FX Daily Strategy: November 18th-22nd

USD strength to pause after initial post-election gains

Scope for some movement on the crosses

JPY disappointed by Ueda speech

GBP could suffer on weak CPI

CAD might recover if CPI comes in stronger

Strategy for the week ahead

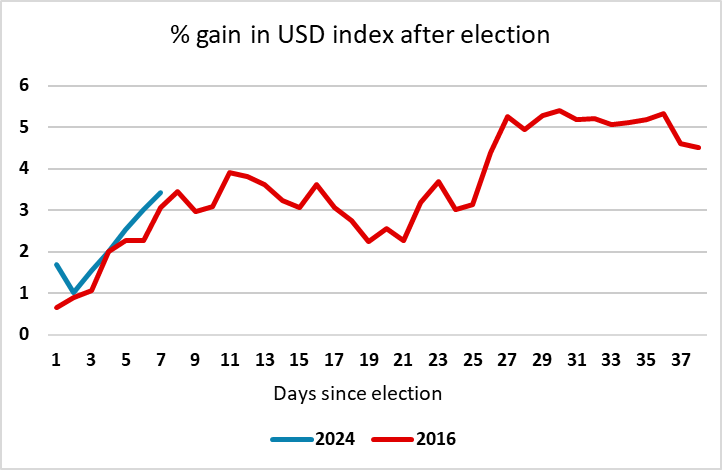

The election has been the dominant issue for the FX market for the past few weeks, and the USD has made strong gains since the Trump victory. Up to now it has essentially followed the playbook from 2016, with the USD index gaining a little over 3% in the first 8 trading days. But as in 2016, we suspect the next phase will be more uncertain. The initial market adjustment of policy expectations is complete, and it will now be difficult to make significant changes to expectations of US policy until the Trump administration is actually in place in January, unless there is significant data ahead of then to change market views. This week offers little in the way of significant US data, with the jobless claims numbers perhaps having the most potential to influence policy expectations. We would therefore expect the USD to see a period of consolidation near current levels. USD strength has broadly been supported by rises in US yields, so there is little reason to expect a significant correction at this stage.

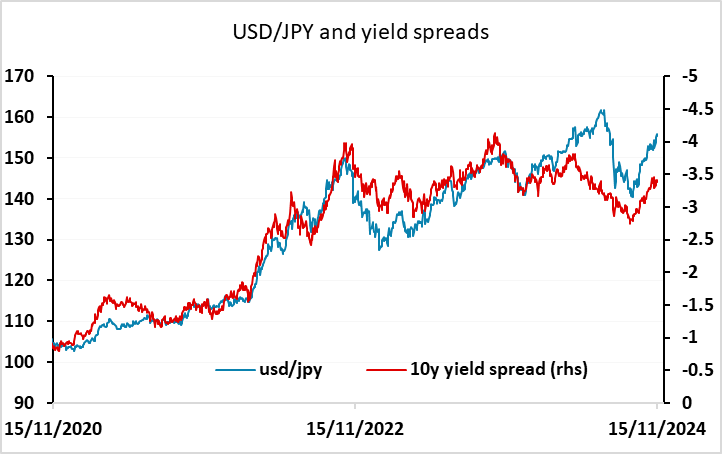

However, the USD’s gains are easier to justify against some currencies than others. There may therefore be more potential for moves in the crosses this week. The first focus could be on BoJ governor Ueda’s speech n Monday. The rise in US yields and the decline in the JPY since the election have led to higher JGB yield and a rise in market expectations of a BoJ rate hike at the December meeting, with a 25bp hike now a little more than 50% priced in. Ueda has the opportunity on Monday to indicate whether a rate hike is on the cards or not. If he suggests not, perhaps by saying that markets are still “unstable”, which has been used a reason not to hike rates quickly in the past, the JPY may give up the ground gained on Friday. But if he indicates that markets are stable enough for the BoJ to move ahead with their intended long term tightening aims, the JPY can advance some more.

