JPY flows: JPY rally continues as risky assets soften

JPY up, riskier currencies down as equities and commodities fall back

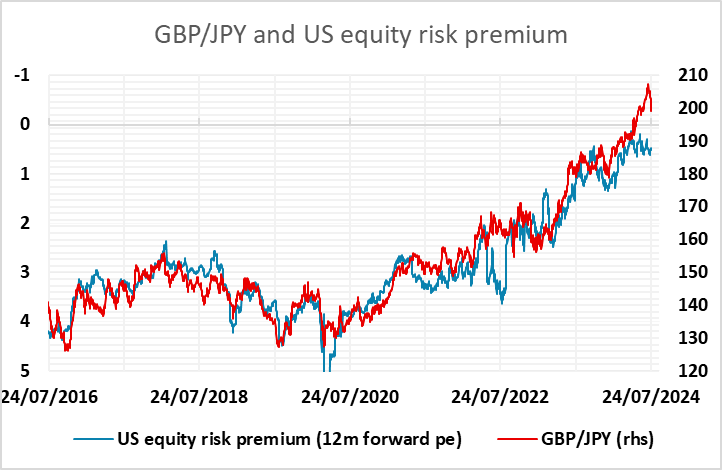

The JPY has been strong overnight, with USD/JPY and EUR/JPY both at their lowest since May 16. The USD has also made gains against the riskier currencies, but these have been relatively modest, with only the AUD and NZD seeing significant declines. Weak equity market performance, particularly in Asia, and weaker commodity prices, notably in iron ore and copper, looks to have been the main driver of JPY gains and weakness in the riskier currencies, triggering general unwinds of carry trades. There was also better Japanese services PMI, but this is not typically a market moving release and was not a significant factor. PMIs from Europe and the US have more potential to have an impact, but on Europe versus the USD rather than the JPY.

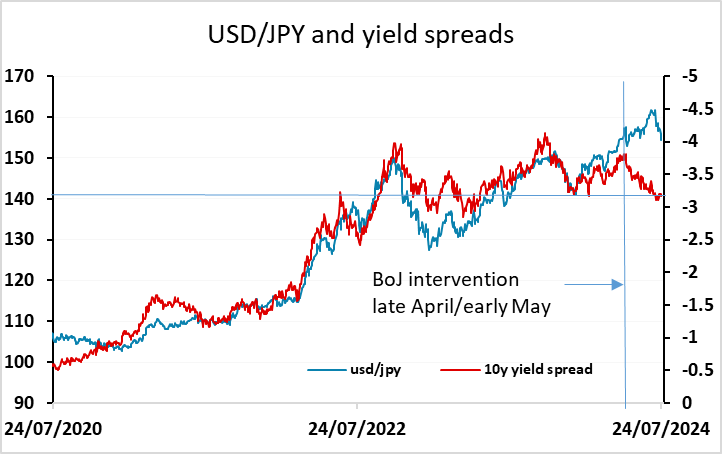

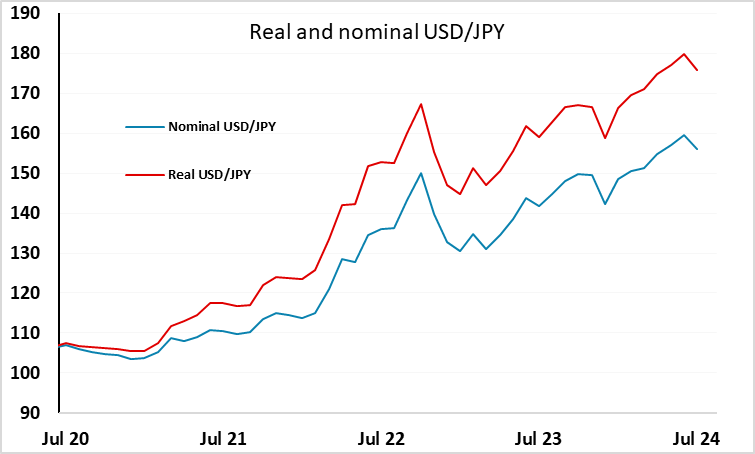

The JPY has now gained 4.5% against the USD since the sharp rise after the US CPI data on July 11 (likely amplified by BoJ intervention). This is normally seen as typically a big move in 2 weeks, but there is still potential for much larger JPY gains longer term, as the recovery has only scratched the surface of JPY undervaluation. The simple correlation with the 10 year yield spread, which was highly correlated with the JPY decline from 2021, suggests scope for a USD/JPY decline to 140. On top of this, the relatively low Japanese inflation rate over the period means that the real JPY decline has been 12% larger than the nominal decline, which would suggest scope to 125. This is a longer term target, but will likely require more consistently negative risk sentiment to be reached. Better PMIs in Europe and the US could halt the JPY rise today, but the underlying picture remains JPY positive.