U.S. CPI and Retail Sales Show Some Loss of Momentum in April

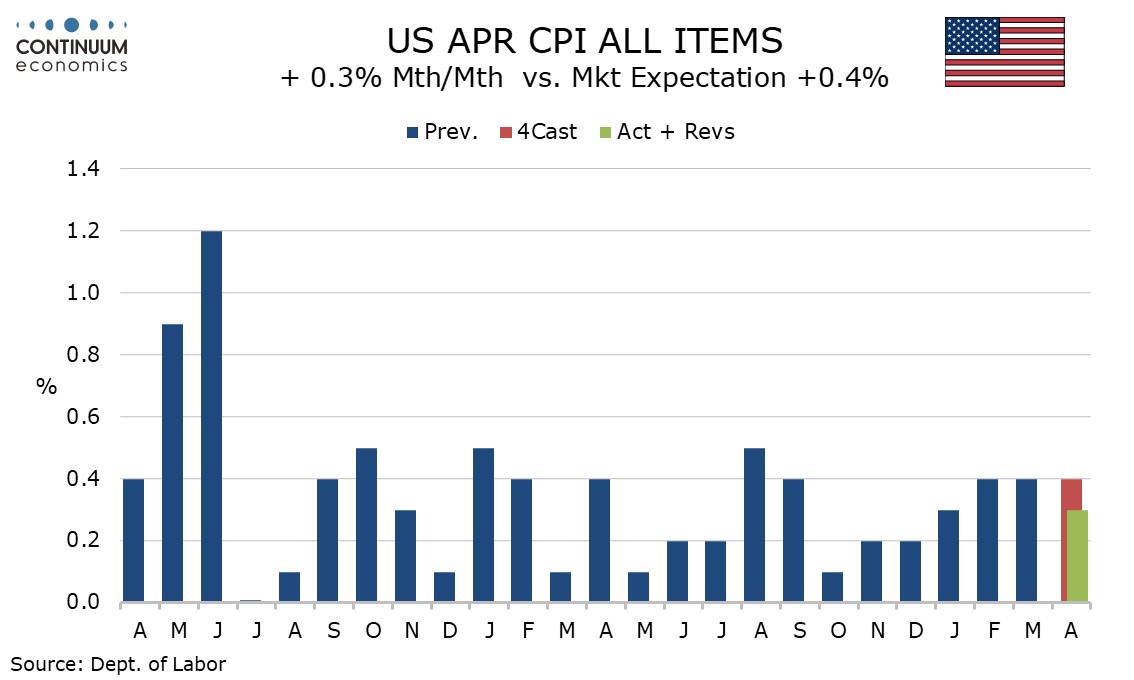

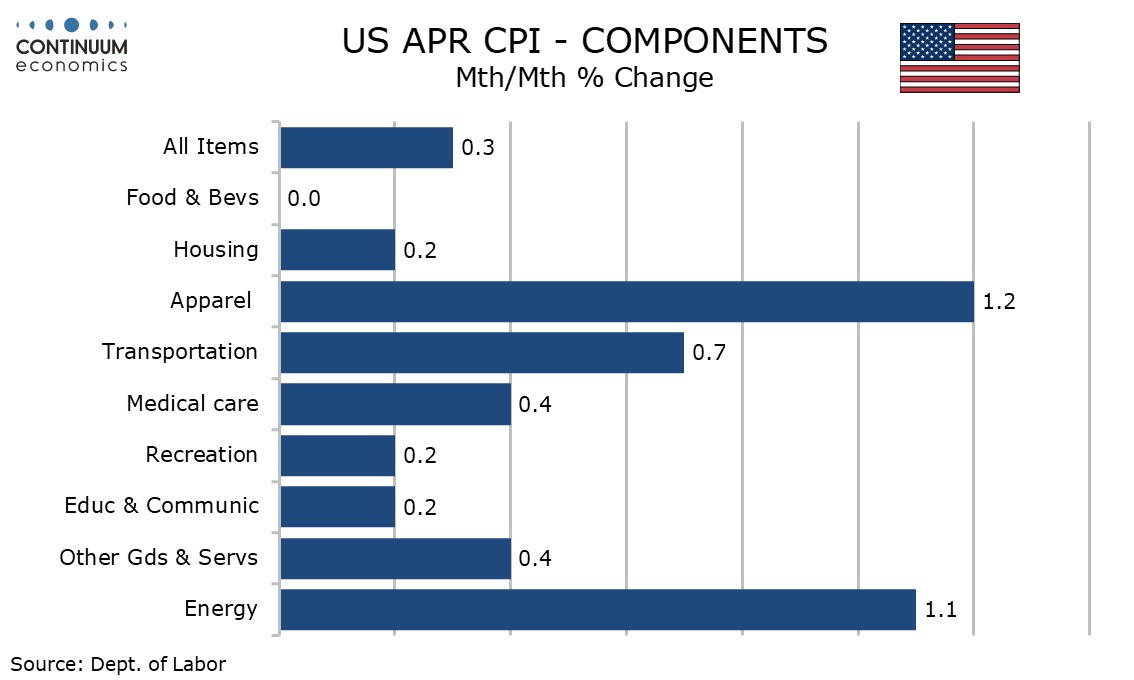

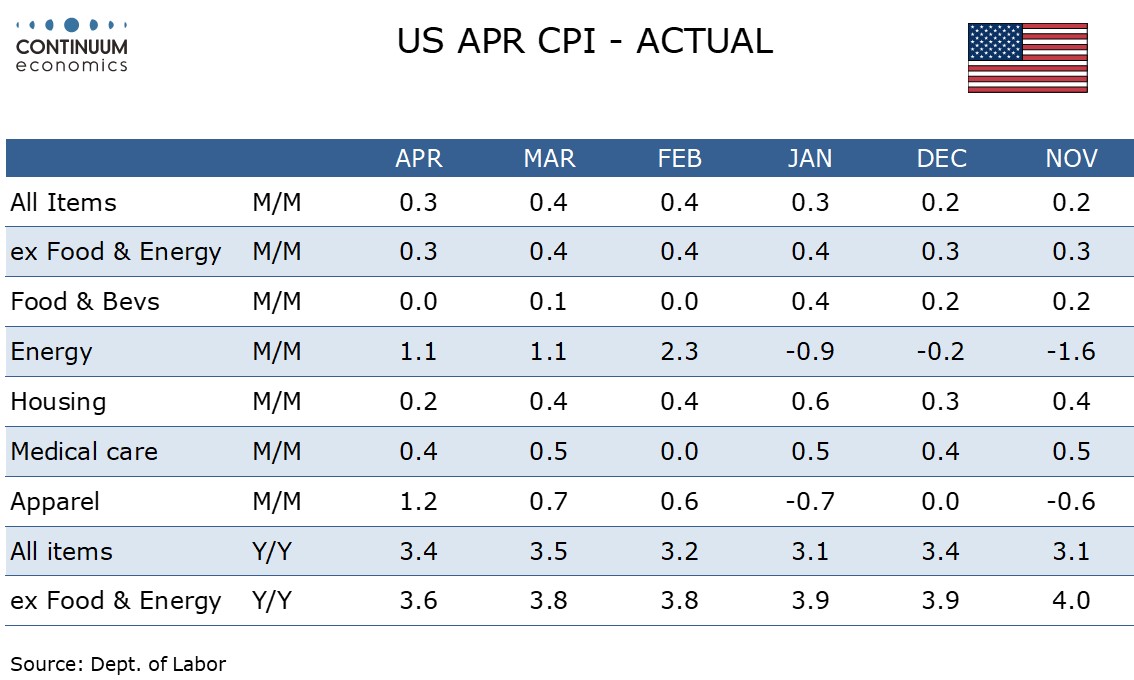

April CPI has provided some relief by coming in lower than expected at 0.3% on the headline and while the 0.3% core is on consensus, it is on the soft side at 0.292% before rounding. Retail sales have also lost some momentum in April, unchanged overall, up 0.2% ex autos but down 0.1% ex autos and gas.

The CPI is still higher than the Fed would like, but yr/yr growth is slowing, the headline to 3.4% from 3.5% and the core to 3.6% from 3.8%, reaching its lowest since April 2021.

