AUD, JPY, GBP flows: AUD and JPY look value based on yields, GBP gains on Budget unreliable

AUD and JPY represent value based on yield spreads. GBP gains on UK Budget reflect improved forecasts rather than positive measures

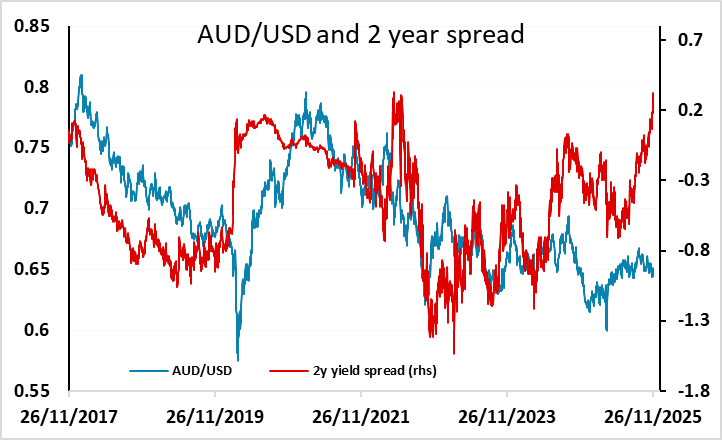

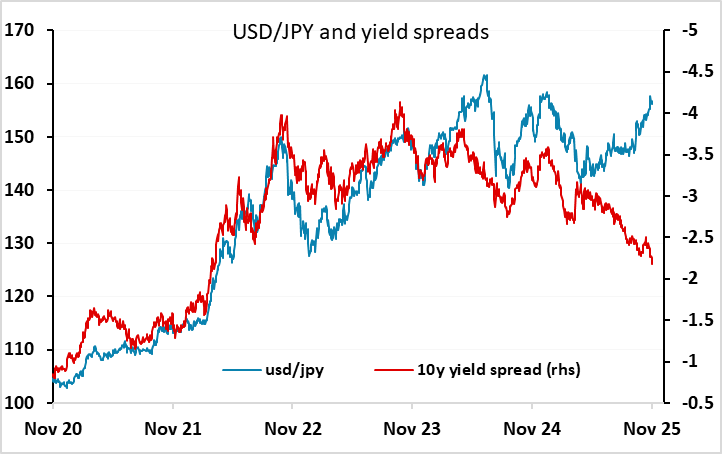

The USD is rallying into early Europe after seeing some early losses in Asia and is generally little changed from yesterday’s European closing levels. AUD and NZD have continued to make small gains and still look to represent value here given the big move in yield spreads in the AUD’s favour in the last few months. The JPY represents similar value based on yield spreads, but has also failed to benefit in recent months, while the EUR has outperformed. The AUD should be preferred if equities continue to perform well, but it is likely to be harder for equities to make gains from here with the S&P 500 high just 100 points away and a Fed ease in December now 75% priced in.

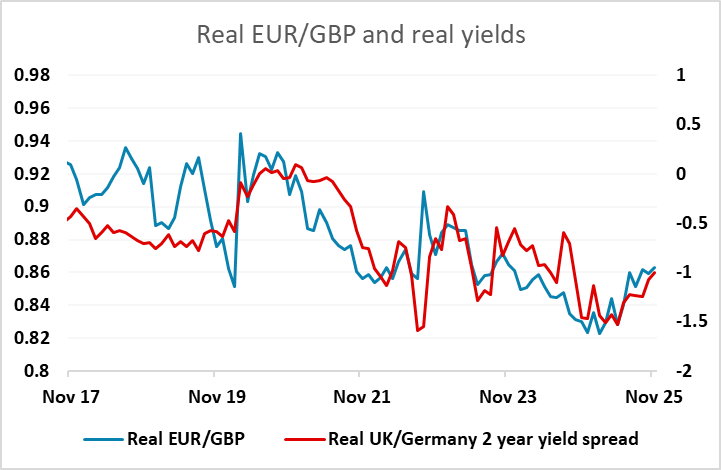

GBP has also performed well in the last 24 hours following the UK Budget, which proved much less contractionary than expected, at least in the next couple of years. But UK yields were generally lower, especially in the longer end, mainly because forecasts of the tax take improved independent of the actual budget measures. In truth this seems an unreliable basis for confidence, but the UK fiscal position is probably less difficult than had been painted. Nevertheless, we don’t see much further upside for GBP, with yield spreads likely to move steadily against the pound in the next year.