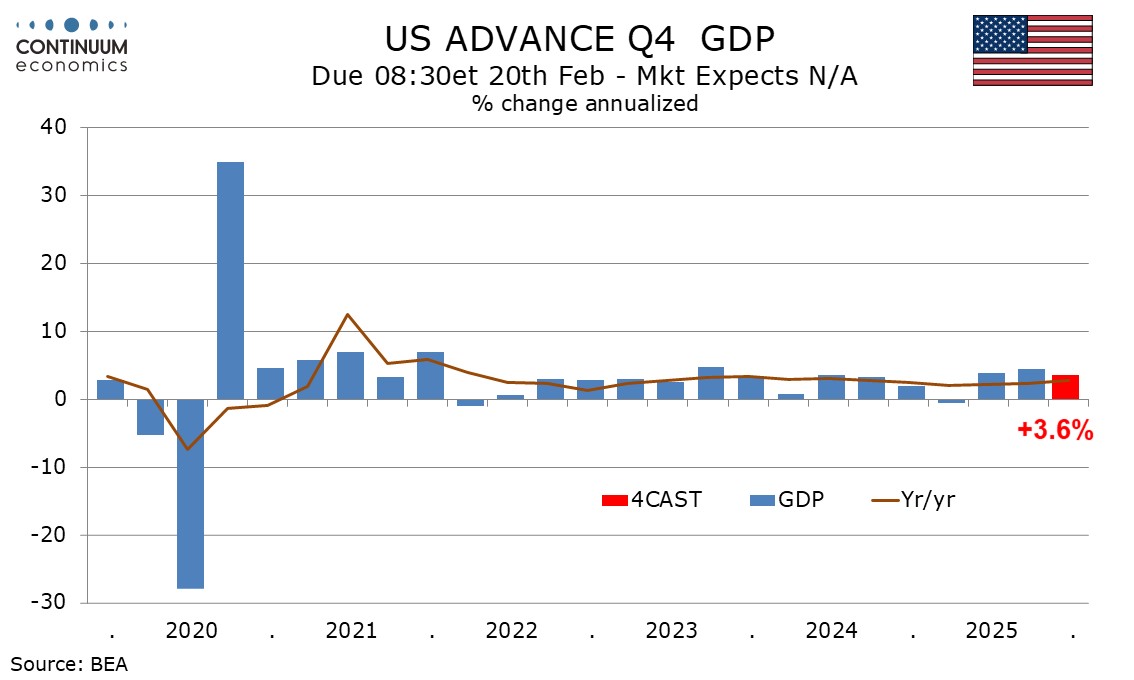

U.S. Q4 GDP now seen at 3.6% supported by consumer spending and net exports

It now looks clear that Q4 GDP is going to be significantly stronger than the flat outcome we expected in the quarterly outlook, with our calculation now at 3.6% annualized. Domestic demand appears to have maintained momentum with the main uncertainty being to what extent the trade balance can sustain a sharp narrowing seen in October.