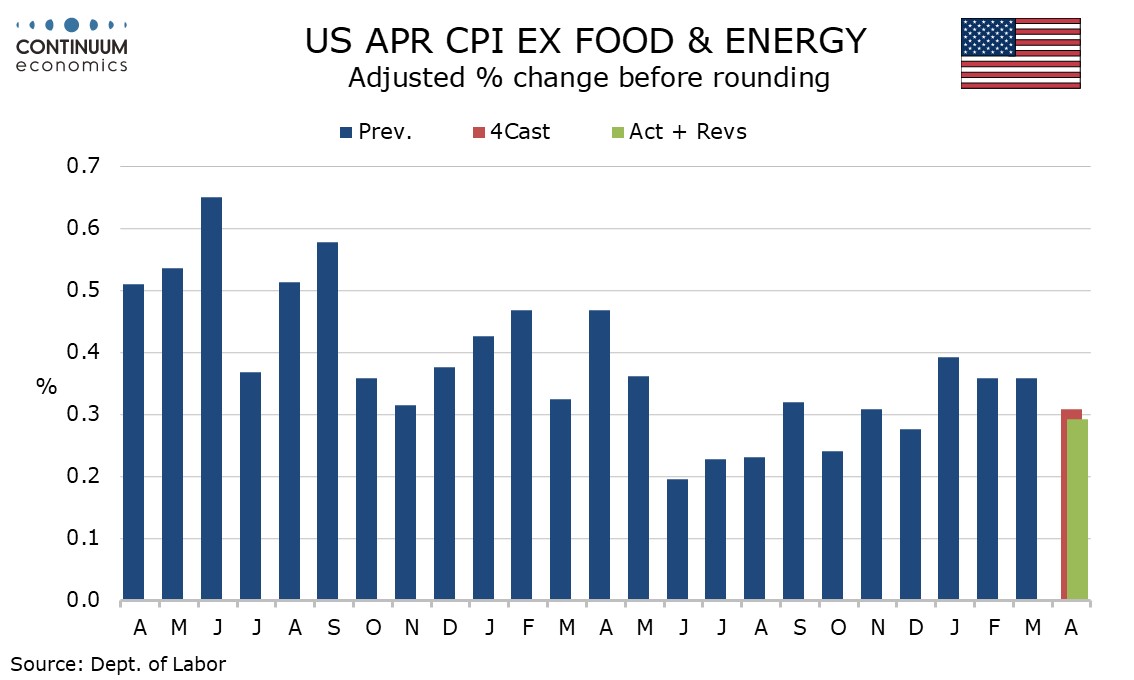

Overall CPI rose by 0.313% before rounding with energy up by 1.1% but food unchanged. Commodities less food and energy fell by 0.1% despite apparel rising by 1.2%, the strongest of there straight gains which looks unlikely to extend much further. New vehicles at -0.4% and used vehicles at -1.4% were increasingly negative. There were several other negatives in the commodities breakdown.

Services less energy rose by 0.4%, the slowest since April. Two volatile components were negative, air fares at -0.8% and lodging away from home at -0.2% but the impact of these is modest. Owners’ equivalent rent saw a third straight 0.4% increase. Transportation services at 0.9% remain firm but down from 1.5% in March with auto insurance at 1.8% from 2.6%.

A 0.3% pace for core CPI is still consistent with inflation above target but we expect some loss of momentum later in the year. Core CPI in the first five months of 2023 was strong, the lowest of those months being March at 0.325% before rounding. The strongest month of the remaining seven in 2023 was September at 0.319% before rounding.

