This week's five highlights

Fed Speakers This Week

UK-EU Getting Back on the (Political) Fence

RBA Cut by 25bps

How Durable a Surge in UK CPI

The Greenback Stays Pressured

The UK has seemingly cobbled together a third trade deal in just over a fortnight is of course more of political importance than economic. The deal to be detailed later today with the EU will help both sides economy wise but only at the margin – the main factor for the UK being an open-ended veterinary deal that will remove much red tape for (hitherto damaged post Brexit) UK agricultural exports to its biggest market. But there is plenty in it for the EU too, not least a security and defence partnership, that may even allow the UK access to the EUR 150 bln defense spending EU fund. But while this deal moves the UK somewhat closer back to the EU, PM Starmer also seems keen to (appear to) sit on the geopolitical fence by limiting the initiatives with the EU, so that the UK is likely to remain a political island between a Trump U.S. and Europe.

Possibly, the EU recognises, if not welcomes this, as any bridge that it can find toward an unreliable U.S. is worth taking. Regardless, this EU-UK summit, the first since Brexit took effect in 2020, has been designed to regain some economic losses caused by Brexit in so-called “reset” talks. But especially with issues over youth mobility still to be finalised, this is very much like the recent ‘trade deal’ with the U.S. - ie the start if negotiating process not the end. It may also reflect genuine efforts and desires by the likes of the German Chancellor for the UK to be brought back more into the EU fold, but the UK will not be willing to go too far down this road given the pressures domestically not to ‘dilute’ Brexit.

In this regard, it is notable that even amid the widely accepted damage that Brexit has caused the UK (likely to hit some 3-4 ppt of GDP by the end of the decade) the UK is still framing this as improving the deal not reforming it. May be that is true as the EU remains keen to leave the suggestion open that in leaving the EU, the UK lost out and that any change in trade agreements a reflection of the UK having moved ground. But even the UK admit the economic benefits will be marginal; an estimated £ 10 bln by 2040 equates to a cumulative rebound in activity of 0.3 ppt and that over a period twice as long as that causing the damage alluded to above!

The RBA has cut the cash rate to 3.85% in the May 20 meeting as they revised their forecast of trimmed mean CPI to 2.6% y/y throughout mid 2026. They now see terminal rate to be at 3.2% till June 2027. Their forward guidance did not change by indicating data dependency approach and being cautious towards the future uncertainty. Our central forecast see two more cuts in 2025 to 3.35% and 3.2% in 2026. Given the cautious take of RBA, we are unlikely to see consecutive cut for now.

The RBA also made some revision to their forecast. They see GDP to recover in 2026, from 1.8% in June 2025 to 2.2% in June 2026, staying the same till June 2027. The RBA seems to think the labor market will stay solid and see unemployment rate at 4.3% in 2026/27. While they are concerned about tariff development, they seems to be optimistic about the recovery in private demand.

The current trajectory likely lead to choppy inflation picture tilting towards the downside for trimmed mean. The next 25bps will likely be in Q3 2025.

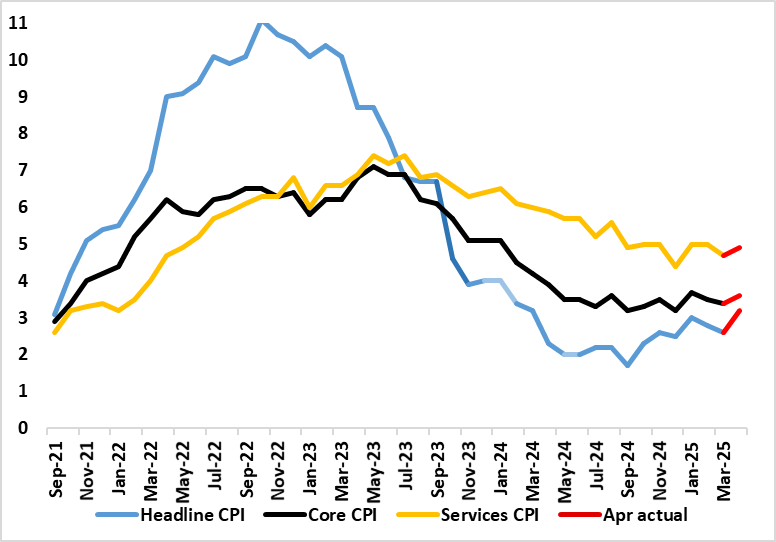

Figure: April CPI Inflation Jump Broadly – Albeit Temporarily?

The UK and the rest of the DM world are now decoupling, at least in terms of inflation, where the UK is seeing a surge, (largely home-grown) just as W European sees their respective inflation fall back to, if not below, targets – although some measures if underling EZ inflation have started to edge back up. Regardless, as for the UK, the main near-term inflation story was (and remains) what would happen in the April data when a series of energy, utility, post office and some other regulated and service price rises are due, albeit now offset somewhat by a fall in petrol prices if the slump in energy prices persists. The result was a notch higher than the BoE expected with a jump to 3.5%, a rise dominated by a pick-up in services, some of which (ie airfares) may be temporary. The data may have persuaded the MC not to cut earlier this month but at the same time there is no clear fresh inflation spiral with six of 12 CPI components seeing softer pressures and where consumer sensitive clothing and household equipment actually turned negative, possible a sign of reined in pricing power.

We see inflation peaking at this April level albeit with some dip before the rate returns (briefly) to (around) 3.5% in September, this latter outcome some 0.2 ppt below BoE thinking. As for BoE rate cutting, we think upside surprises would have to dislodge the MPC from cutting at least twice more this year albeit it clear that the MPC will remain divided, if not more so, even against a backdrop where there is a general view that policy restriction needs to reduced, the difference being over how fast given worries about price persistence.

The greenback continues to stay pressured along with choppy short end Treasury yields. The broader risk sentiment is also positive, which did not help with the greenback offers. There has been little from the tariff man himself yet market seems to be optimistic in his capability to make deals before the end of 90 days grace period.

On the chart, DXY edged up from the 99.33 low as prices consolidate losses from the 102.00 high of last week. Prices are unwinding oversold intraday studies but negative daily studies keeps pressure firmly on the downside and see room for extension to support at 99.00 congestion. Bbreak here will return focus to the 98.00 level and 97.92, 21 March YTD low. Below this will extend the broader losses from 114.78, September 2022 multi-year high. Meanwhile, resistance remains at the 100.00/100.15 congestion and September 2024 year low is expected to cap.