As We Expected, SARB Kept the Key Rate Stable at 6.75%

Bottom Line: South African Reserve Bank (SARB) kept the policy rate unchanged at 6.75% during the MPC on January 29 due to inflationary risks such as food prices and rise in administered costs, such as electricity prices. The MPC decision was not unanimous. We think the SARB’s (new) 3% inflation target remains the sticking point for cuts, as we foresee cautious and data-dependent SARB will likely try to bring inflation first down to 3% anchor and assess the impact of earlier cuts before (re)continuing its easing cycle.

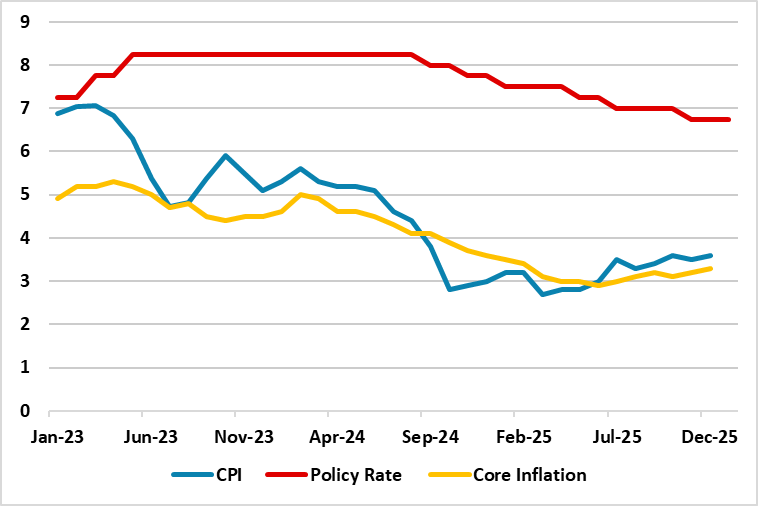

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – January 2026

Source: Continuum Economics

SARB’s MPC convened on January 29 announcing the first key rate decision of 2026, and kept key rate stable at 6.75% due to inflationary risks such as food prices and rise in administered costs, such as electricity prices. (Note: Annual inflation edged up moderately to 3.6% y/y in December from 3.5% the previous month due to higher housing and utilities; and insurance and financial services prices while inflation remained within the tolerance band of 1 percentage point either side of 3%). MPC decision was not unanimous, with four members of the MPC voting to hold and two voting to cut by 25 basis points.

Speaking about the rate hold, SARB governor Kganyago mentioned that “Inflation generally slowed last year, and many central banks have had space to adopt more neutral policy settings. Financing conditions for emerging markets remain benign. We believe that local inflation peaked in December at 3.6%, with the expectation that it will now continue to fall.”

Despite December inflation staying within the SARB’s 1 percentage point tolerance band of 3% target, we think possible increase in utility costs and stubborn food prices will continue to pressurize prices in 2026. The usual increase in sin taxes in the budget and hikes in wages and salaries will likely pressurize CPI in Q1 2026. (Note: We foresee average inflation will hit 3.8% and 3.5% in 2026 and 2027, respectively, supported moderately by lagged impacts of previous tightening, and a relatively stable ZAR).

The SARB’s 3% inflation target remains the sticking point for cuts. Despite the SARB’s Quarterly Projection Model forecasts gradual rate cuts as inflation subsides and interprets the policy stance as moderately restrictive currently, with rates reaching neutral levels during 2027; we foresee cautious and data-dependent SARB will likely try to bring inflation down to new 3% anchor and assess the impact of earlier cuts before (re)continuing its easing cycle in 2026. We think SARB will likely halt its cutting cycle in H1 and our end-year key rate predictions remain at 6.75% for 2026. If inflation undershoots our forecast, then SARB could do a little more easing in 2026.