AUD, JPY, EUR flows: AUD gains on CPI, JPY still weak

AUD/NZD at a post 2022 high, EUR/JPY approaching all time high from July 2024

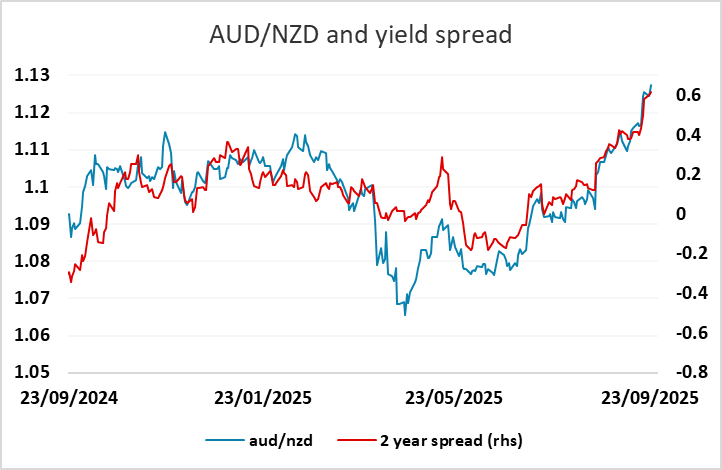

Another fairly quiet overnight session, with AUD the only real mover after the Australian August CPI data came in above consensus at 3.0% y/y for both the headline and the weighted mean. Front end Australian yields rose and AUD/USD has moved up as a result, but AUD/NZD is showing the most notable rise, trading above 1.13 and at another new post 2022 high. The rise in consistent with the widening of spreads in the AUD’s favour this year, but we may be approaching a near term high as there is now twice as much easing priced in for the RBNZ as for the RBA by the end of 2026.

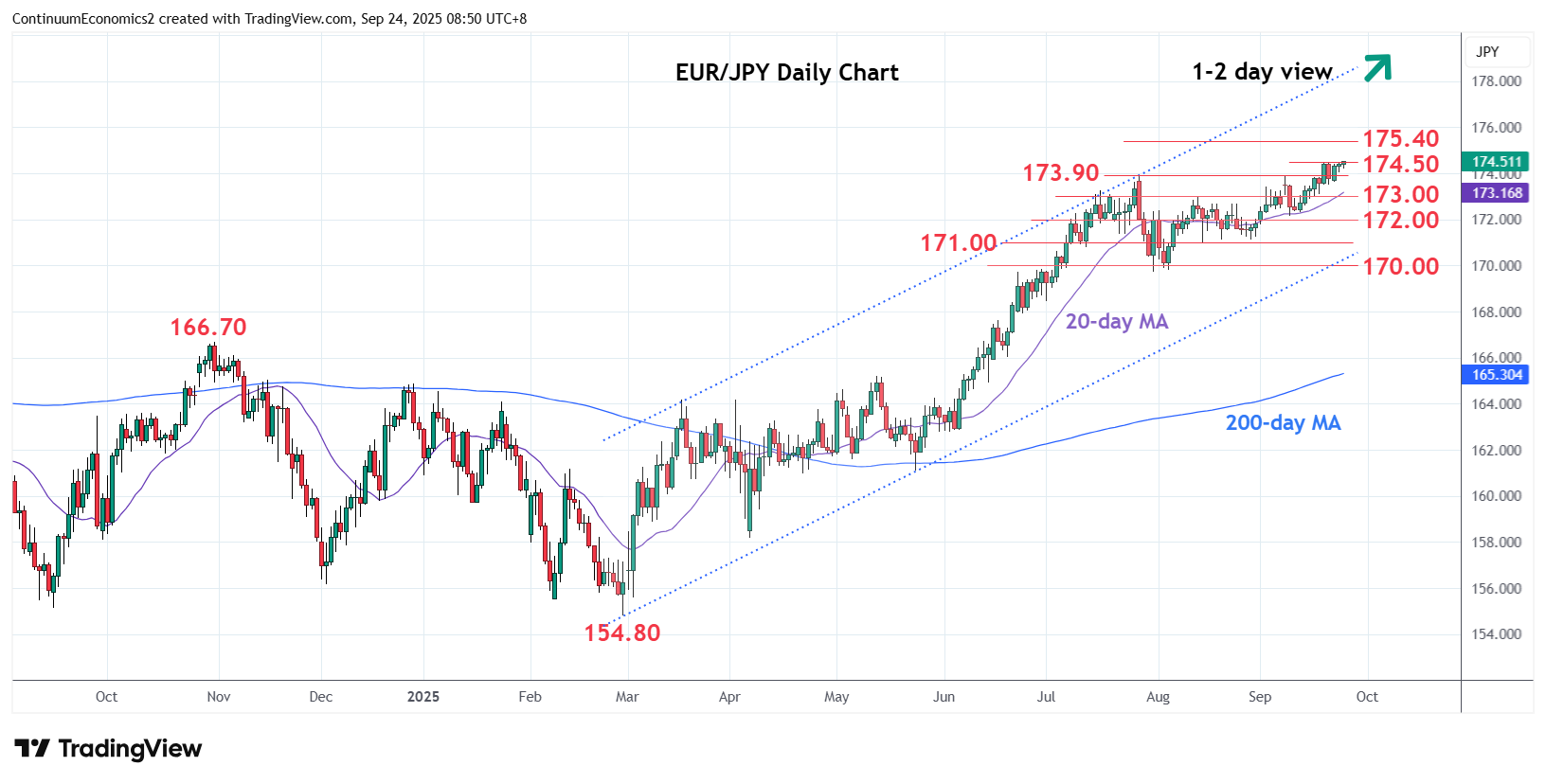

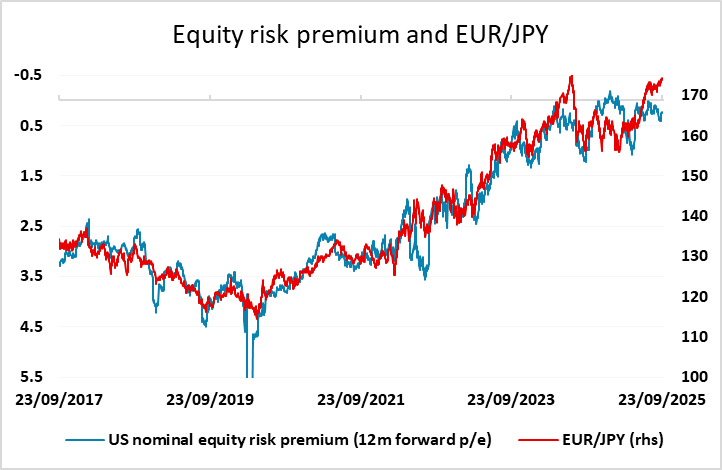

The JPY has also remained on the back foot overnight, with EUR/JPY trading to a new one year high, and is now less than a figure below the all time high of 175.42 reached last July. This continues to look hard to justify, even given the low level of risk premia, but the July 2024 will no be a target, and a turn seems unlikely to come until it is broken.