EUR/USD, EUR/JPY, USD/JPY flows: EUR steady despite weaker NRW CPI

NRW CPI at -0.1% m/m suggests downside risks for national CPI relative to consensus. Softer EUR and US yields point to a JPY recovery

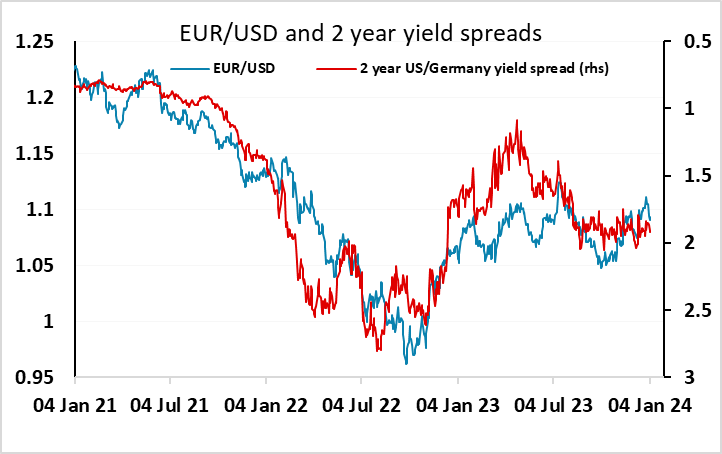

NRW CPI out this morning provided the first guide to the likely national CPI later, and is slightly on the soft side of expectations. The m/m decline of 0.1% compares to a consensus for national CPI of +0.1%. However, the y/y rate rose from 3.0% to 3.5%, which is consistent with the consensus expectation of a rise in the y/y rate in the national numbers from 3.2% to 3.7%, so it is not 100% clear that the numbers will be on the weak side. Still, bund yields are a little lower in response, suggesting downside risks for the EUR. But while EUR/USD did initially dip slightly on the data, it has now fully recovered. Partly this reflects the fact that US yields dropped after the European close yesterday following the FOMC minutes. We wouldn’t see the minutes as being particularly dovish relative to current expectations, but they were consistent with the dovish tilt in Powell’s language after the last FOMC.

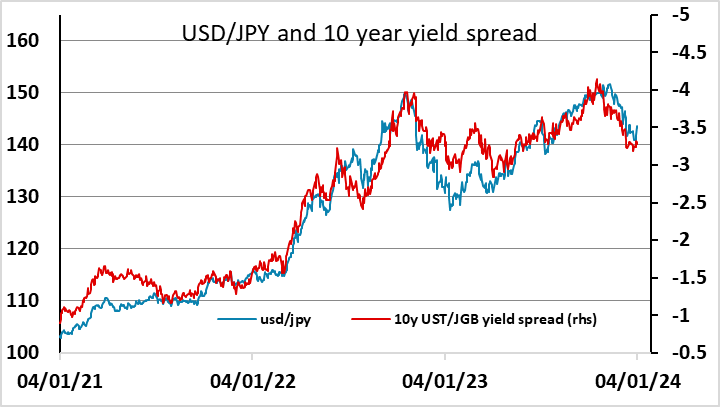

Softer yields in both the US and Europe would normally be a positive signal for the JPY, which has underperformed so far this week as yields have risen. Even though JGB yields also fell overnight, spreads do suggests downside risks for USD/JPY and EUR/JPY here.