This week's five highlights

Potential New Dovish Fed Chair

Could See DXY Extending late-November losses

Services Inflation Still Problematic for EZ

BoE Offers Financial Boost?

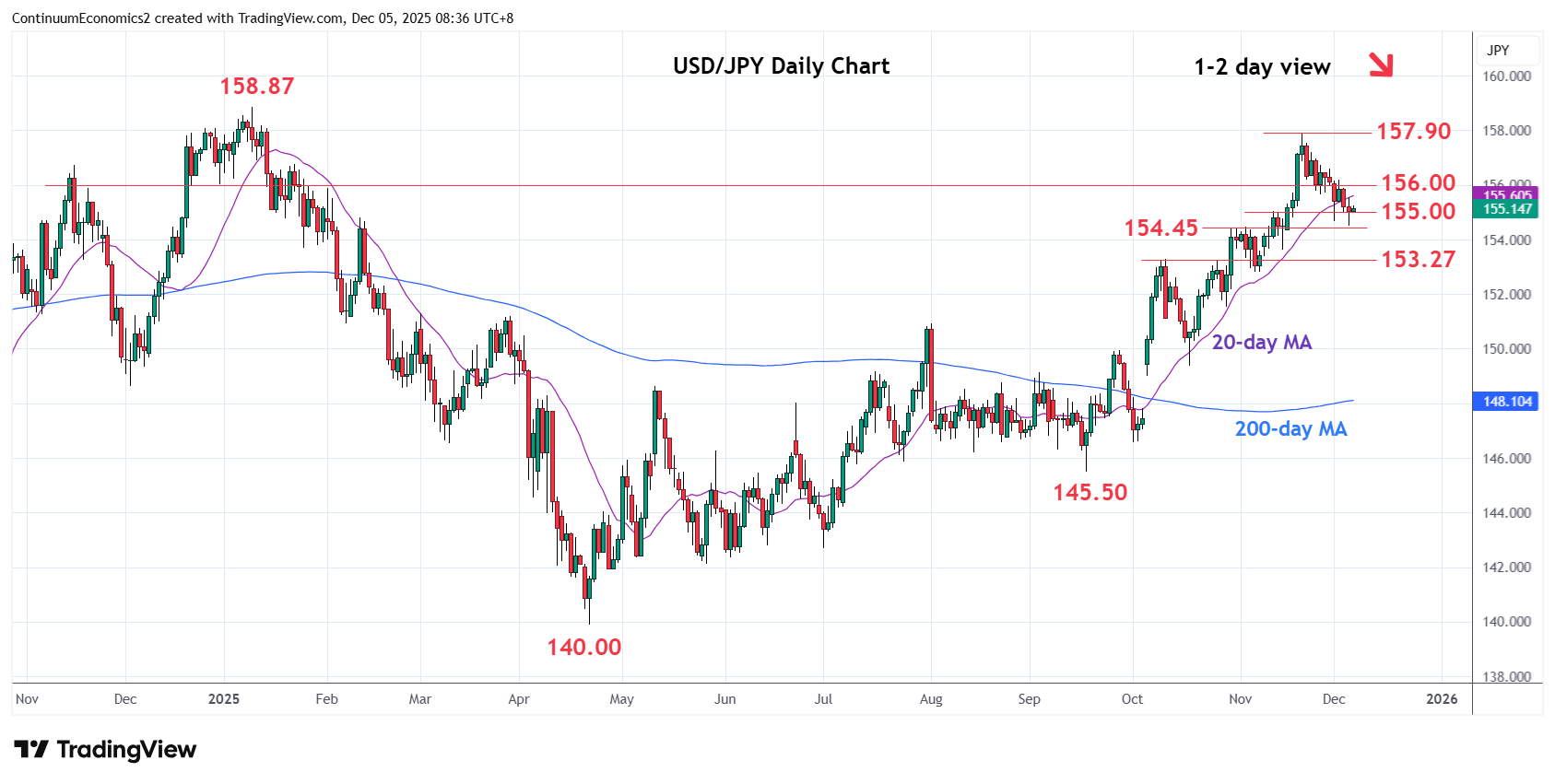

USD/JPY Under pressure after Bloomberg Report

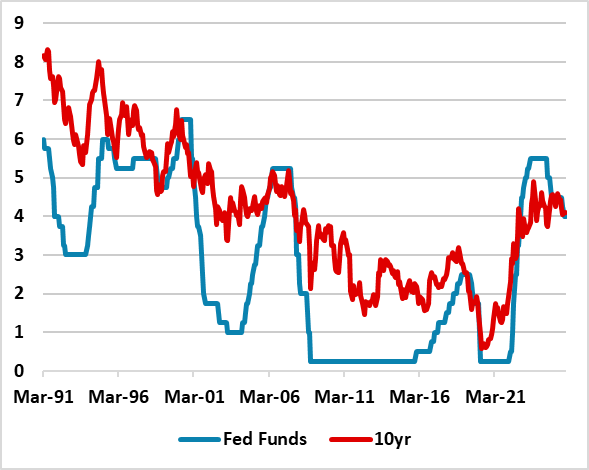

Figure 1: 10-2yr Yield and Inverted Fed Funds Rate (%)

