FX Weekly Strategy: December 8th -12th

FOMC risks slightly on the USD upside

AUD remains well supported and should see buyers on any dip

GBP recovery may extend

JPY likely to struggle unless wage data are surprisingly strong

Strategy for the week ahead

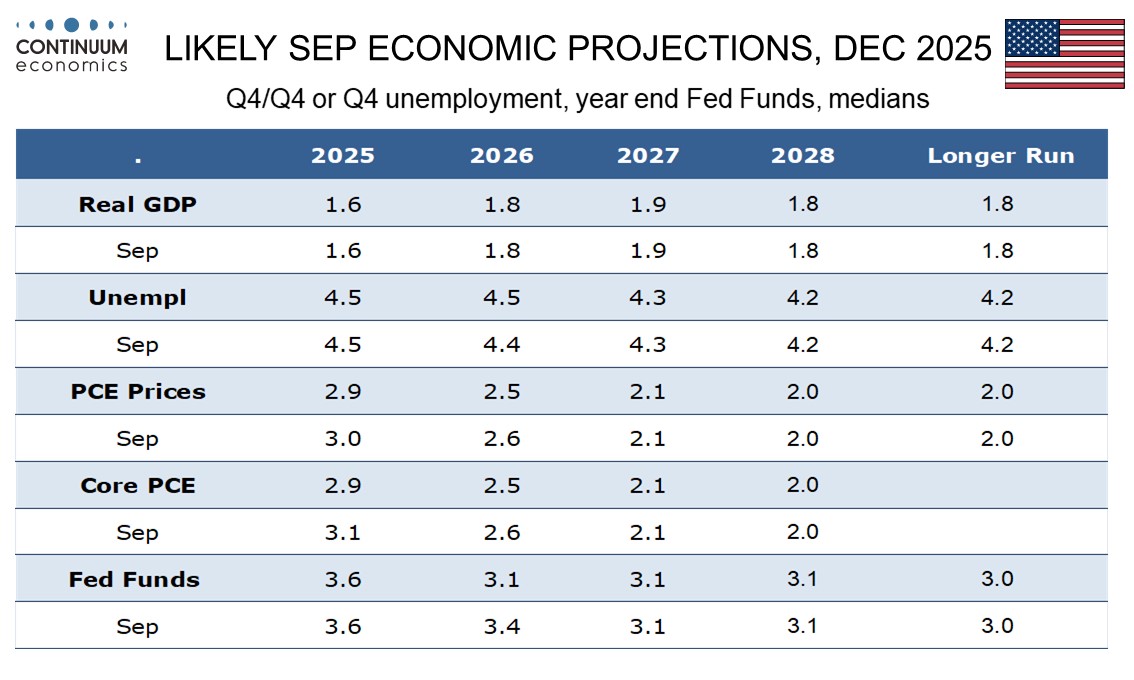

The FOMC meeting is the main focus this week. We go along with the market in expecting a 25bp ease from the Fed, but the market reaction will depend more on the impression of future policy Powell provides. We suspect the risks for US rates are on the upside, as there are a further 57bps of easing priced in by the end of 2026, and the update to the dot plot is likely to suggest only a further 25bps over the next year, unchanged from the September story. Nevertheless, we would expect the market to retain most of the easing expectation currently priced in, suggesting only mild USD upside.

