JPY flows: JPY weaker despite rate hike

JPY weakens even though BoJ hiked rates and removed YCC, which was on the hawkish side of market expectations

USD/JPY has moved higher overnight even though the BoJ hiked the policy rate and abolished YCC, which most didn’t expect to happen until April. However, the BoJ also said “Given the current outlook for economic activity and prices, it anticipates that accommodative financial conditions will be maintained for the time being." This suggests the BoJ is in no rush to tighten further. Additionally, while yield curve control has been officially removed, the BoJ announced they will be purchasing roughly the same amount of JGBs, and will intervene if yields spike. These moderating factors are being used to justify the JPY’s failure to rally on the rate hike, even though a hike was only a minority view. JGB yields are also marginally lower, supporting the softer JPY. Nevertheless, it is hard to understand why the JPY would be weaker considering the alternative outcomes. Few would have expected the BoJ to indicate substantial further tightening was coming when hiking rates for the first time. Would the JPY have been even weaker if they had not hiked?

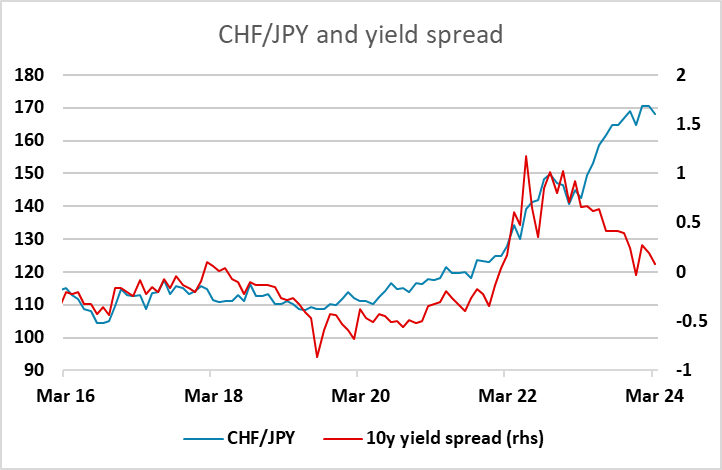

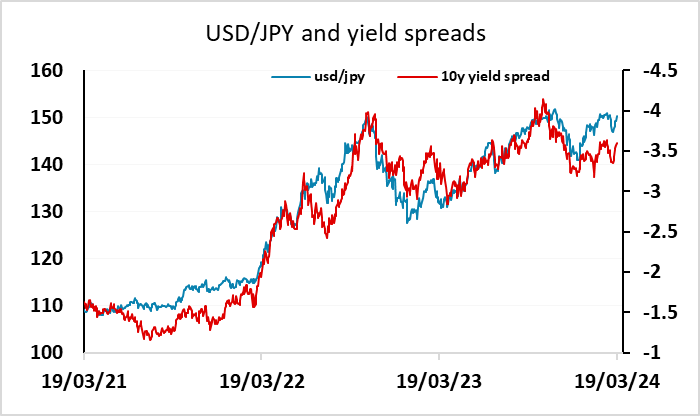

It seems most likely that the short term market was geared up for a BoJ move and the lack of any rise in JGB yields meant there was no impetus for any further JPY buying. But the decision to raise rates when central banks elsewhere are looking at cutting has to be seen as a JPY positive move, and we would not expect JPY weakness to extend. While yield spreads have edged in the USD’S favour overnight, spreads are still at a level that suggests scope for JPY gains based on recent correlations. However, with the Fed quite likely to signal a slightly less dovish view at this week’s meeting, scope for JPY gains may be greatest against those currencies where easing is more possible near term. The CHF looks the best candidate, with the SNB the most likely central bank to ease this week. The market prices this as around a 30% chance of a 25bp cut, but in any case yield spreads and valuation point to huge scope for JPY gains against the CHF after the 50% rise in CHF/JPY in the last 4 years.