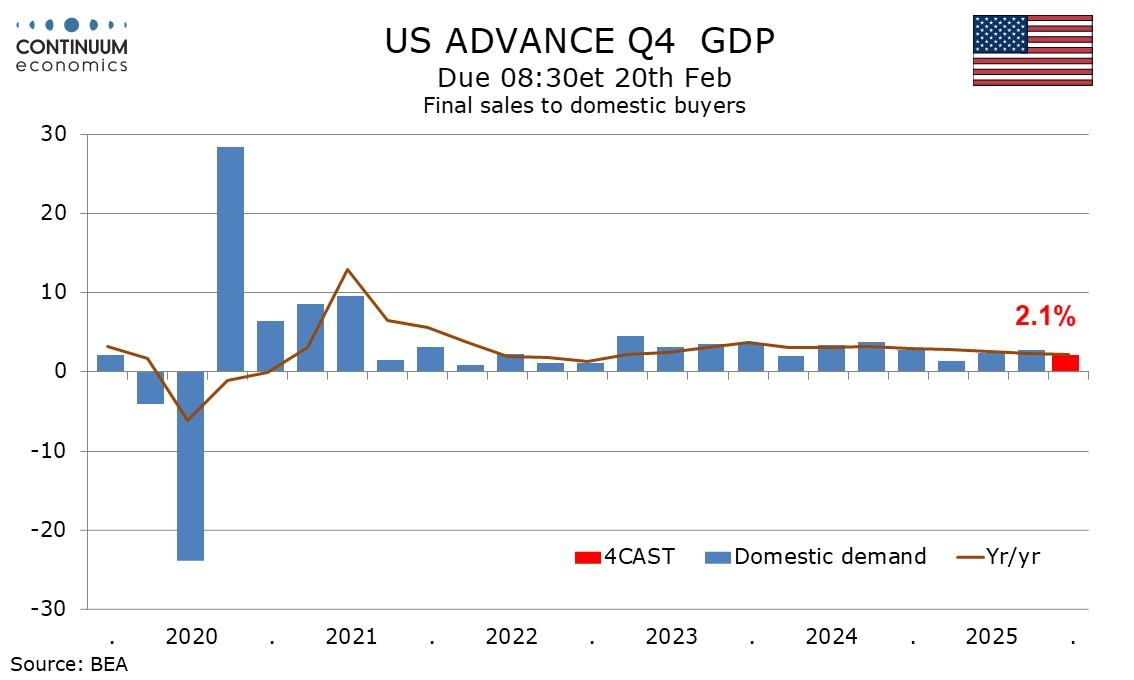

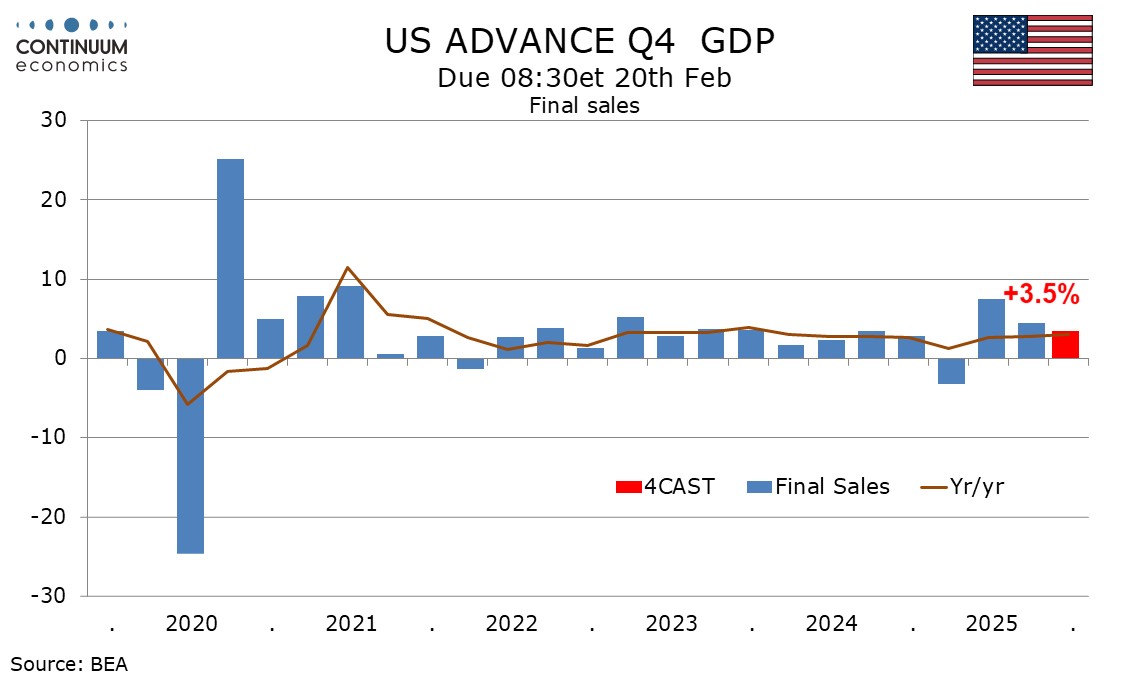

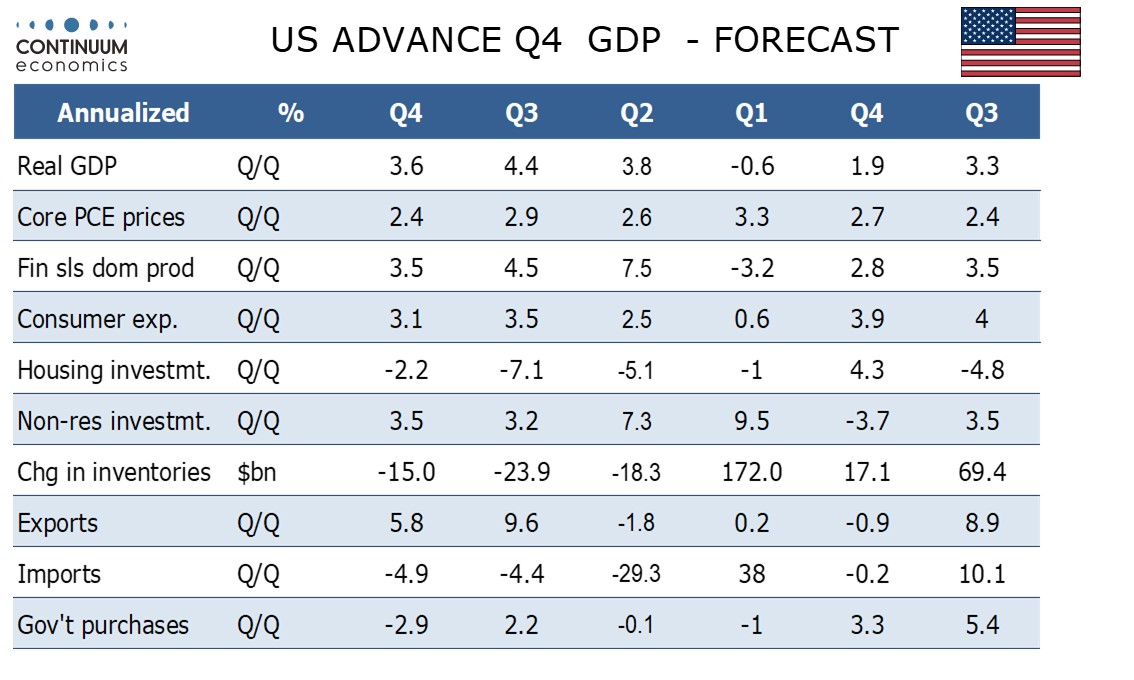

We expect final sales to domestic buyers (GDP less inventories and net exports) to rise by 2.1%, which would be in line with recent trend with the yr/yr pace seen at 2.2%.

