volatility due to energy prices.

After an unprecedented 400 bp cumulative rate rises seen in 21 months, this helps produce a sizeable output gap persisting out to 2026, embracing a cumulative near-2 ppt GDP drop by mid-2024, this partly responsible for the already slumping price pressure picture.

Meeting Scheduling Outlook

The number of Riksbank monetary policy Board meetings has varied over time. However, the Board now sees a need to increase the number of ordinary monetary policy meetings to eight per year from the previous five. The rationale is to make it easier for the Riksbank to adapt monetary policy more rapidly to the prevailing situation and communicate a coherent view on economic developments more often. Rather than at every meeting, only at four of the eight monetary policy meetings, will there now be a Monetary Policy Report where forecasts including an interest rate path will be published. No new forecasts will be published at the other four meetings and this includes this last February decision where a more limited monetary policy update was instead be provided.

But the next policy meeting decision on Mar 27 will have a fresh set of forecasts but where a more formal flag a rate cut (as early as June) may come at the following decision on May 8

Plunging Price Pressures?

Clearly, the Riksbank continues with an explicit admission that policy is restrictive, as the Riksbank has taken policy to a terminal rate of around 4%. Belatedly, the Riksbank has begun to accept an improving inflation picture and outlook, noting that these hikes have contributed to lower inflationary pressures and to inflation expectations being firmly anchored around the 2% inflation target while wages are increasing only moderately. In addition, it noted that in November and December, inflation continued to fall, and when measured in terms of the CPIF excluding energy, it was lower than expected.

This did see the y/y rate slump in December with the CPIF almost back down to target, albeit mainly due to base effects but where February numbers saw a decisive and surprise fall in the core measures. Amid these distortions, a clearer perspective is provided by seasonally adjusted m/m readings (computed by CE) for both overall CPIF and the CPIF ex-energy. Indeed, such adjusted data show a very much softer profile of late, even excluding energy with the CPIF measure consistent with m/m outcomes averaging around 0.1% in the last few months (Figure 1). Thus, from our standpoint, the risks may be that inflation returns to target earlier and possibly undershoots target much earlier and more durably than the end-year schedule thought by the Riksbank. Indeed, CPIF inflation may be below target by June.

Figure 2: Negative Credit Dynamics

Source: Riksbank