Bank of Japan Governor Ueda has given a speech and so far market participants have disappointed by the lack of direct cues of an imminent hike. However, they seems to have underread the weight of his comment on driver of Japan's inflation shifting towards rise in domestic wages, which is the critical inspect for further BoJ tightening.

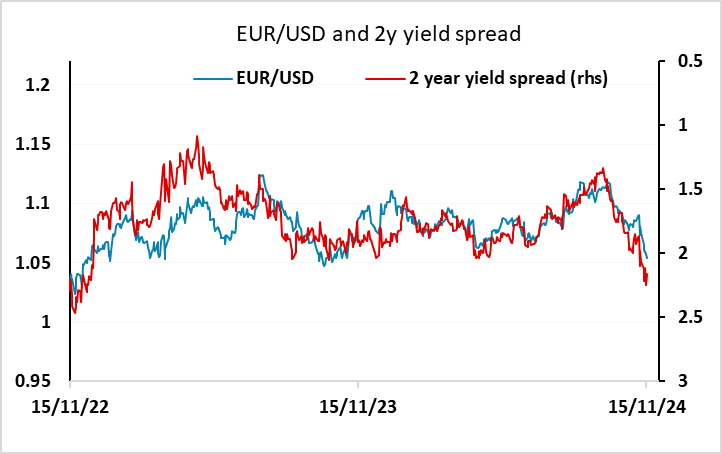

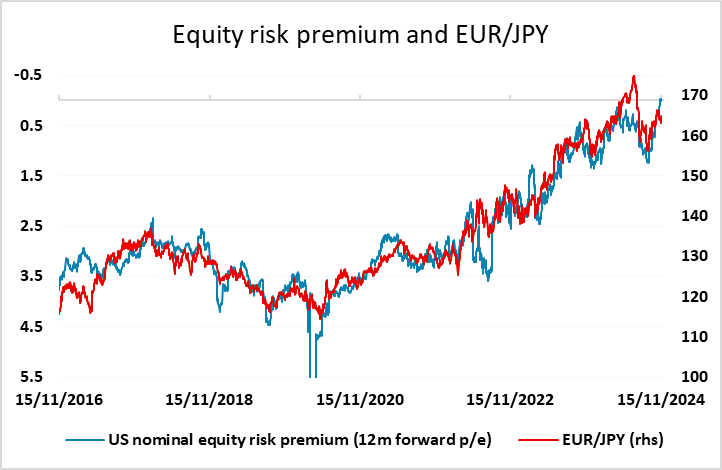

In general, Japanese policy has not been the key factor driving USD/JPY in recent years, with most of the volatility in yield spreads due to moves in US and European yields, while movement in US equity risk premia remain highly correlated with movements in the JPY. This is especially true of EUR/JPY in recent years, but also holds for USD/JP over a longer period. The current JPY market is consequently receiving conflicting signals. Yield spreads suggest that the JPY is too low, especially against the EUR, but declining equity risk premia suggests there is still downside scope for the JPY on the crosses. There is a better fundamental case for JPY strength, with the correlation with equity risk premia having little fundamental justification, but the correlation is nevertheless hard to ignore, and we doubt there will be major sustained JPY strength unless equities fall back. But JPY action on Monday will likely depend on Ueda.