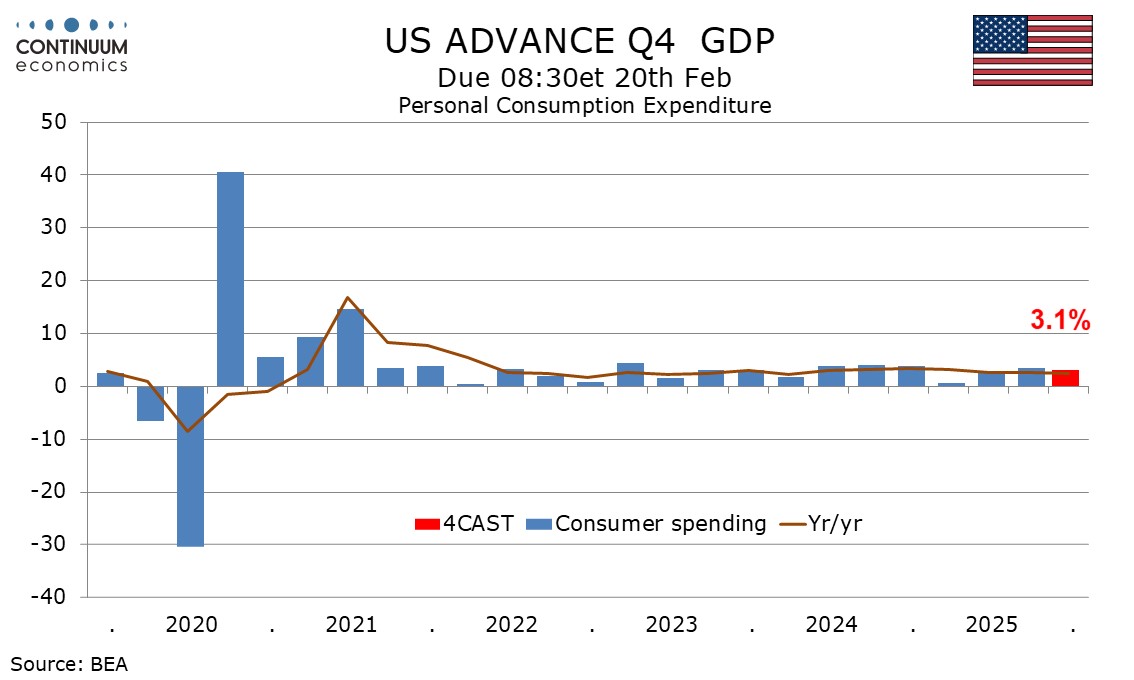

Consumer spending data is available through November and signals on December retail sales, particularly autos, remain healthy. We expect a 3.1% increase in consumer spending.

The resilience of consumer spending is however in contrast to signs of continued weakness in real disposable income, which looks set to come in almost unchanged for a second straight quarter.

Slowing employment growth is weighing on real disposable income, along with persistent inflation. Price growth does however seem to have slowed from Q3, with PCE prices seen at 2.6% in Q4 versus 2.8%, with the core rate at 2.4% from 2.9%.

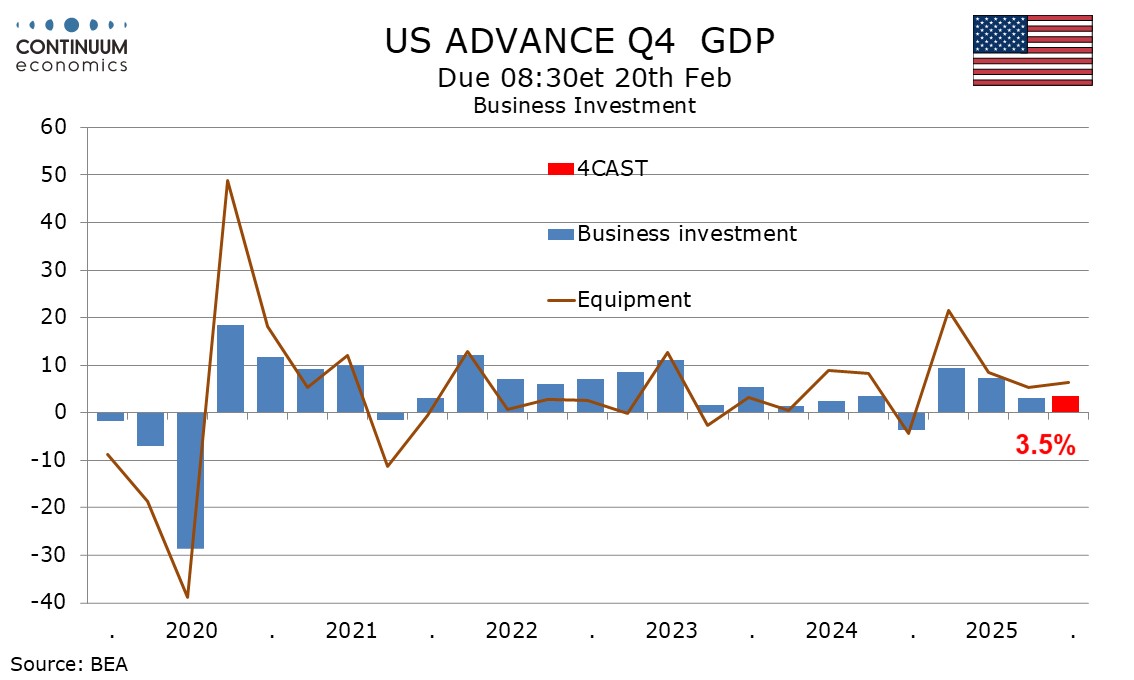

We expect business investment to rise by 3.5%, similar to Q3’s 3.2%, again with positives from equipment and intellectual property and a negative from structures. There are mixed signals with durable goods data stronger than industrial production.

