U.S. May CPI Loses Momentum, Most Notably in Transport Services

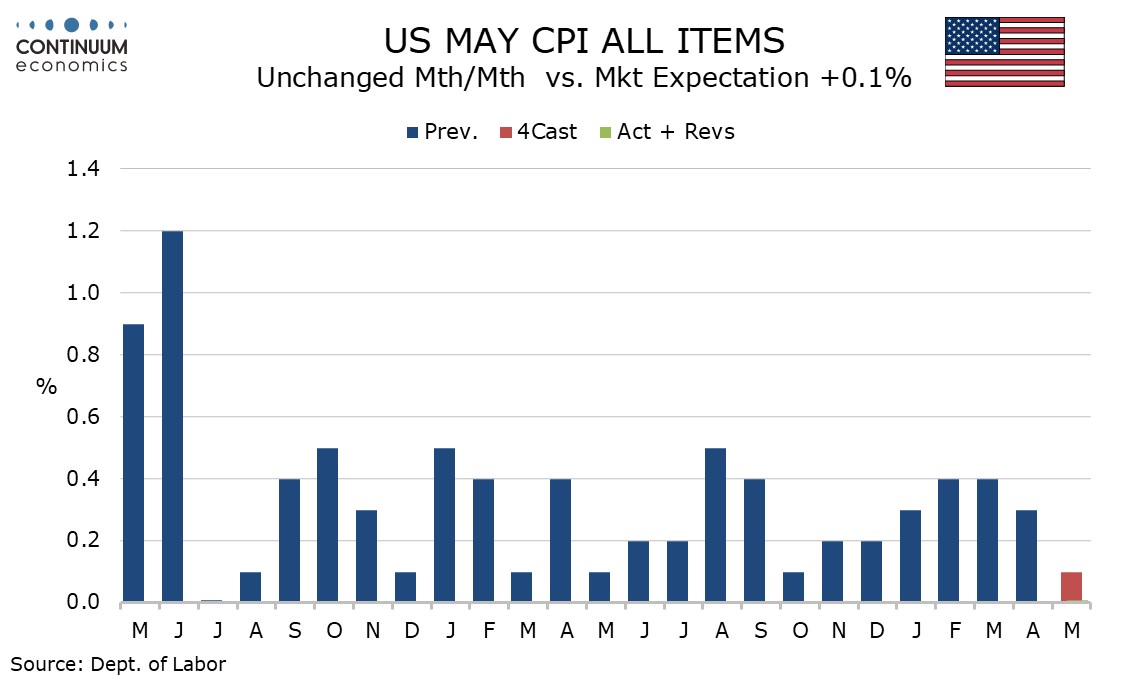

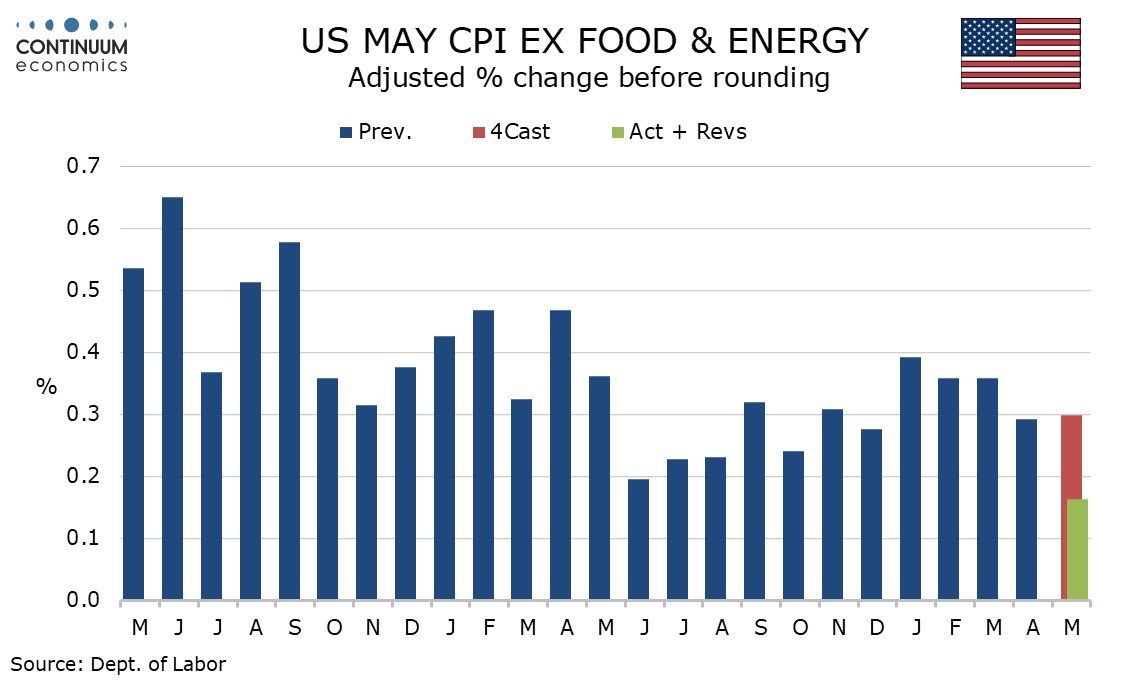

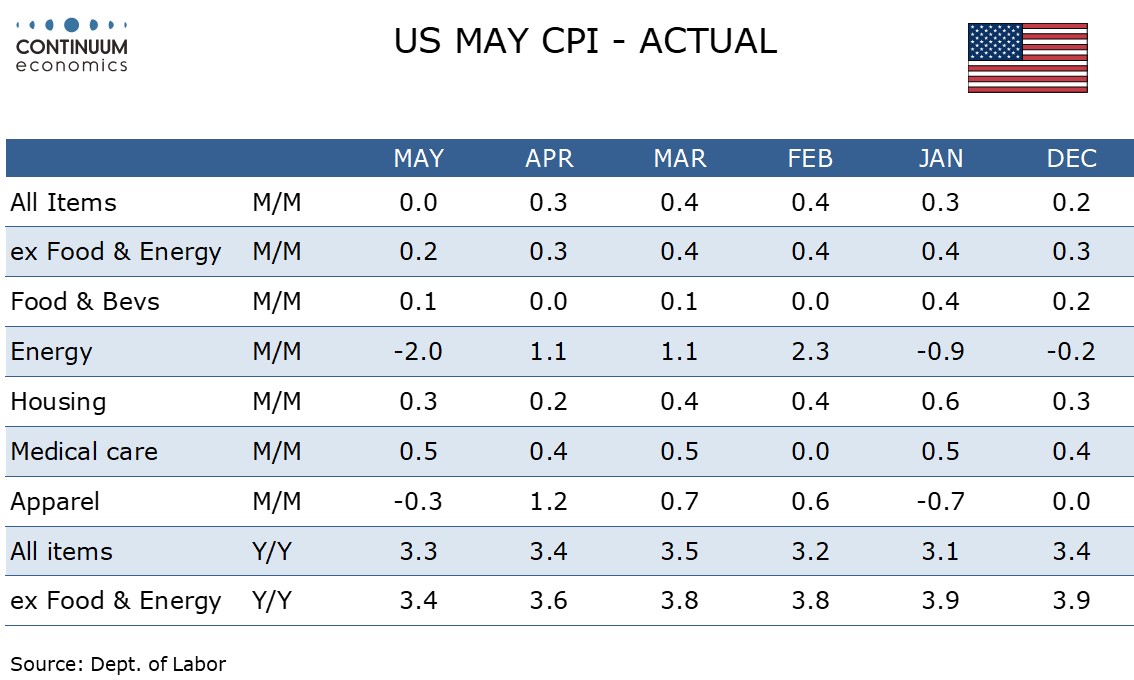

May CPI has come in softer than expected, unchanged overall with a 0.2% increase ex