USD, CHF flows: USD continues to weaken, CHF leading

USD weakness continues with CHF making new 10 year highs

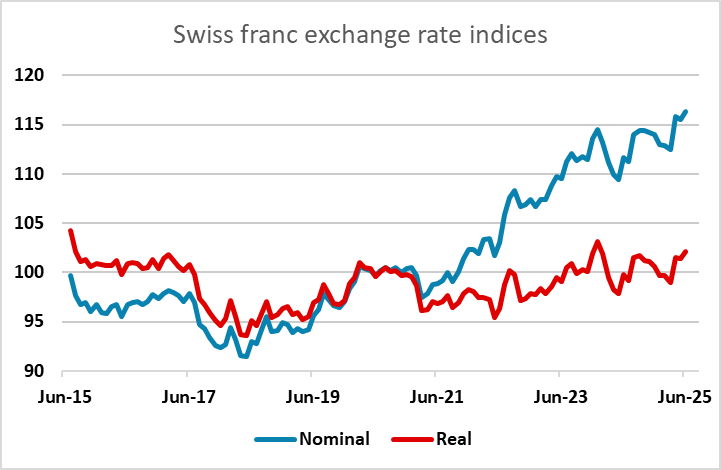

A fairly quiet start in Europe but the USD remains close to its recent lows following the sell off in the US afternoon on the back of more tariff speculation and more Trump attacks on Fed Chair Powell. The CHF continues to lead the USD decline, with another post-January 2015 low in USD/CHF at 0.7914 recorder in Asia. EUR/CHF is also tracking lower even though there is no obvious risk aversion evident in other markets. The SNB is likely to be getting interested in the current CHF strength, which is testing the top of the post 2015 range, with inflation well below target. But they are likely to be reluctant to intervene both because intervention is not typically effective for long and because the Trump administration may see this as currency manipulation, so that it could affect any trade negotiations. Of course, the CHF remains the world’s strongest currency by a distance, so such accusations make little sense, but this doesn’t mean they won’t be made.

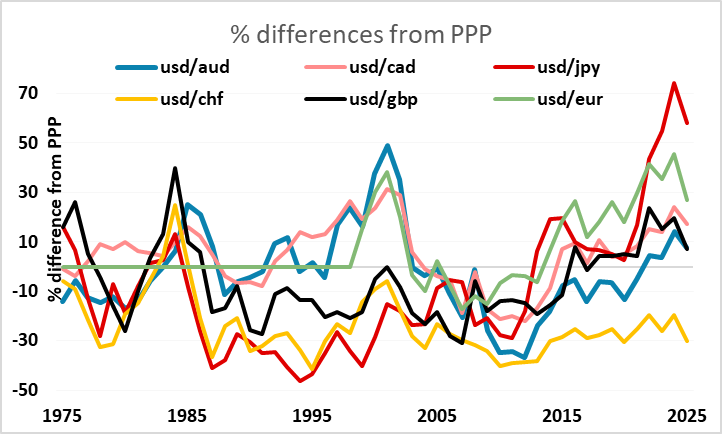

USD weakness continues to follow the playbook from Trump 2016, and the upcoming tariff deadline on July 9th may mark a watershed. Aggressive tariff increases might push the USD lower still (as has tended to be the case despite theory suggesting the opposite), while a more benign attitude could trigger a USD correction. USD weakness does look stretched against European currencies based on yield spreads, but there is still scope for the USD to fall back considerably further against the JPY and AUD on this basis.