Services Surplus and Decreasing Trade Deficit Partly Heal Turkish Current Account Deficit

Bottom Line: Turkiye’s annualized current account deficits (CAD) stood at $31.8 billion as of February 2024 when compared to $37.6 billion a month earlier, driven by a marginal increase in the services surplus, a reduction in the gold trade deficit, and a recovery in net energy trade. We envisage CAD will likely be remedied by slowing domestic demand and imports thanks to ongoing strong monetary tightening coupled with bettering services trade balance and tourism revenues in H2 2024, and 2024 CAD will stand at around $31-33 billion.

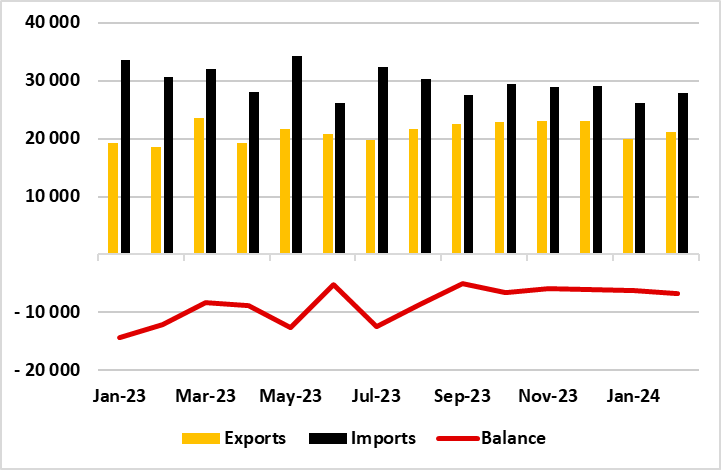

Figure 1: Turkish Foreign Trade (Million USD), January 2023 – February 2024

Source: Continuum Economics

According to the figures announced by the Central Bank of Turkiye (CBRT) on April 17, Turkish CAD stood at $3.27 billion (TRY 106.39 billion) in February, marking the highest monthly gap in seven months after $5.7 billion gap in July 2023.

The trade deficit, the biggest component of the current account, declined by 44.2% YoY in February to $6.77 billion. The goods deficit amounted to $4.75 billion in February, while services saw a net surplus of $2.38 billion. Travel, under services, also recorded a net inflow of $1.96 billion in February.

The improvement in the current account was primarily driven by a moderate increase in the services surplus, and a reduction in the gold trade deficit, which fell to $0.7 billion in February from $3.4 billion in January. There was also a recovery in net energy trade, with the deficit shrinking to $4.4 billion from $5.8 billion. (Note: According to CBRT’s announcement, balance posted a surplus of $2.1 billion in February excluding gold and energy trade). Despite annualized CAD improved to $31.8 billion when compared to $37.6 billion a month earlier, and stood at approximately 2.9% of GDP as of February 2024, the deficit continued to put pressure on already weakening Turkish Lira (TRY).

Speaking about the CAD, Treasury and Finance Minister Mehmet Simsek indicated on April 17 that the fall in CAD will support foreign exchange reserve accumulation and will also contribute to disinflation through the macro-financial stability channel. President Erdogan also highlighted the falling trend in CAD, and emphasized on April 16 that the CAD is expected to be 2.5% of GDP at the end of the year.

After recording around $45 billion in 2023, we foresee 2024 deficit will be around $31-33 billion. Despite increasing geopolitical risks and volatile global energy prices continue to put pressure on Turkish CAB in 2024, we think slowing domestic demand and imports thanks to ongoing strong monetary tightening coupled with likely bettering services trade balance and tourism revenues in H2 2024 will likely heal CAD. Despite we project 2024 could be a better year, this will unlikely bring significant relief to Turkiye's CAB or competitiveness as continued volatility in energy prices and food prices particularly ignited by the regional tension in the Middle East and Ukraine will increase Turkiye's CAD pain.

It is worth mentioning that the government hopes to fill in the gap by possible hikes in the export revenues triggered by continued TRY weakening, but this would likely have limited impact. (Note: We continue to see losses for TRY as foreign capital inflow remains weaker-than-expected, and we see the USD/TRY rate at 37.5 by the end of 2024. TRY losses set to accumulate on still wide inflation differentials and domestic vulnerabilities). We think attracting consistent FDI inflows, winning back investors’ credibility and cutting persistent trade deficit would have to remain the key agenda items for Turkiye in H2 2024.