USD flows: Quiet market but focus on Trump

USD marginally softer against the riskier currencies on hopes of moderation on tariffs

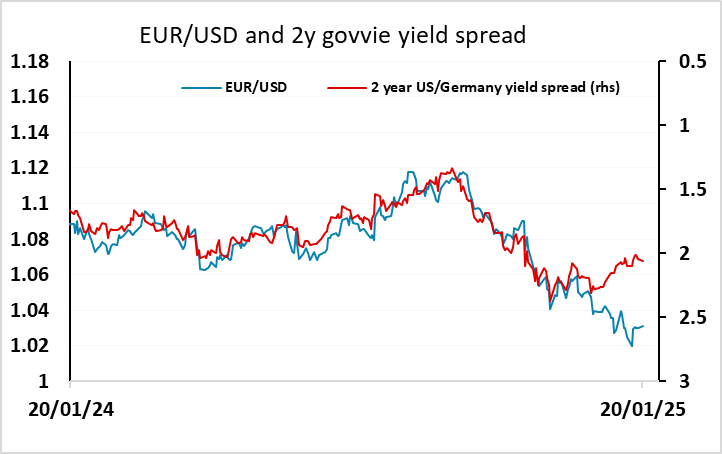

A quiet but mildly risk positive start to the European day, with European and Antipodean currencies edging slightly higher against the USD while the JPY is edging marginally lower. There is very little on the calendar, and the US is on holiday, so a generally quiet days looks likely. However, there will be a lot of focus on the Trump inauguration and speculation about the executive orders that will follow over the rest of the week. From an FX perspective, the main potential market mover would be decisions on tariffs. Overnight, there was some optimism that there would not be an immediate increase in tariffs on China, with the WSJ indicating Trump wants to travel to China in his first 100 days. USD/CNY fell slightly through the Asian session on the back of this optimism, and if there isn’t any early announcement of a tariff increase, the risk is towards a more general USD decline. As it stands, the USD has outperformed yield spreads against the EUR since the start of the year, in part on the back of speculation about Trump policies. There could be some gains for the EUR and the AUD and CAD in particular if concern about tariffs fade.