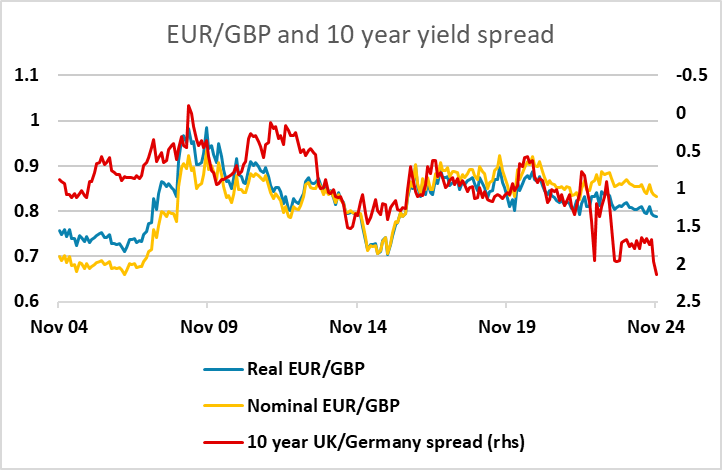

Otherwise the main data of the week in the G10 is UK and Canadian CPI data. Japanese CPI data will also be of interest but the national CPI data is usually well predicted by the Tokyo data already released. GBP fell back a little on Friday after weaker than expected September and Q3 GDP data, but EUR/GBP still looks biased lower if UK yields hold close to current levels. A weak CPI number could change that, however, as the market is currently pricing little chance (around 20%) of a BoE rate cut in December.

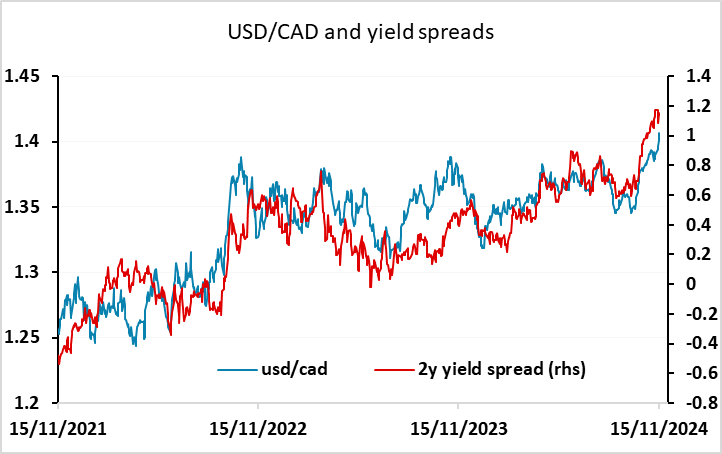

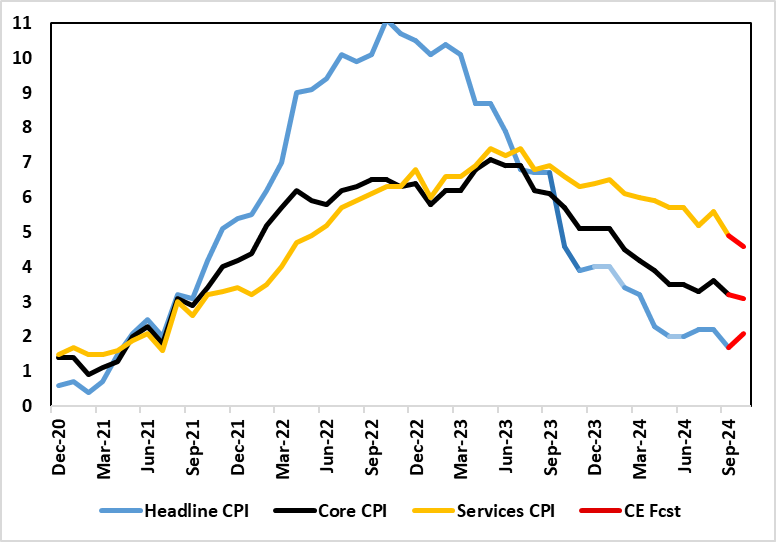

It also looks hard to oppose the uptrend in USD/CAD given the yield spread moves in favour of the USD in recent weeks. However, speculative positioning is quite extreme according to the CFTC data, so a stronger than expected CPI number could trigger a sharp CAD correction higher, even though it seems unlikely to chance BoC policy expectation sufficiently for nay CAD gains to be sustained.

