USD, NOK, SEK, JPY flows: Quiet markets ahead of US price data

FX markets briadly steady but JPY and NOK remain undervalued

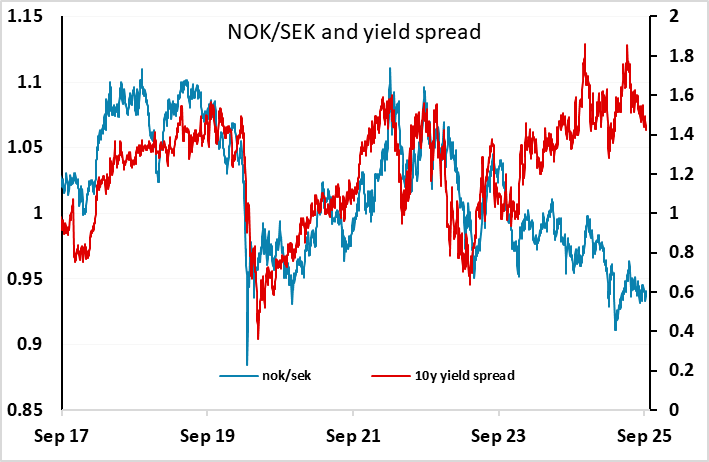

A quiet start in Europe. Scandis haven’t reacted significantly to the Swedish and Norwegian data released this morning. Swedish GDP was reported down 0.2% in July, but the June number was revised up dramatically to 1.4%, so the net result looks positive. But these monthly numbers have been quite unreliable, so the market is paying them little attention. The Norwegian CPI data was in line with consensus at 3.5% y/y headline 3.1% y/y core, so there has also been little impact on the NOK. We remain positive on the NOK against both the SEK and the EUR, but no short term progress looks likely after this data.

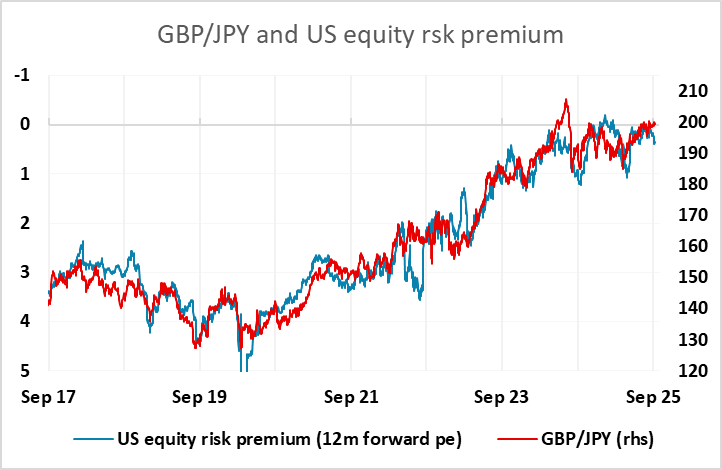

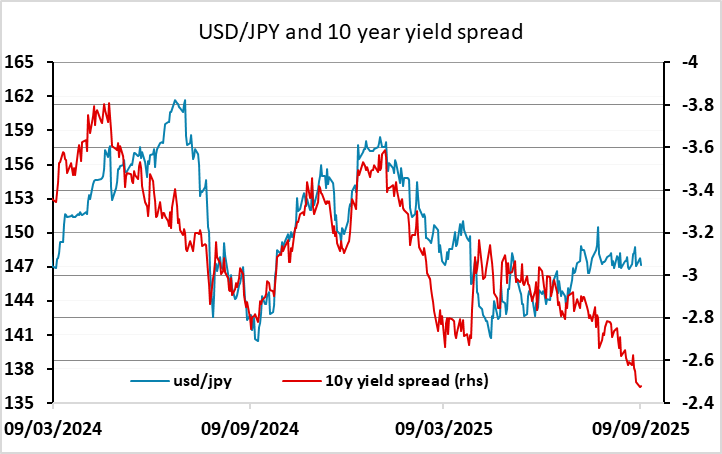

Overnight was also relatively quiet. Despite some geopolitical concerns around the Russian drone reportedly in Polish airspace and the usual Middle East concerns, there is little evidence of any nervousness in equity markets. We continue to see the JPY as undervalued here, both relative to yield spreads and relative to the usual risk premium correlation. But markets are likely to remain fairly quiet ahead of the US PPI today and the more crucial CPI data tomorrow.