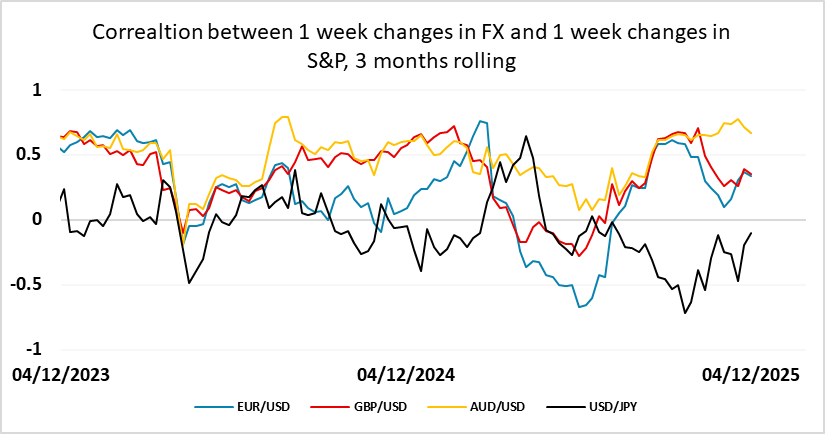

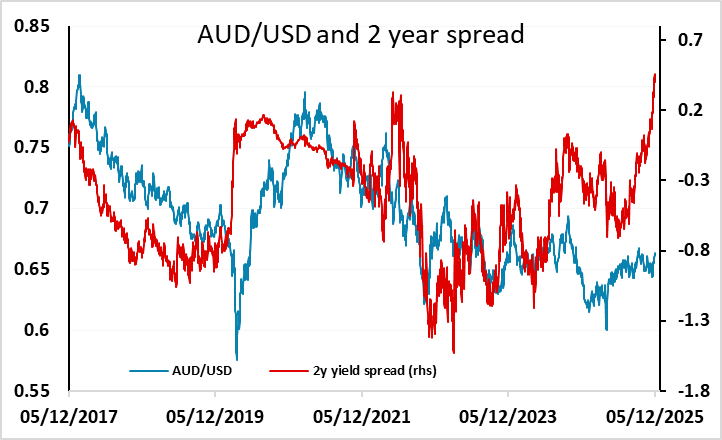

Slightly less optimism about Fed easing due to higher US yields could be expected to take the steam out of equity markets and lead to some correction to the AUD gains seen over the last week. But we continue to see the AUD as the most attractive of the riskier currencies due to the significant rise in AUD yields seen in recent months. While this week’s RBA meeting is unlikely to see any change in rates, it may support the market view that the next RBA rate move could be up, and this should ensure that the attractive yield spread picture in favour of the AUD is maintained. The correlation with equities mans some downside risk, but we would expect good support for AUD/USD on any dip sub 0.66.

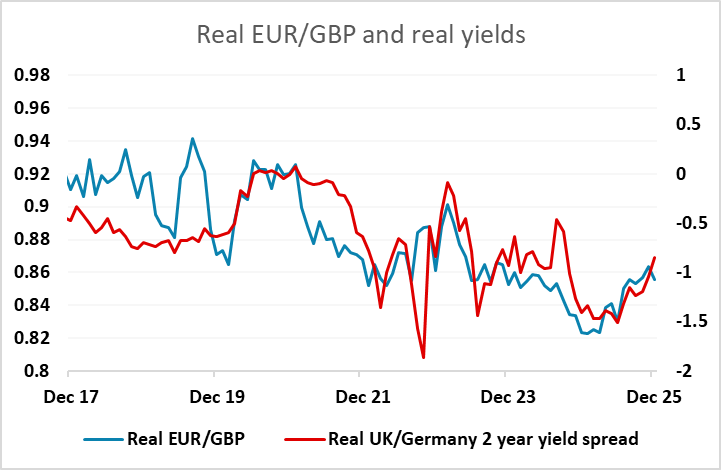

The UK sees October GDP data this week and testimony to the Treasury select committee from MPC members around the November Monetary Policy Report. The risks may be toward more GBP gains, as the October GDP data should show a bounce after the September dip which was due in large part to the JLR shutdown following a cyberattack. The MPC testimony may also be slightly less dovish than might have been expected before the Budget, as while the MPC are not supposed to take unannounced Budget measures into account, the fact that the Budget is slightly expansionary in the front year may moderate some of the dovish views. Even though we wouldn’t expect this to prevent a rate cut in December, this is close to fully priced in so the market is more concerned about future policy. Longer term we remain GBP bears, but we doubt we will see a return of downward momentum this week.

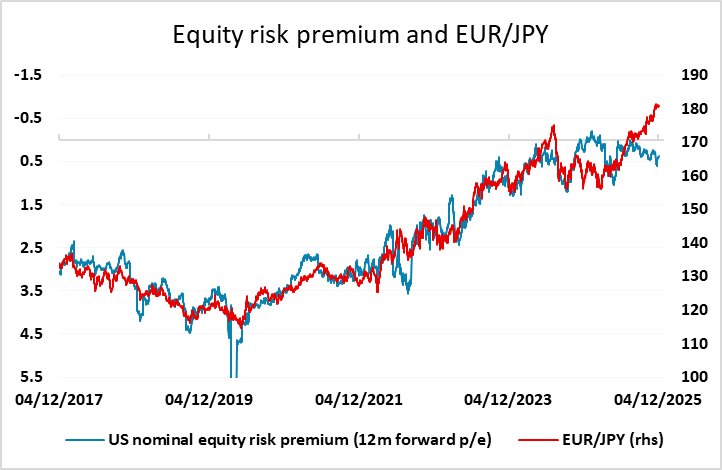

There isn’t much on the EUR calendar, and EUR/USD will likely be driven more by US events (as usual). The JPY will take an interest in the wage data at the beginning of the week, but looks likely to continue to be driven mostly by risk premia. If we see higher US yields this will tend to push risk premia lower as long as we don’t see an unusually large reaction in equities, and this will tend to favour further JPY weakness. We doubt this will be sharp, as recent comments from government officials have stressed the willingness to intervene to prevent further significant JPY losses, but this seems unlikely to be the week for a JPY recovery unless the wage data at the beginning of the week prove surprisingly strong.

