USD, AUD, NOK, JPY flows: Equity strength supports riskier currencies, but...

Equity gains have helped AUD and NOK rise, but rising risk premia suggest JPY can catch up.

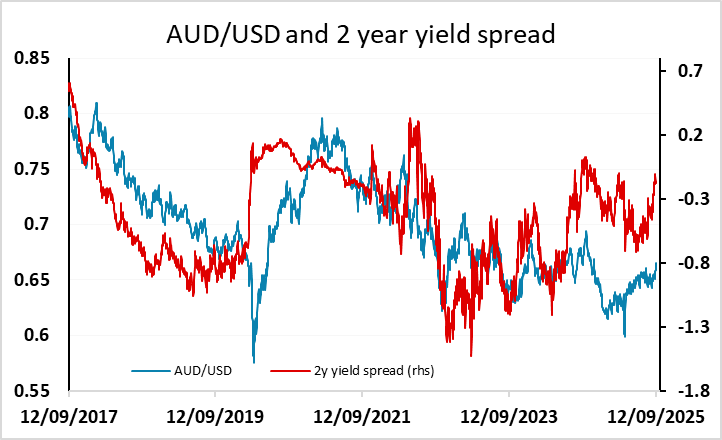

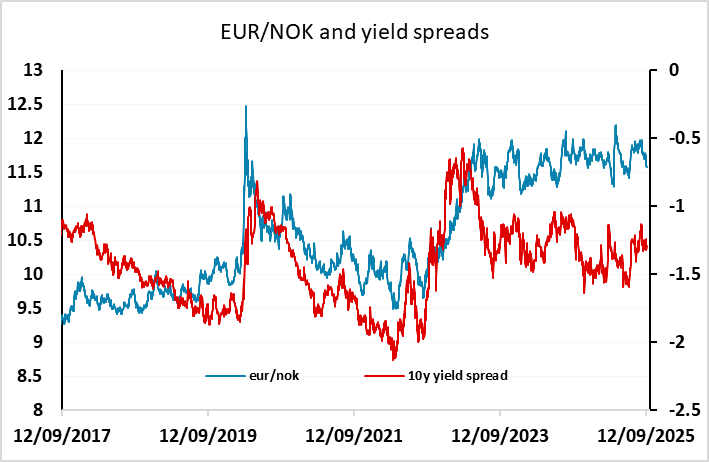

There’s little of interest on today’s calendar, and FX overnight has been relatively quiet. The main feature of the markets at the end of last week was the strength in equities, with the S&P 500 once again hitting an all time high, helped by lower US yields. This has been positive for the riskier currencies, notably the AUD, which has hit new highs for the year, and the NOK, with EUR/NOK at its lowest since June. EUR/USD and GBP/USD have shown a mild upside bias, while USD/JPY remains very rangebound, holding a tight 146.50-149 range since the beginning of August.

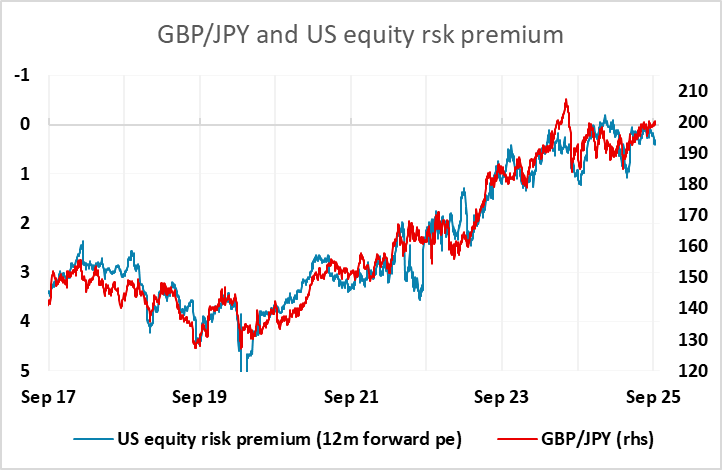

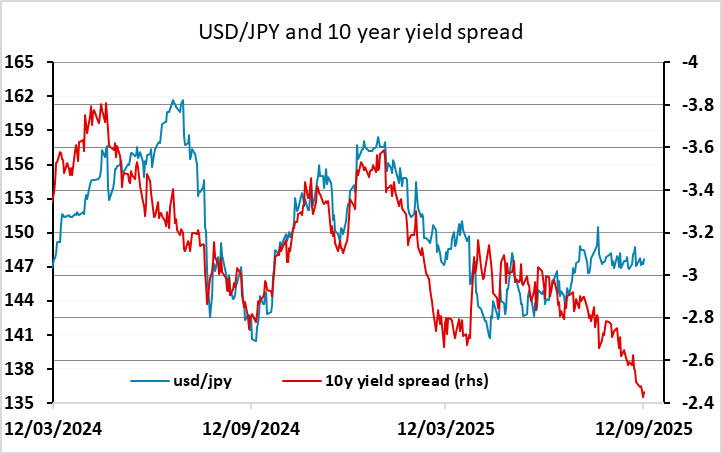

While the S&P hit a new all time high, the gains have been due to lower US yields rather than an implied rise in expectations of US earnings. The implied US equity risk premium has actually risen slightly over the last week, and this suggests there is upside scope for the JPY. JPY crosses have broadly moved with the risk premium in the last 8 years, and while USD/JPY has held up despite the sharp decline in US/Japan yield spreads, rising risk premia should start to allow the JPY to play some catch up.

Having said this, the AUD and NOK both look cheap relative to yield spreads, and may well be the best performers if equities continue to do well. But US 10 year yields are up modestly this morning, and this may hold equities back and allow some general USD recovery, particularly against the higher yielders.