JPY flows: JPY softer but downside limited

Strong equities, weak Chinese CPI and comments from the BoJ's Uchida combine to weaken the JPY, but dip looks likely to be short-lived

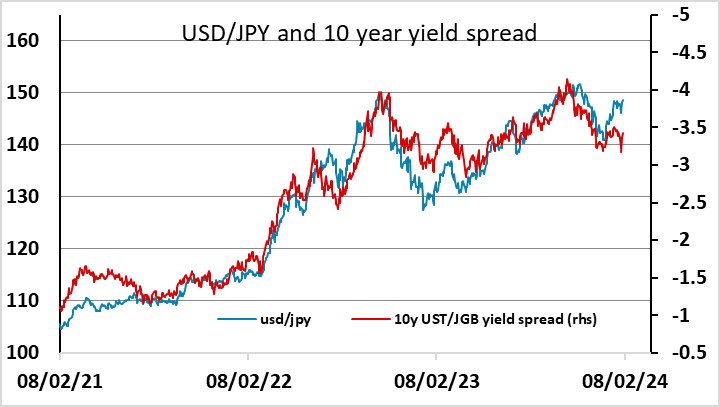

After showing some mild strength on the crosses on Wednesday, the JPY has reversed lower overnight on a combination of weak Chinese CPI, strong equities, and some perceived dovish commentary from the BoJ’s Uchida. However, Uchida’s comments did suggest that the BoJ would be exiting from ultra-easy policy, noting that companies were hiking wages and passing on the impact of higher wage costs in service prices, but he indicated that the exit would not be rapid. JGB yields edged lower, but spreads remain consistent with a significant decline in USD/JPY if markets start to look at imminent BoJ tightening or if risk assets shows some clear weakness.

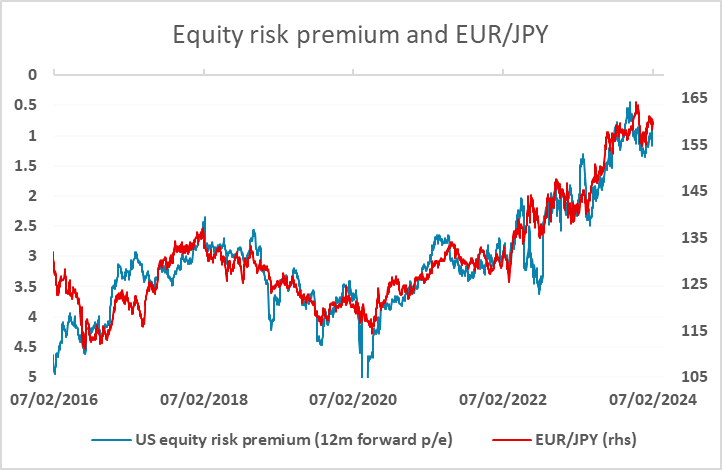

Risky currencies generally performed well on the back of the continues strength in US equities, with the S&P 500 breaching the 5000 level for the first time at the end of Wednesday’s US session. The strength in equities continues to support risky currencies against both the USD and JPY, although relative US equity strength does also tend to favour the USD. Inasmuch as the strength in equities is driven by lower US yields, it should have less impact on the JPY crosses, which are more sensitive to moves in risk premia than equity prices. We doubt the bounce in EUR/JPY and CHF/JPY will extend. EUR/JPY above 160 and CHF/JPY above 170 looks overstretched.