Data and events for the week ahead

USA

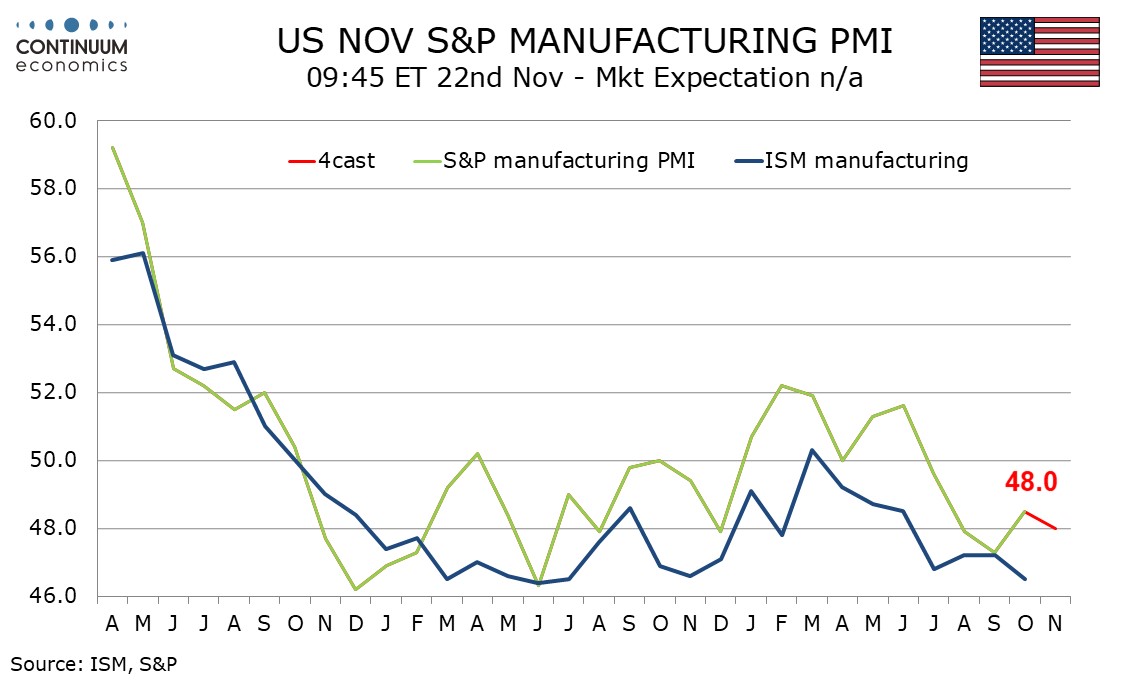

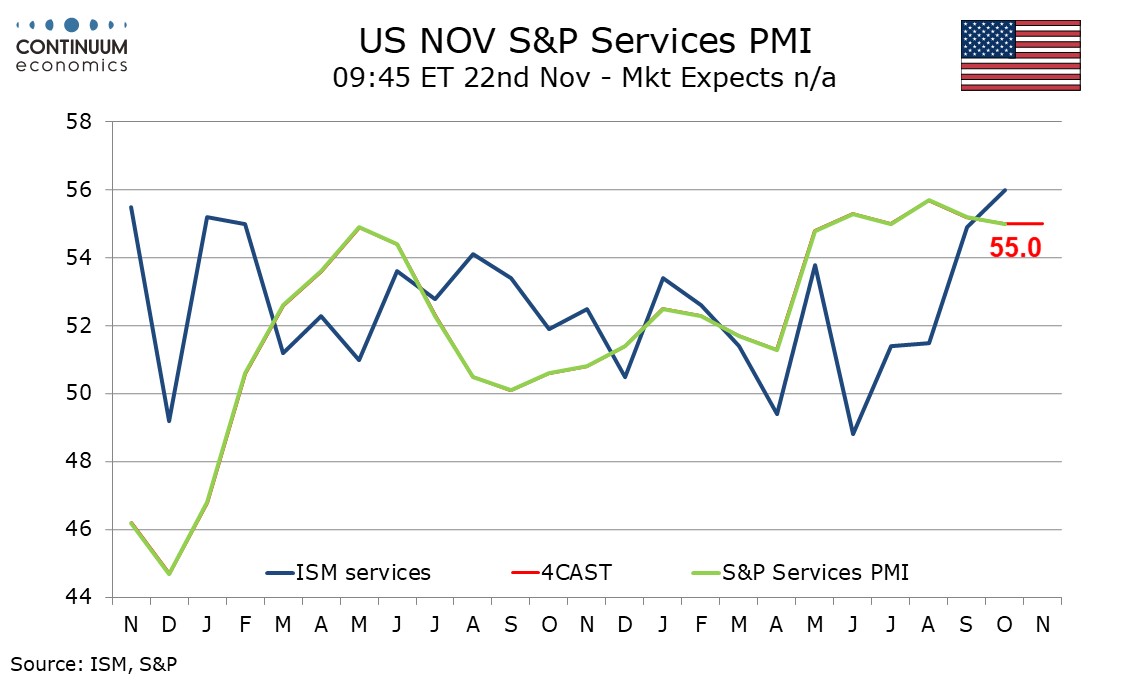

It is a fairly quiet week for US data. Monday sees November’s NAHB homebuilders’ index which could be vulnerable to rising bond yields and Fed’s Goolsbee is due to speak. On Tuesday we expect October housing starts to fall by a marginal 0.3% to 1350k while permits rise by 0.4% to 1450k. Thursday’s jobless claims data will cover the survey week for November’s non-farm payroll. November’s Philly Fed manufacturing survey is also due. Later we expect a 2.3% increase in October existing home sales to 3.93m. October’s leading index is also due while Fed’s Hammack and Goolsbee again are due to speak. On Friday we expect November’s S and P manufacturing PMI to slip to 48.0 from 48.5 but services to be unchanged at 55.0. Final November Michigan CSI data on Friday will be of interest, as it will, unlike the preliminary, include responses taken after the election.