Data and events for the week ahead

USA

The FOMC meets on Wednesday and we expect a 25bps easing to a 3.50-3.75% range for the Fed Funds target, though there will be a lively debate between easing and no change. We expect two dissents for no change, from Schmid and Musalem, while Miran is likely to vote for a 50bps easing. If easing is delivered, Powell may suggest at the press conference that rates are now at the right level with sufficient insurance now taken against downside labor market risks. Dots will be updated but we expect only marginal changes from September.

Tuesday sees November’s NFIB survey on small business optimism and JOLTS data on labor turnover for both September and October. On Wednesday we expect a fourth straight 0.9% increase in Q3’s Employment Cost Index. Thursday sees weekly initial claims, which are likely to correct from a sharp fall in Thanksgiving week, and September’s trade balance, where we expect the deficit to increase to $70.5bn from $59.6bn in August. September wholesale inventories and sales are also due. Fed’s Paulson and Hammack will speak on Friday.

Canada

The Bank of Canada meets on Wednesday but looks very likely to leave rates unchanged at 2.25% and to reiterate its view made after October’s easing that rates are now at an appropriate level. Surprising strength in Q3 GDP further reduces the case for another easing, but tightening remains unlikely in the near term.

Canada releases September trade data on Wednesday, and Q3 data implies a significantly lower deficit unless preceding deficits are revised lower. Friday sees October wholesale sales, where preliminary data showed a 0.1% decline, October building permits, and Q3 capacity utilization.

UK

The week sees more BoE insight with MPC speeches (Mon) from both Taylor and Lombardelli and then a financial stability discussion from Gov Bailey (Thu). The key BoE event though is the appearance of several MPC member before the Treasury Select Committee on Tuesday to discuss the last MPR with the Committee then grilling Chancellor Reeves the following day. These all come after more and likely to be still-weak labor market survey data from REC (Mon).

Otherwise, the key is the October GDP figures (Fri). As we have underlined, GDP has hardly moved since March and this is unlikely to change with the October GDP release. Indeed, it has fallen in two of the last three months, albeit where some recovery should be in store for the current quarter as the September numbers were hit (temporarily) by the cyber-attack at JLR vehicle manufacturing and by weather swings. But amid less friendly weather patterns and what have already been weak retail sales numbers, as well as only a slow recovery on the vehicle side, we see only a 0.1% m/m rise for October. There is also the RICS housing market survey (Thu).

Eurozone

Very few important updates are due this week, the question for Germany being the extent to which Monday’s industrial production shows fresh weakness. There are several ECB appearances most notably from Lagarde (Wed)

Rest of Western Europe

There are a key events in Sweden, most notably final November CPI data (Thu) where the clear fall in the flash y/y rates will be detailed. There is also labor market numbers (Fri) and also the monthly GDP indicator (Wed) which has suggested some improvement in the real economy is occurring. In Norway, CPI data (Wed) should see targeted core inflation (CPI-ATE) ease somewhat – from 3.4% y/y in October down to the Norges Bank’s projection of 3.1%. Turning to the Norges Bank Regional Network survey, it may see growth prospects relatively unchanged.

As for Switzerland, and along with just about everyone, we see unchanged SNB policy when it gives it next quarterly assessment on Thursday. It is likely to retain what were modest growth outlook for this and next year and still see inflation nearer zero than the 2% upper target (figure 1). But this will be enough to justify stable policy. However, explicit will be a retained not so much an easing bias but an acknowledgement that the policy rate could go negative again, but with a high bar to make this occur. Indeed, financial stability issues may feature more in the Board’s discussions as the scheduled summary of this month’s discussion (Jan 8) may highlight.

Japan

Starting with labor cash earning on early Monday. The figure remains critical, especially after the poor household spending this week. Negative real wage has been taking its toll on private consumption and we will be happy to see another cash earning growth above 2%. It will be hawkish if we see above 3% and dovish below 2%. The second GDP release will also be on the same day, though we are not expecting major revision. If any, we doubt it will be positive revision. Else, we have PPI on Wednesday and some tier two data scattered throughout the week.

Australia

The key RBA interest rate decision is on Tuesday. There is no chance the RBA will cut in this meeting given the latest inflationary dynamics. Some market participants are dreaming of a rate hike but we fear it is not on solid ground. It will be a binary surprise if the RBA choose to change interest rate rather than on hold. There is a good possibility there will be dovish surprise from forward guidance as market seems to be pricing too little of one more cut. The Australian labor market will show its color on Thursday. It is expected to remain healthy but should not be as hot as October figure.

NZ

Only Business PMI and electronic car retails sales on early Friday.