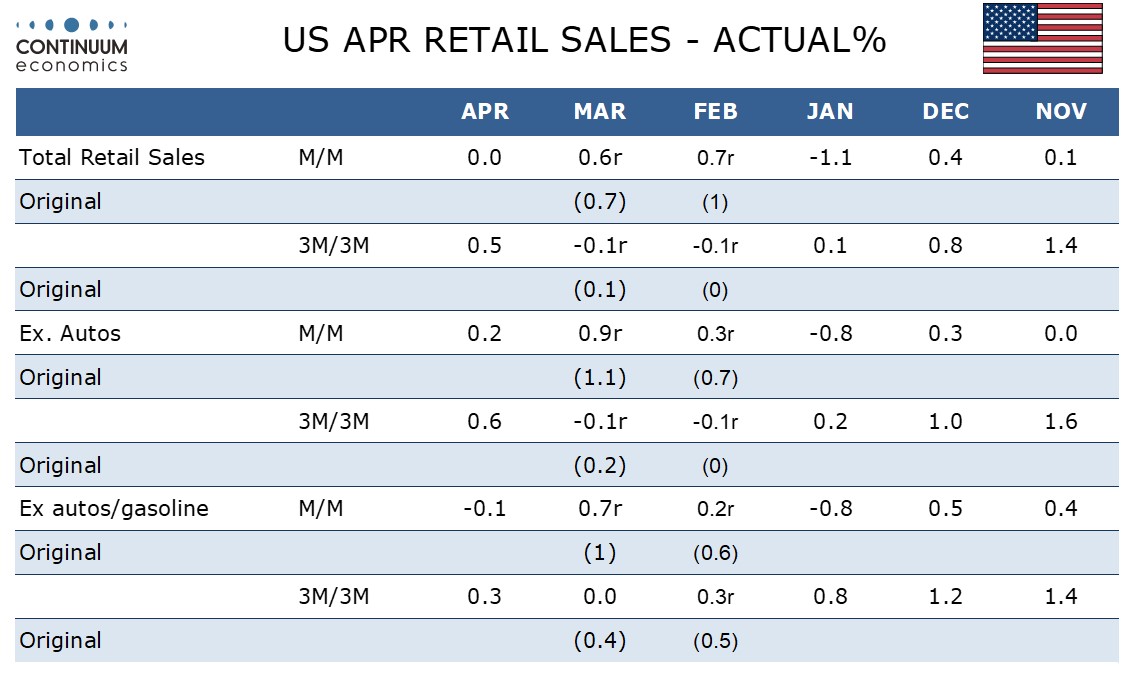

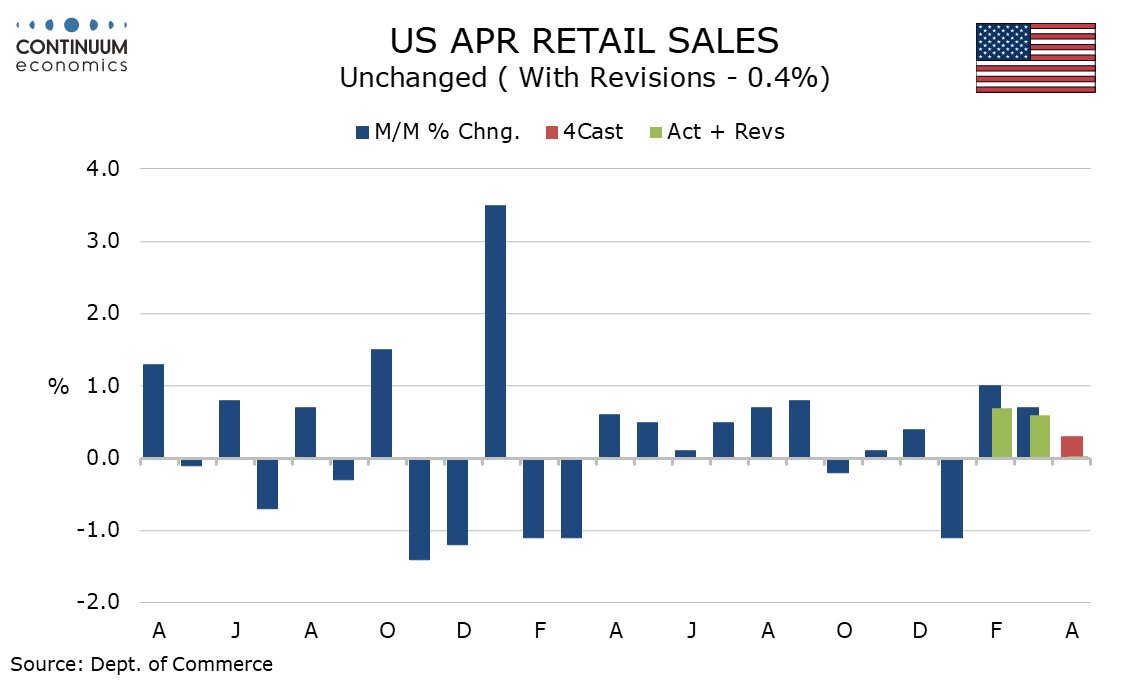

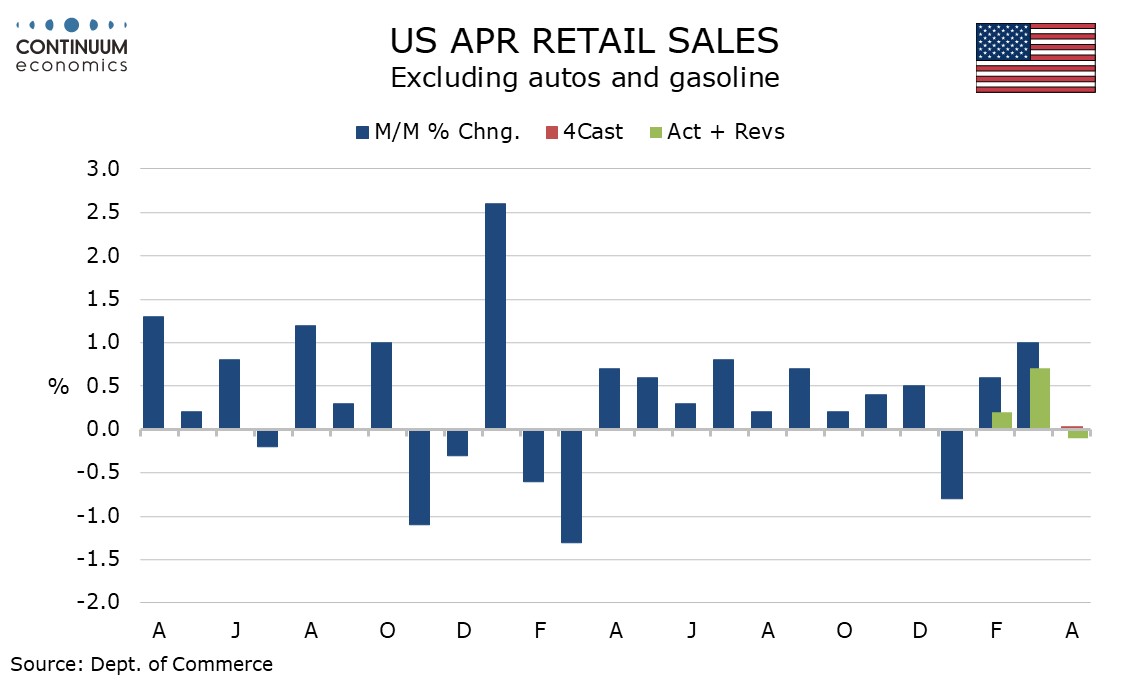

April retail sales followed a strong March with an unchanged outcome, while March was revised to a 0.6% rise from 0.7% and February saw a more significant downward revision to 0.7% from 1.0%. Given that January saw a weather-depressed 1.1% decline momentum over the four months looks quite modest, though 3 month/3 month rates are positive again as the weak January drops out.

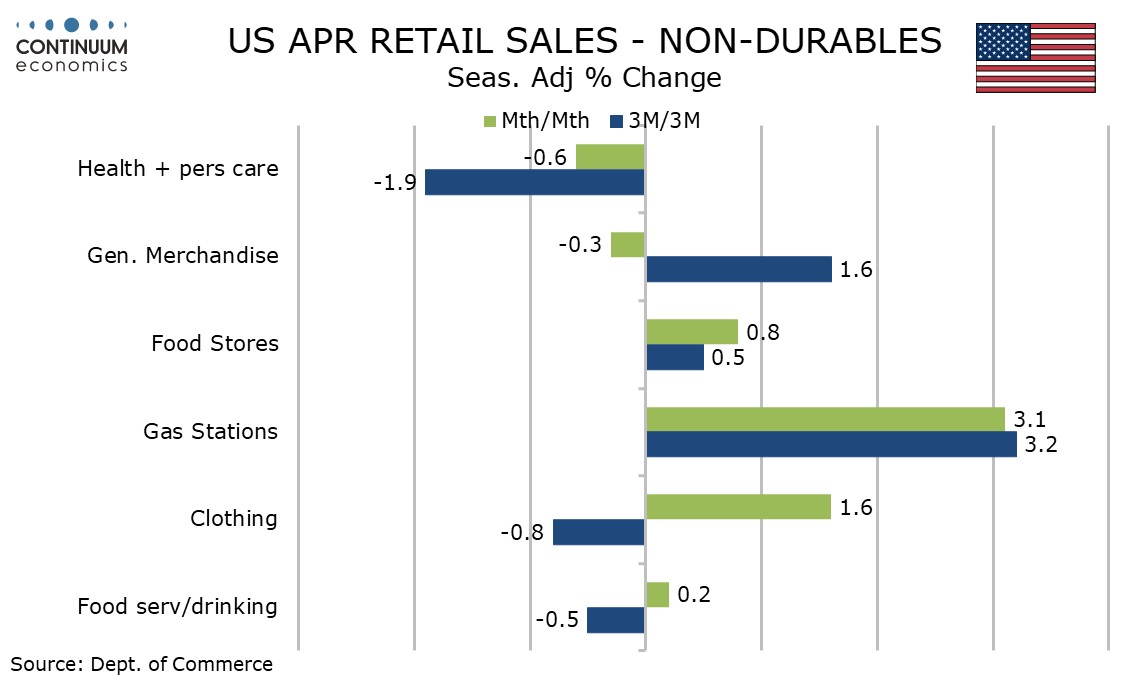

Ex-auto sales rose by 0.2% after a 0.9% rise in March and sales ex autos and gasoline fell by 0.1% after a 0.7% rise in March. The early Easter may have inflated March and restrained April though seasonal adjustments do attempt to adjust for the timing of Easter.

Consumer spending has been running ahead of real disposable income and if employment growth is starting to slow that will put a further restraint on personal income. While May is likely to look a little stronger than April we do expect trend to lose some momentum through Q2.

The strongest increases in the retail sales breakdown were gasoline at 3.1% and clothing at 1.6%, both sectors where the CPI showed rising prices. The control group, which contributes to GDP, fell by 0.3% after a 1.0% increase in March.