Exceeding Expectations: Turkish Economy Grew by 4.5% in 2023

Bottom Line: Turkish Statistical Institute (TUIK) announced on February 29 that the economy expanded by 4.5% last year, and 4.0% YoY in Q4 2023 driven by the buoyant demand and lending, high government expenditure and investments during the election-and-earthquake-year. Despite strong Q4 figure, we expect the pace of the GDP growth to decelerate in 2024 due to lagged impacts of strong monetary tightening by the Central Bank of Turkiye (CBRT) coupled with fiscal actions aiming to squeeze demand and lending. We foresee the Turkish economy to grow by 2.7% in 2024.

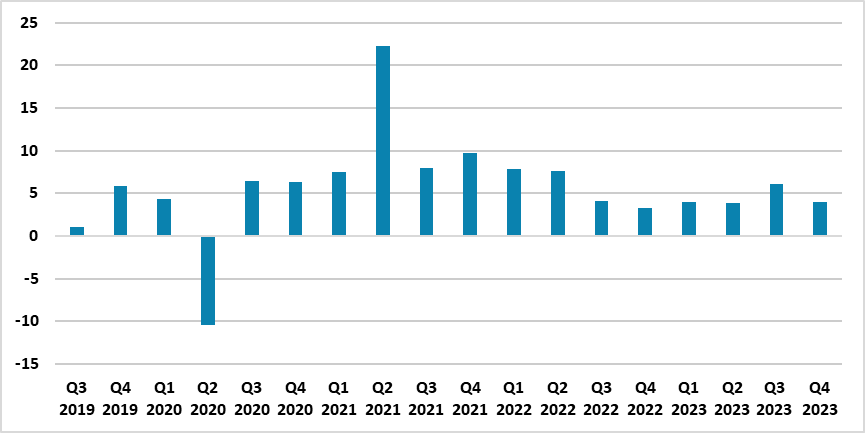

Figure 1: GDP (%, YoY), Q3 2019 – Q4 2023

Source: Continuum Economics

When the activities which constitute GDP are analyzed, it appears household spending played a key role in propelling the economy forward in 2023, as final consumption expenditures of households surged by 12.8% compared to 2022 backed by rising wages.

Construction sector made the highest contribution to the economy with an 8.1% YoY rise, partly due to reconstruction activities after the earthquakes on February 6, followed by 5.7% in the industry sector and 5.1% in the financial and insurance sector.

The growth figures exceeded expectations despite the negative impacts of the twin earthquakes over domestic production, and slowdown in the German economy which contracted by 0.3% in 2023.

Following the GDP growth announcement, the treasury and finance minister Mehmet Simsek stated that "We saw a notable shift in growth dynamics, a significant portion of the growth in 2023 stemmed from increased investments in machinery and equipment, enhancing productive capacity and fostering higher quality growth." Simsek indicated he anticipates a moderate, balanced growth in 2024, with positive contributions from net external demand and added that the improved growth composition resulting from government policies will aid in the disinflation process.

Despite the strong growth reading, the country continues to struggle due to galloping inflation, and weakening Turkish Lira (TRY). (Note: TRY weakened by almost 58% against the dollar in 2023).

In addition to this, low demand for Turkish exports, particularly due to EU slowdown, negatively impacted the Turkish economy in 2023. On the foreign trade front, exports decreased by 2.7% YoY and imports increased by 11.7% YoY last year lead to a widening trade deficit. We believe the decline in export revenues in addition to the country’s heavy dependence on imported inputs for exported goods, which are increasingly expensive due to TRY devaluation, continue to jeopardize GDP expansion in the upcoming quarters and contributing to potential inflationary pressures.

From the inflation standpoint, the CPI surged to 64.9% annually and 6.7% monthly in January, which marked the biggest jump in the last five months. There are signs that inflation will continue to stay high in the first half of 2024, in line with CBRT’s inflation projections. (Note: CBRT forecasts that annual inflation will record 36% at the end of 2024 after rising to the 70-75% band towards the middle of the year). We think recent hikes in salaries and pensions, elevated services prices, strong domestic demand, continued adverse impacts of deterioration in pricing behaviour, weakening currency, high inflation expectations and uptick in public spending before the March local elections continue to ignite general level of prices.

Despite CBRT lifted the benchmark one-week repo rate from 8.5% to 45% after June 2023 to establish the disinflation course as soon as possible and to control the deterioration in pricing behavior and to squeeze demand, lagged impacts of the aggressive tightening cycle are still feeding through. We are also of the view that final consumption expenditures will not easily decrease due to rise in consumer confidence and spending fueled by rising wages.

We feel the pace of the GDP growth will decelerate in 2024 due to CBRT’s hawkish bias, contractionary fiscal actions targeting to slow down demand and lending coupled with elevated inflation, weakening TRY and widening trade deficit. Taking into account all of these, we foresee the Turkish economy to grow by 2.7% in 2024.