USD, EUR, JPY flows: USD starting softer as yields slip

Yield spreads pointing lower for the USD

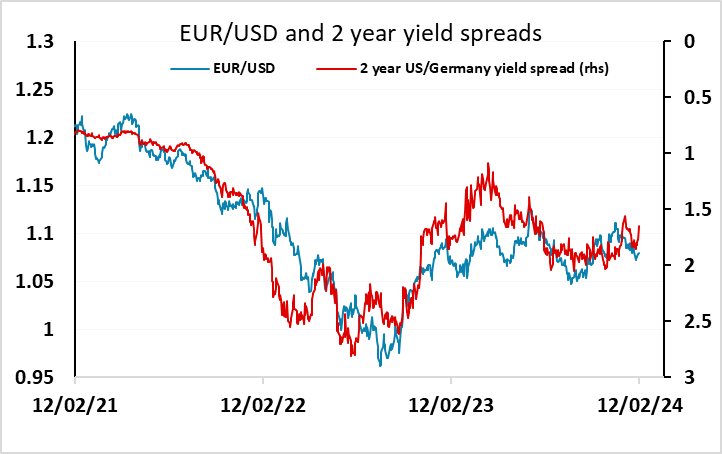

The USD showing a little weakness in early trading, as yield spreads move against the USD, although without an obvious trigger. German 2 year yields are firmer this morning, up above 2.8%, while USD yields are edging lower. We are a little sceptical that the rise in German yields makes sense, with an April ECB rate cut now down to being priced at only a 65% chance compared to being nearly fully priced a week or so ago, but the wider front end yield spread does support a EUR/USD rally back towards 1.09.

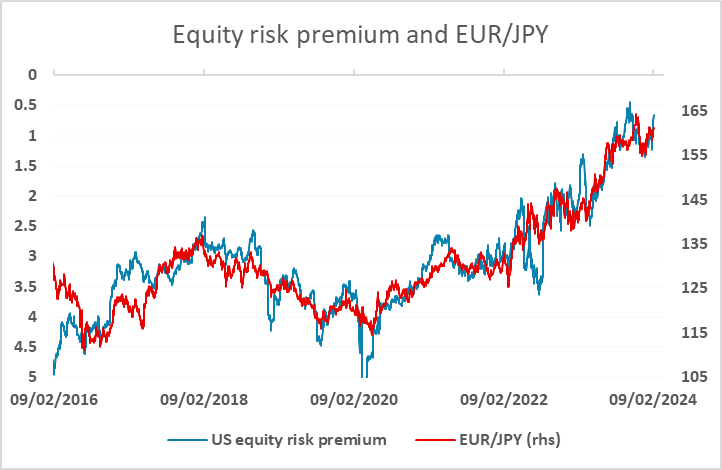

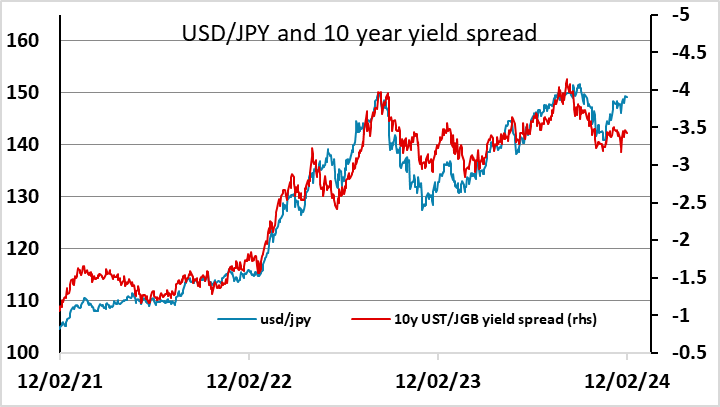

USD/JPY has for some time been trading well below the level suggested by yields spreads, helped by the strength of equity markets which have encouraged JPY selling on the crosses. The strength of equity markets in the face of firmer yields on Friday pushed US equity risk premia to their lowest level since October, and continues to suggest support for EUR/JPY. However, US yields slipping lower this morning suggests the JPY may start the day on the front foot.