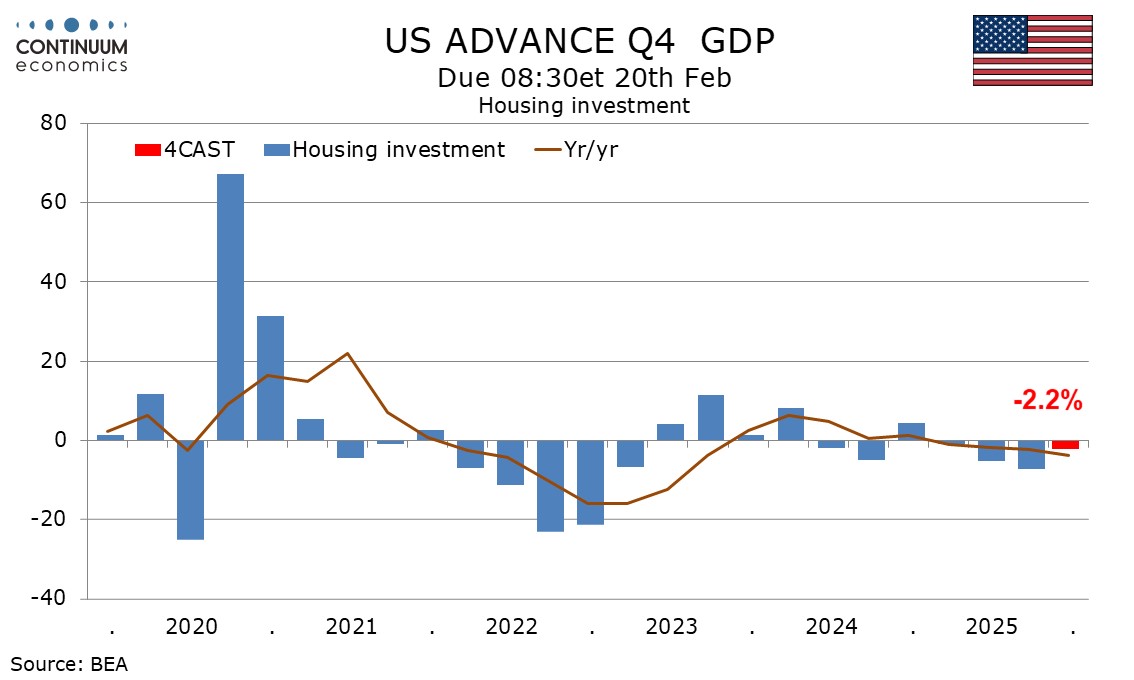

We expect a less negative picture from housing, at -2.2% versus -7.1% in Q3, with a positive possible if data still to be released picks up.