Reports over the weekend suggest that the Trump administration is trying to name the new Fed chair before Christmas to start in May 2026. The reported shortlist includes current Fed Governors Waller and Bowman; NEC Director Hassett; former Fed Governor Warsh and BlackRock CEO Rieder. Bloomberg reported that Hassett was viewed as the front-runner by the White House. Most of the other candidates ex Rieder and Hassett are seen to be conventional in nature and would not materially impact expectations of Fed policy. However, Hassett is seen to be dovish on rates and seen to a close ally of President Trump.

Even so, the dynamics of FOMC voting could mean that Hassett as Fed chair in itself does not deliver more Fed easing. This is already evident with Miran who has taken an uber dovish view, but has not convinced other FOMC members to follow. Certainly Waller and Bowman has been more proactive in recent months in arguing for easing, but this is measured (e.g. 25bps); based on reasonable uncertainty about the labor market and does not appear to have seen them lower their neutral rate estimates (looking at the September dot plot). Additionally, the NY Fed president and four rotating district presidents, plus remaining traditional three Fed governors, could out vote a new Fed chair, Miran, Bowman and Waller! One option for the Trump administration is to push the Fed governors to block reappointment in February 2026 for all the Fed district presidents, but Trump is unlikely to have a majority on Fed governors to be able to do this. The next chance would be February 2031.

