GBP, EUR, USD, CHF flows: GBP slightly firmer on GDP, USD remains under pressure

GBP benefiting from much strogner than expected UK GDP. USD remains under pressure, CHF strength may be a little overdone

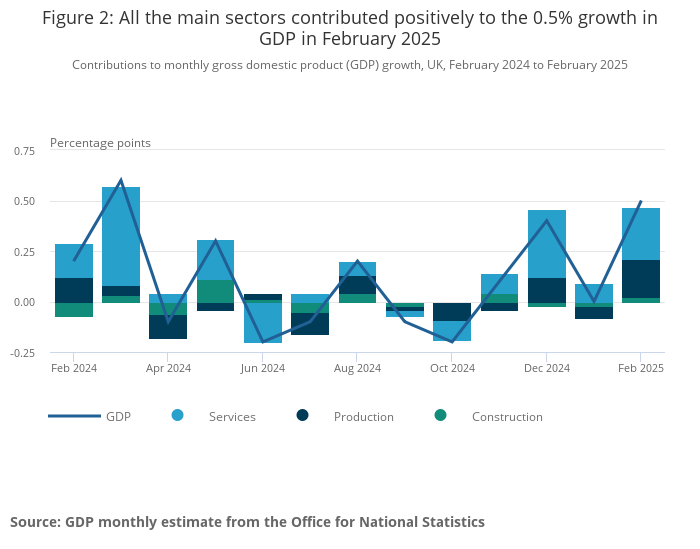

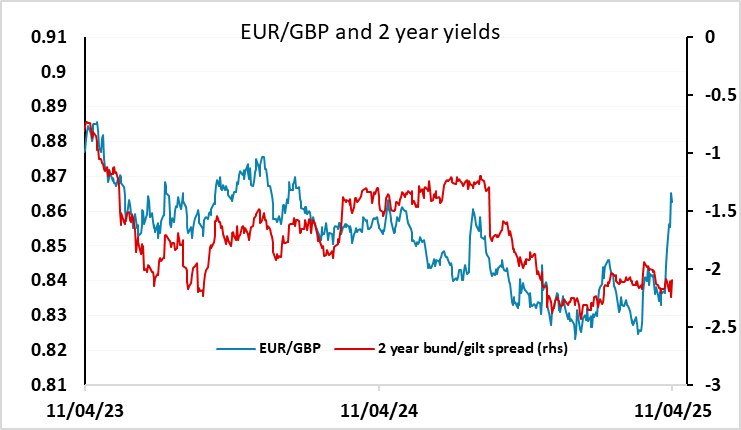

UK February GDP has come in much stronger than expected at 0.5% m/m in February, with strength seen in all the main categories, although the 2.2% rise in manufacturing output stands out. Thus followed a 1.0% decline in January, but was the largest monthly gain since June 2023 and the 3m/3m gain was the largest since March 2024. Services and construction output also rise, and the 3m/3m growth in GDP is up at 0.6%, suggesting a solid Q1 performance. GBP is modestly firmer, with EUR/GBP down around 15 pips to 0.8660, but the impact is modest with the focus still very much on the general health of markets and GBP’s tendency to weaken against the EUR in riskier markets. Still, with equities a little firmer early in the session, there is scope for GBP to recover somewhat further.

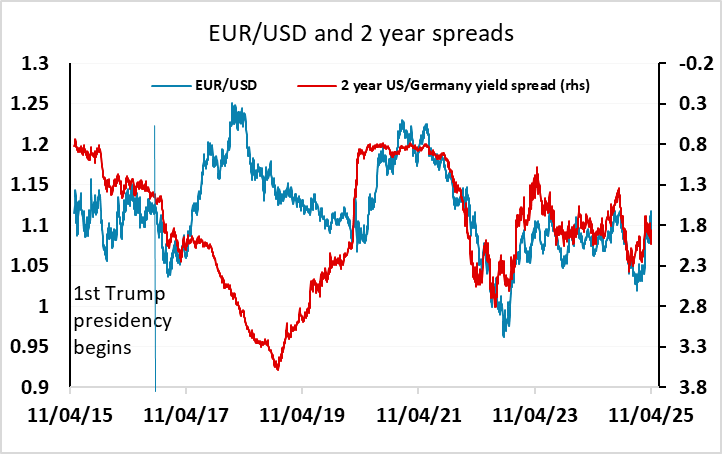

Coming into the weekend, it is unlikely we will see any definitive news on the tariff front, so the market will continue to adjust to what we already know. The 10% universal tariff introduced is going to have little impact on patterns of trade, but will raise US prices, and the 100%+ tariff on China will do so even more. The somewhat hawkish comments from FOMC members yesterday suggests this will mean weaker growth as well, as the Fed may not ease as much as the market is hoping. For now, this is being seen as USD negative, with the CHF being the biggest gainer. But the strength of the CHF looks a little excessive if we see some stabilisation in markets. More broadly, the USD is on a similar path to that seen in Trump’s first term, when we also saw a major break with the usual yield spread relationship. On that basis, the USD decline likely has a lot further to go.