Fed SLOOS on Bank Lending does not strengthen case for easing

The Fed’s latest quarterly Senior Loan Officer Opinion Survey on bank lending practices is unlikely to generate any urgency for easing, with the proportion of banks tightening lending standards declining, while measures of demand were also less negative, if less changed from October than data on lending standards.

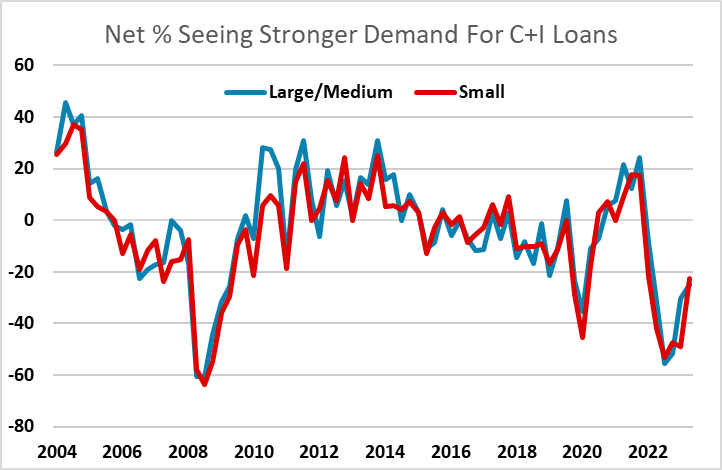

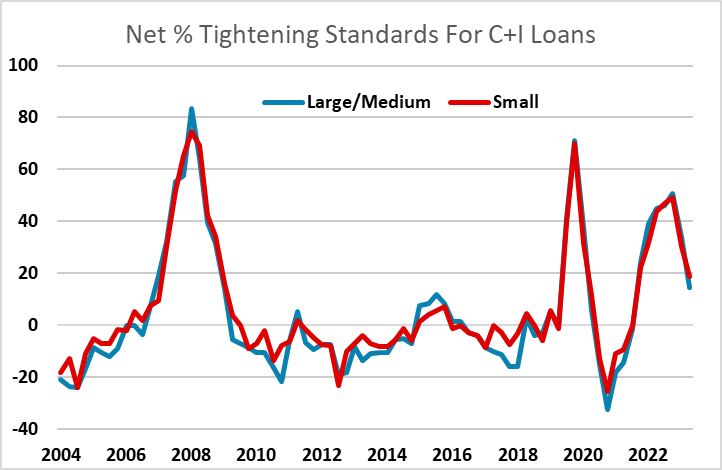

On C+I loans, the net proportion tightening standards was 14.5% for large and medium firms and 18.6% for small firms, down respectively from 33.9% and 30.4% in October and both the lowest since near flat outcomes in Q2 2022. The net proportion seeing stronger demand remains negative, but less so, at -25.0% from -30.5% for large firms and -22.4% from -49.1% for small firms. These are the least negative outcomes since Q4 2022, and thus slightly less impressive than the standards data.

Elsewhere in the report, lending standards are generally seeing a smaller proportion tightening standards, be it for commercial real estate, mortgage or consumer loans. Demand signals for mortgages and consumer loans were a little less negative, but those for commercial real estate picture remain particularly weak, with around 50% of respondents still seeing declining demand, not much changed from October.