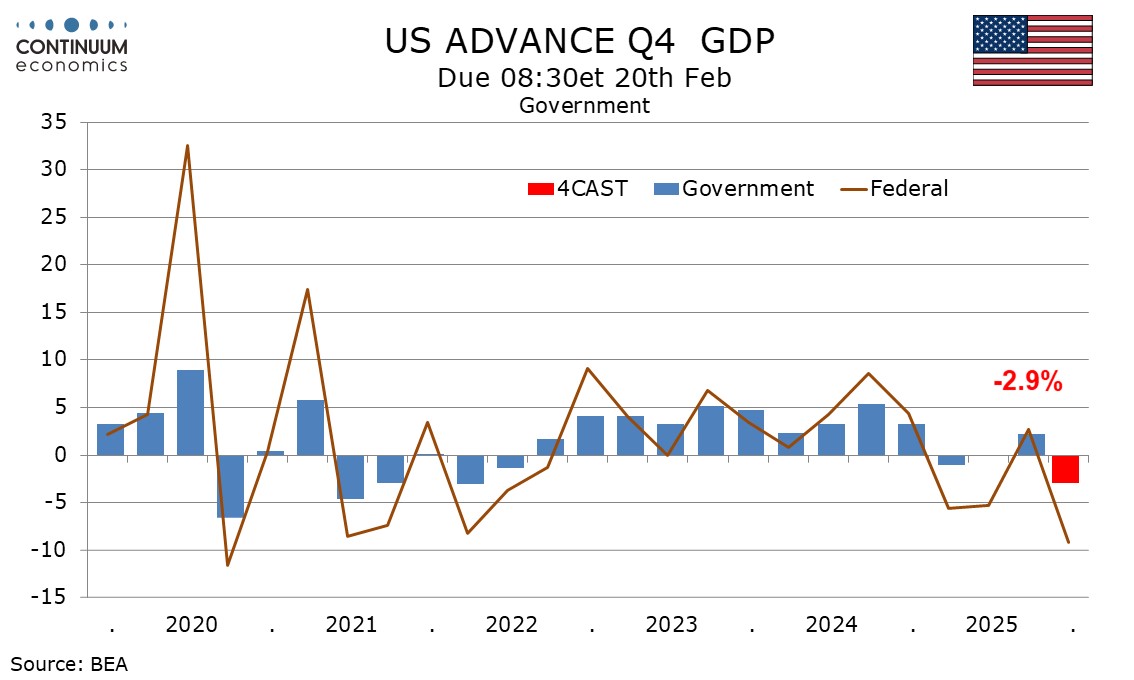

With the Federal government having shut down in October and early November, we expect a weak quarter from government at -2.9%. The decline will be due from Federal spending but we also expect State and Local at 1.2% to slow from 2.0% in Q3.

We expect final sales (GDP less inventories) at 3.5% to be similar to GDP, with inventories seeing only a marginal positive contribution. Inventories are still declining after surging in Q1 ahead of the tariffs but October data suggest the pace of decline in slowing.

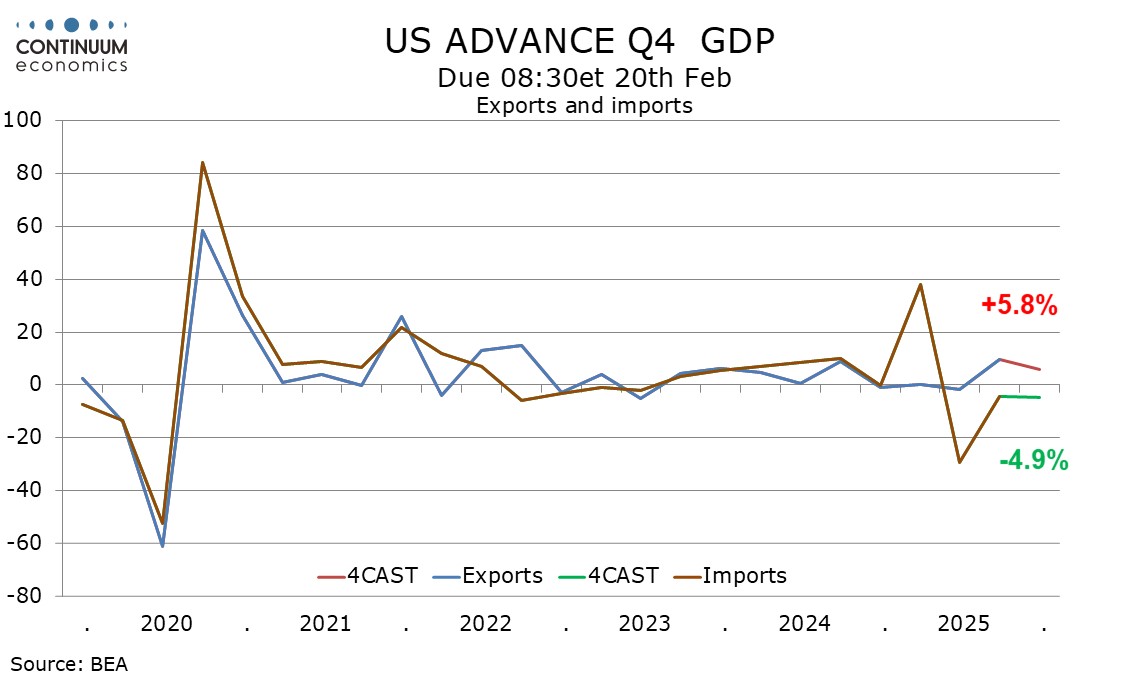

For net exports only October data is available and that showed a sharp fall in imports and a sharp ruse in exports, though the moves were not broad based and unlikely to be sustained. Wee are assuming trade deficits in November and December similar to those seen in August and September, though narrower than July’s. This would leave Q4 net exports significantly improved from Q3 and a third straight improvement after a sharp Q1 deterioration as imports surged ahead of the tariffs.

We expect a positive contribution to Q4 GDP of 1.4% from net exports, with exports up by 5.8% and imports down by 4.9%. While the quarterly volatility in net exports has been massive, our forecasts would leave exports up a moderate 2.2% in 2025 from 2024 and imports up by a similar 1.9%. 2025 GDP would be up by 2.3%, though Q4 would be up by 2.8% from Q4 2024.