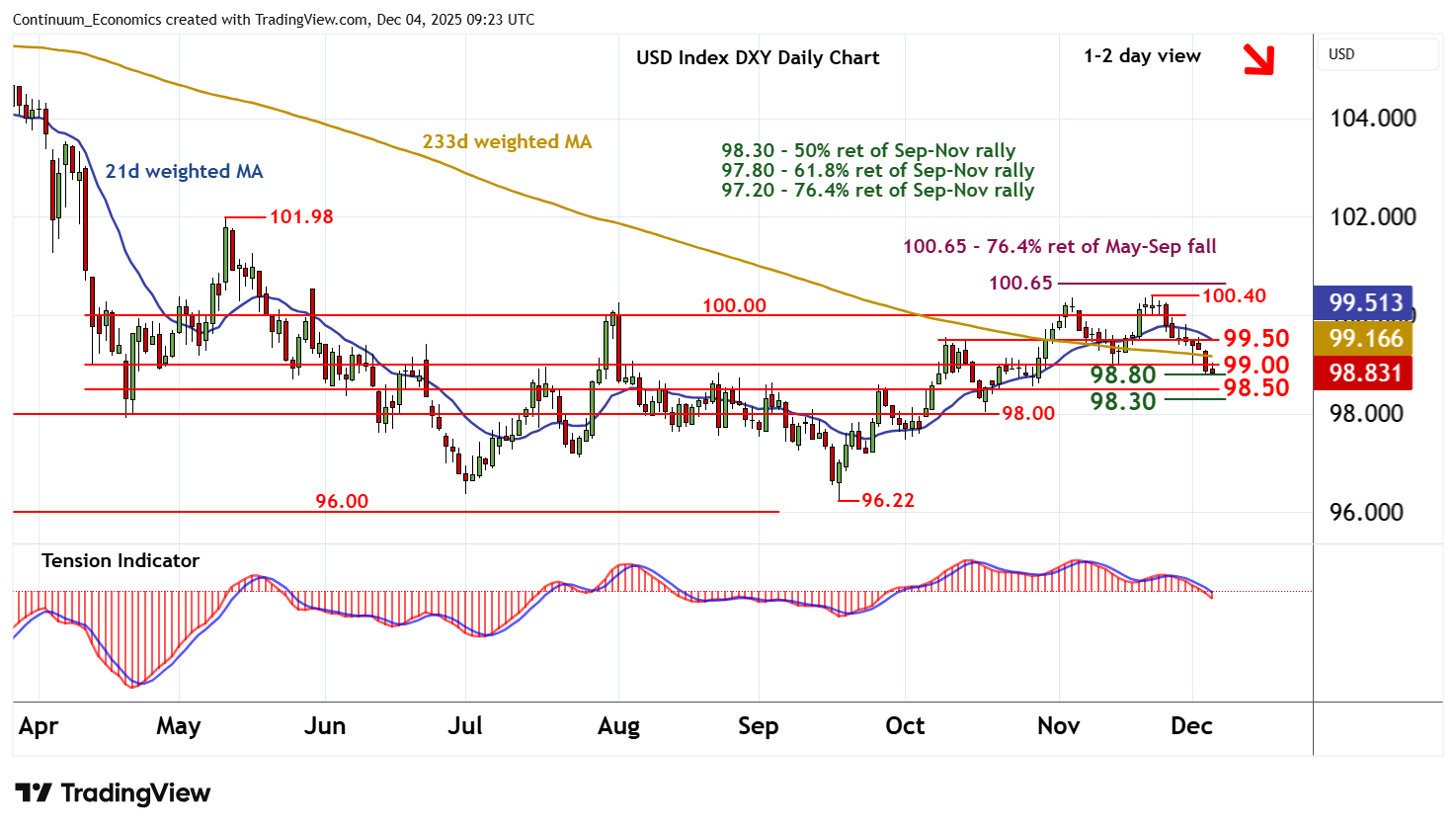

On the chart, the anticipated break below 99.00 has reached support at the 98.80 Fibonacci retracement, where unwinding oversold intraday studies are prompting short-term reactions. Daily readings remain under pressure and broader weekly charts are turning down, highlighting a deterioration in sentiment and room for further losses in the coming sessions. A break below 98.80 will add weight to already bearish sentiment, and extend late-November losses towards congestion around 98.50. Just lower is the 98.30 retracement, where already oversold daily stochastics could prompt short-covering/consolidation. Meanwhile, a close back above congestion resistance at 99.00 will help to stabilise price action and prompt consolidation beneath 99.50.

