USD, JPY flows: USD firm, JPY weak on election speculation

USD stays firm despite softer CPI, JPY weak as election speculation continues.

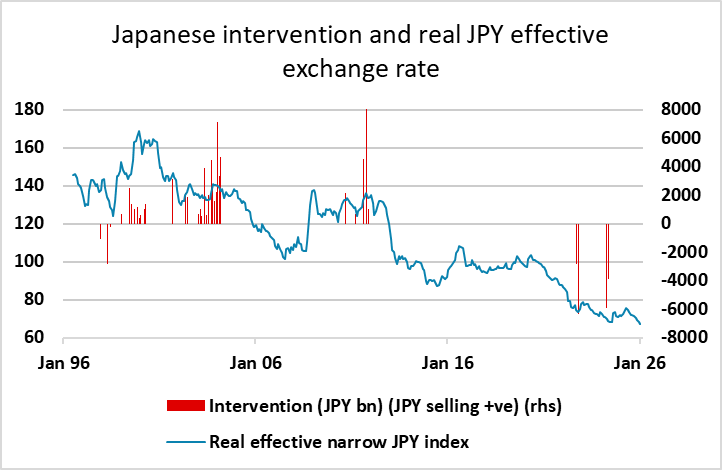

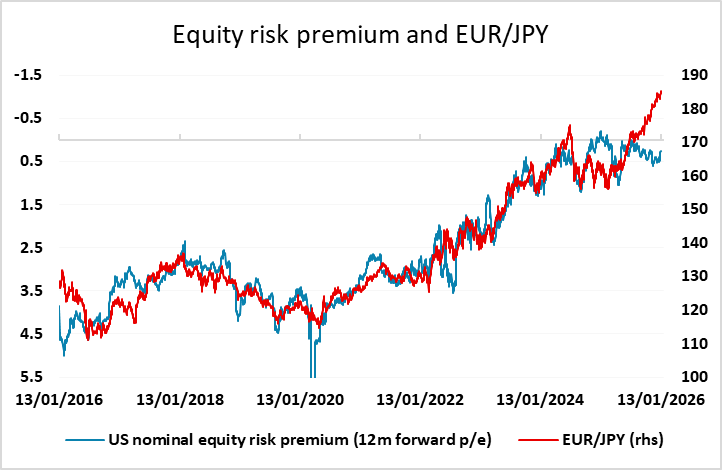

Little new overnight, but the JPY remains weak, making another new all time low against the EUR this morning, while the USD generally remains firm in spite of yesterday’s softer than expected CPI data. Geopolitical unease may be supporting the USD, while uncertainty around the rumoured snap Japanese election in February is undermining the JPY. There is little reason to expect a significant policy change to result from such an election, and even if there were, any fiscal expansion ought to be seen as JPY positive by increasing the chances of tighter monetary policy. But every piece of Japan news is taken as a negative for the JPY nowadays, almost regardless of its implications for the economy and policy. One thing the election possibility might do to weaken the JPY is reduce the chances of intervention, with the government likely reluctant to get involved in a battle with the markets ahead of the poll. Intervention is, in our view, already overdue, as it looks likely to be necessary rather than just desirable to prevent further JPY weakness. Delays will lead to a weaker JPY and ultimately more volatility.

The US retail sales data is a focus today (see here) but there is also a possibility of a Supreme Court ruling on the legality of the Trump tariffs. While we expect a ruling to deem some of the tariffs illegal, it shouldn’t make much practical difference, as most of the tariff changes are now contained in trade deals that the administration has negotiated and are beyond the reach of the Supreme Court. Even so, there is scope for volatility – probably initially a weaker USD – on any announcement that tariffs are illegal, even if the reaction is not sustained.