FOMC more balanced but not in a hurry to ease

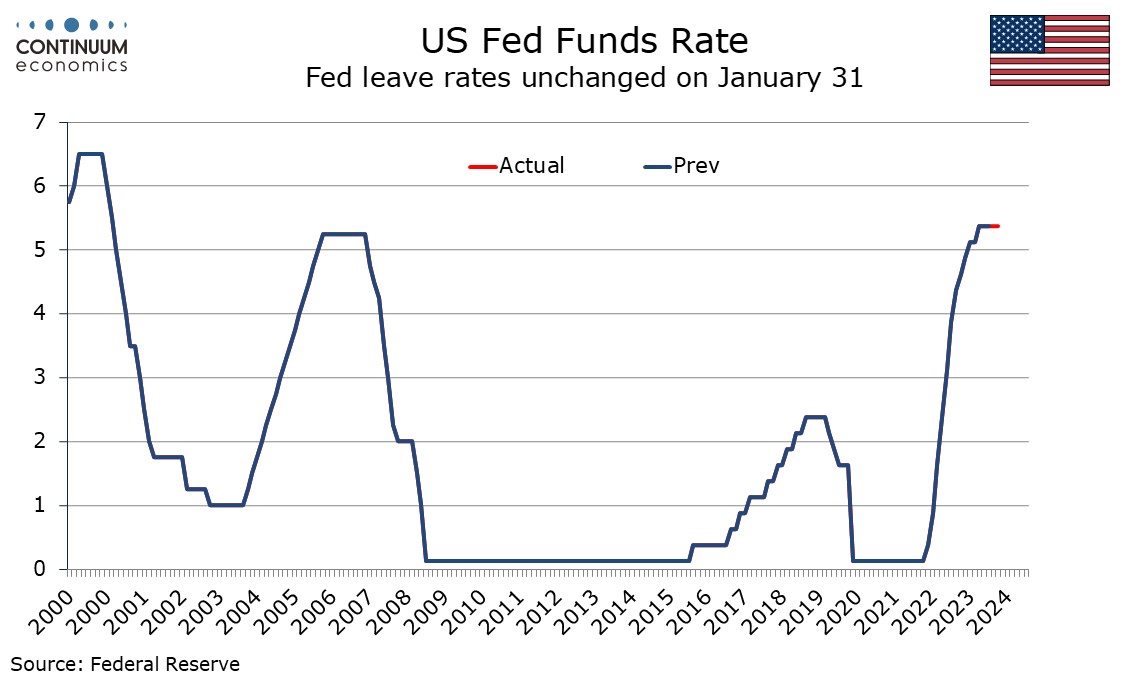

The FOMC has left rates unchanged at 5.25-5.50% as expected. While the FOMC has moved away from a tightening bias, seeing risks having moved into better balance, it is making it clear it is not in a rush to ease, requiring greater confidence that inflation is moving sustainably to the 2% target.

The statement has seen plenty of adjustments from the last one on December 13. It does not overreact to the stronger than expected Q4 GDP, stating that the economy has been expanding at a solid pace, not inconsistent with its prediction that Q4 would be slower than Q3. Inflation is still described as having eased over the past year while remaining elevated. A reference to the banking system being strong and resilient has been removed, without making clear if worries in the market today over New York Community Bancorp are relevant to this, but also removed a reference to tighter financial and credit conditions weighing on activity.

The statement goes on to state that risks to the employment and inflation goals are moving into a better balance, while noting uncertainty and attention to inflation risks. Importantly, a reference to determining the extent of any additional policy firming that may be needed is removed, replaced by a reference to considering any adjustments to the target range, thus leaving both tightening and easing options open. However they go on to state that they do not expect it will be appropriate to reduce the target range until it has achieved greater confidence that inflation is moving sustainably toward 2%.

A lack of a rush to ease suggests rates will be left unchanged into Q2 without significant downside surprises on the data. Tightening is not ruled out though the bar for a move is now probably high, with the next move likely to be an easing, even if such a move does not appear to be imminent.