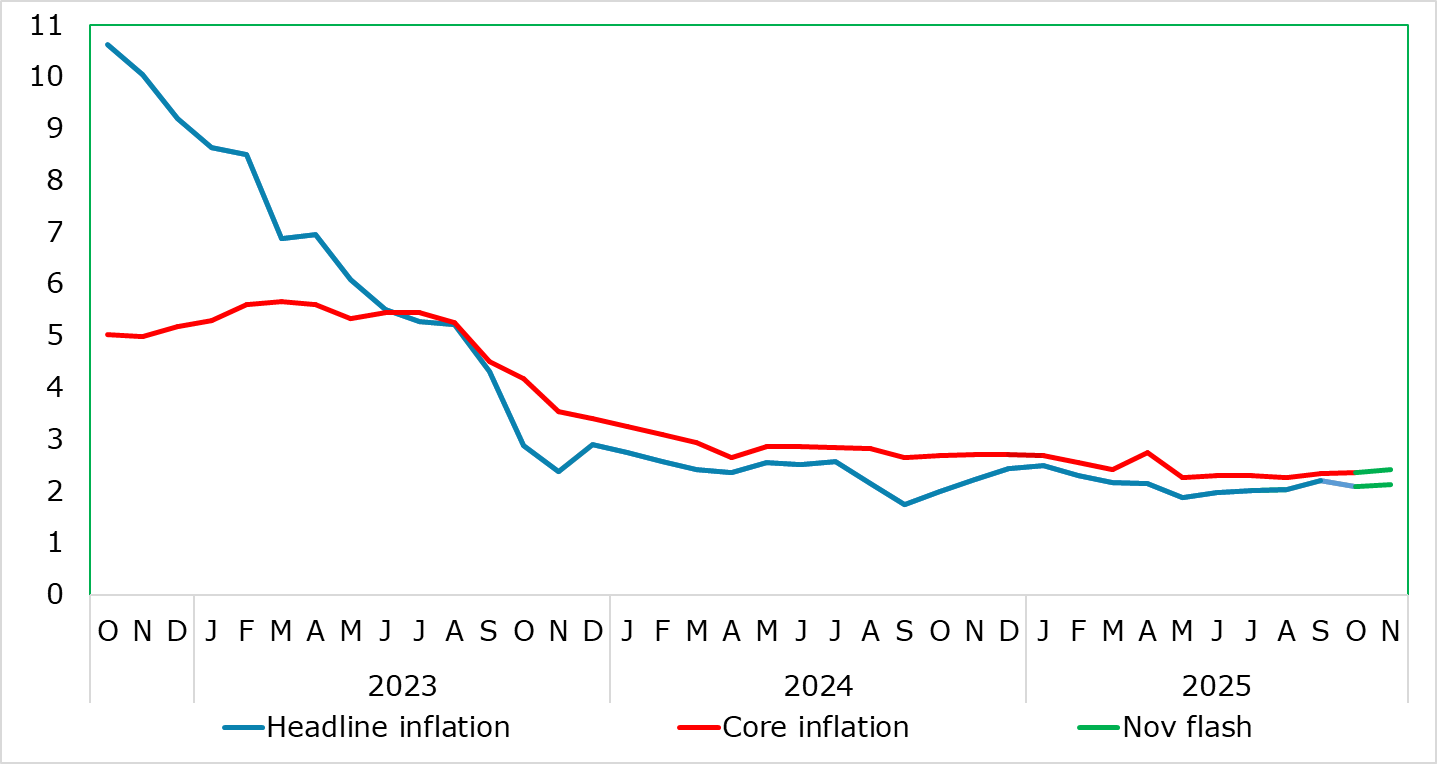

Figure 1: Headline and Services Edge Back Up

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. This reversed in the flash November numbers in what was an outcome a notch above both consensus and probably ECB expectations. But the diehard hawks at the ECB will focus on the small further rise in services inflation to a seven month high of 3.5%, a shift higher echoed by less favourable, but still target-consistent, adjusted m/m data. Even so, core inflation stayed at 2.4% still supporting an ECB view for core inflation staying below 2% out to 2027 is very plausible. Thus is backed up also by (much softer) wage data which also very much suggest that the pick-up in services inflation is spurious and where more abundant labor supply is evident !

In contrast to food inflation in neighbouring economies (at least until recently), that for the EZ seems under control, actually slipping back further in October and staying at 2.5% last month despite some adverse weather of late. Admittedly, services inflation, at 3.5% moved up further but from an August reading that was the lowest since March 2022 but despite this rise, it still seems to be belatedly following in the footsteps of lower wage pressures. Moreover, labor market data released today alongside that are showing a still clear rising workforce (Figure 3) may explain such weaker cost pressures.

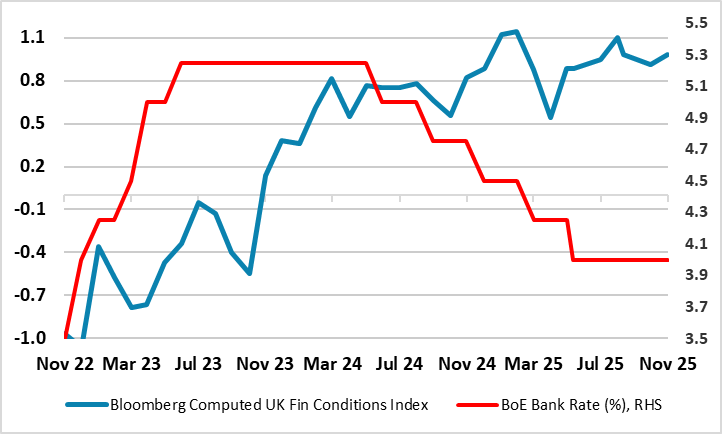

Figure 1: Financial Conditions Impervious to Lower Bank Rate?

In its updated financial policy report which included fresh bank stress tests, the BoE Financial Policy Committee (FPC) is reducing bank capital requirements. This very seems to be designed to encourage bank to lend and may reflect what have been modest, if not flagging, numbers regarding actual private sector credit growth and may even be a reaction to evidence that despite reduction is Bank Rate, financial condition have not loosened – the opposite (Figure) while credit growth has slowed. This decision is very much separate to the BoE’s monetary policy decisions, but will be a factor when the MPC updates its projections in February but has little bearing on its likely rate cut decision expected later this month.

Some perspective first. Banks account for around 85% of lending to UK households and just under half of lending to UK corporates. They also play an increasingly significant role in supporting market-based finance, including through the provision of lending and other services to various types of non-bank financial institutions.

Bloomberg reported on Friday that the BoJ is tilted towards hiking rates in the December meeting. It echoes with our call and see current inflationary picture supportive of such action. Early signs of wage negotiation re broadly viewed to be positive with Rengo asking for 5% increase. Such will bring comfort to the BoJ as they view increasing cash earning to be critical in sustainable inflation. More importantly, Takaichi seems to have turned on the green light for Ueda as the rhetoric began to change after their meeting.

On the chart, the pair is under pressure but no follow-through on break of the 155.00 level as prices unwind oversold intraday studies. Consolidation here is expected to give way to eventual break to extend losses from the 157.90, November current year high. lower will see room for extension to strong support at the 154.45/154.00, October high and congestion area. Below this will open up room for deeper pullback to support at the 153.27/152.80, October high/November low. Meanwhile, resistance at the 156.00 congestion is expected to cap bounce attempt.