Canada

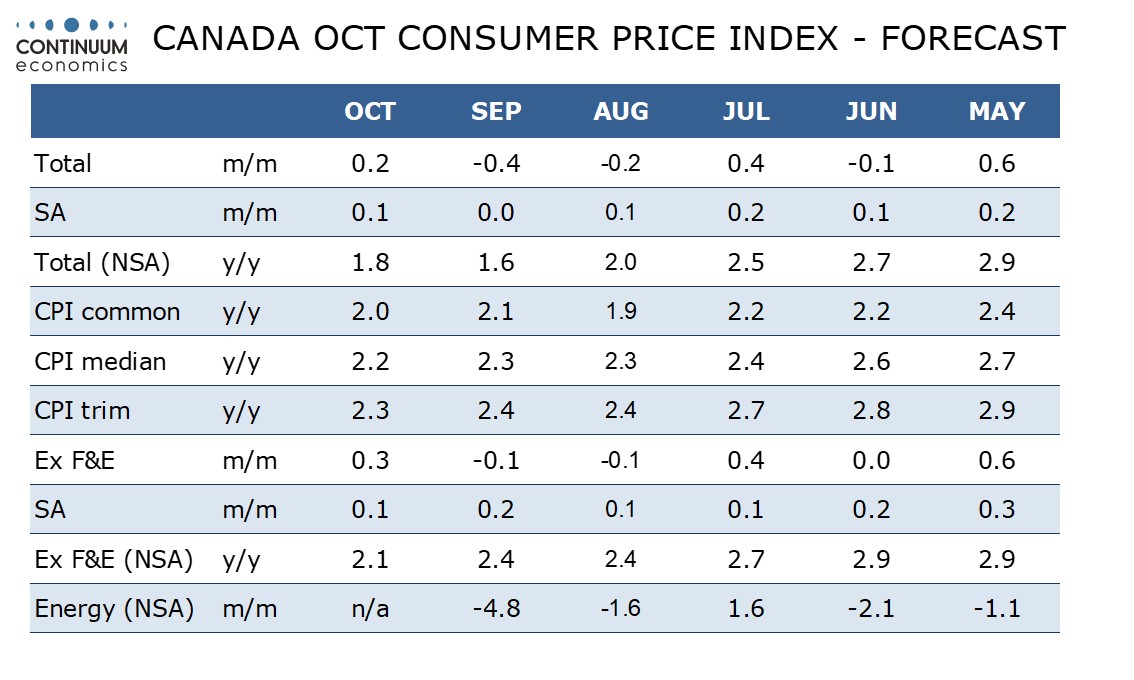

Canada releases October housing starts on Monday. The key Canadian release will be October CPI on Tuesday, where we expect yr/yr growth to correct higher to 1.8% from 1.6% but renewed slippage in the Bank of Canada’s core rates. October’s IPPI and RMPI follow on Thursday. Friday sees September retail sales, for which a preliminary estimate of a 0.4% increase was given with August’s report.

UK

Tuesday sees the BoE hierarchy testify to the parliament Treasury Select Committee on its recent Monetary Policy Report. Wednesday sees CPI data. UK inflation dropped to 1.7% in September (from 2.2%), thus falling below target for the first time since April 2021. This drop was greater than expected and included an unexpectedly large fall in services inflation to a 28-mth low of 4.9%, in turn dragging the core down 0.4 ppt to a cycle low of 3.2% (Figure 1). Admittedly, that drop in the headline is likely to be short-lived as last month’s rise in the energy price cap (partly dampened by a drop in fuel prices) should pull the headline rate back to around 2.1% in October. Thursday sees public borrowing numbers that are likely to be sizeable, still reflecting spending overshoots.

Clear Inflation Drop in Core to Continue?

Source: ONS, Continuum Economics

Seemingly key PMI data arrive on Friday, important not just to assess if the economy is slowing but also the extent to which price and cost pressures may be ebbing further. The Composite Index fell to 51.8 in October from 52.6 in September, the lowest reading since November 2023. We see a further, but modest fall in November, partly Budget related. Finally, retail sales data (also Fri) may be down partly due to poor weather which was unsettled through October as well as reflecting Budget apprehension.

Eurozone

ECB thinking may be shaped by Q3 negotiated wage data (Wed). But the week starts with visible trade numbers (Mon) and then sees final HICP data with a full break-down (Tue). After consumer confidence data (likely to remain weak), the week ends with PMI data for November, and as with the UK, important not just to assess if the economy is slowing but also the extent to which price and cost pressures may be ebbing further. The October Composite PMI edged up to 50.0 in October, which indicates no change in private sector output levels and we see no further change this time around. The implied absence of growth would reflect a further weakening of demand conditions after October saw the sharpest drop in employment since December 2020. As for prices, rates of inflation in both input costs and output charges may again be little-changed and therefore among the weakest seen in over three-and-a-half years.

Rest of Western Europe

In Norway, Q3 GDP data (Thu) may show a second successive q/q rise of 0.1% while the Norges Bank expectations survey arrives later in the same day. In Switzerland, new SNB Chairman Martin Schlegel speaks (Fri) on ‘The SNB and its Watcher’.

Japan

National CPI next Friday remains critical for the next step from the BoJ. Private consumption seems to have steadied from the Q3 preliminary GDP and such momentum will likely carry on if real wage returned to positive, again. The headline CPI is expected to moderate further while ex fresh food & energy more stubborn. If both surprise to the upside, our call for a December hike will likely be supported. There is also trade balance on Wednesday but would carry less weight.

Australia

Little market moving release for Australia next week, perhaps except RBA meeting minutes where we expect there to be no surprises with they suggest cutting is still too early.

NZ

PPI on Monday and Credit Card spending on Thursday.