food and energy, with the latter up only 0.163% before rounding, which is the softest since August 2021. If sustained this would be consistent with inflation returning to target though the Fed will treat one soft month cautiously.

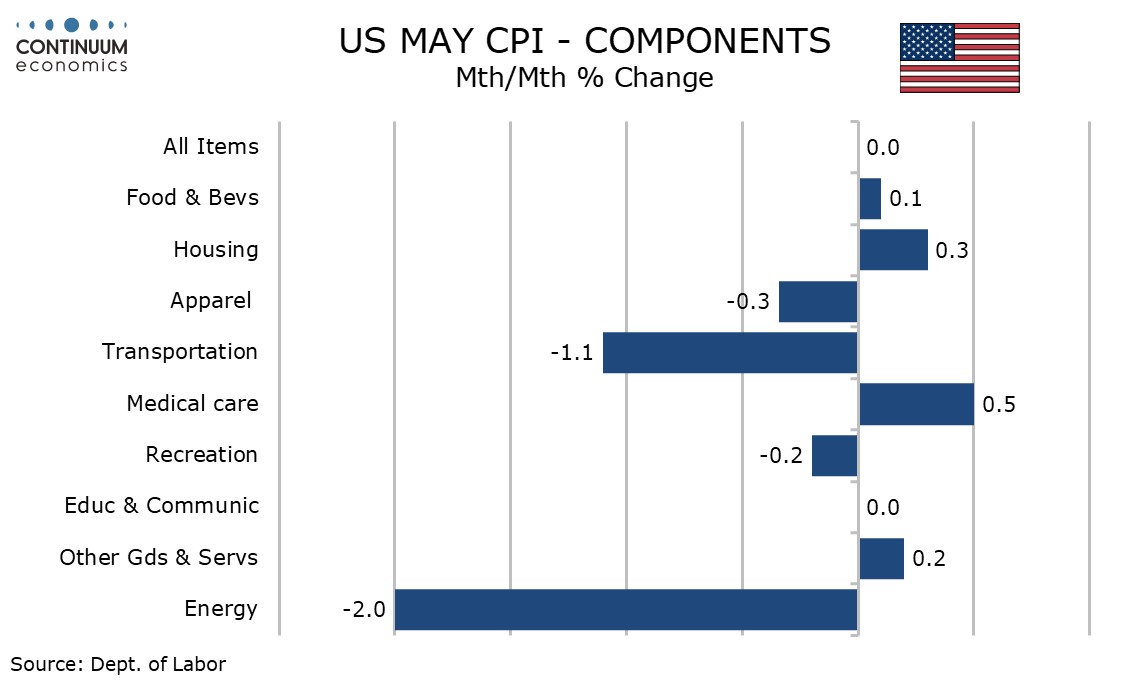

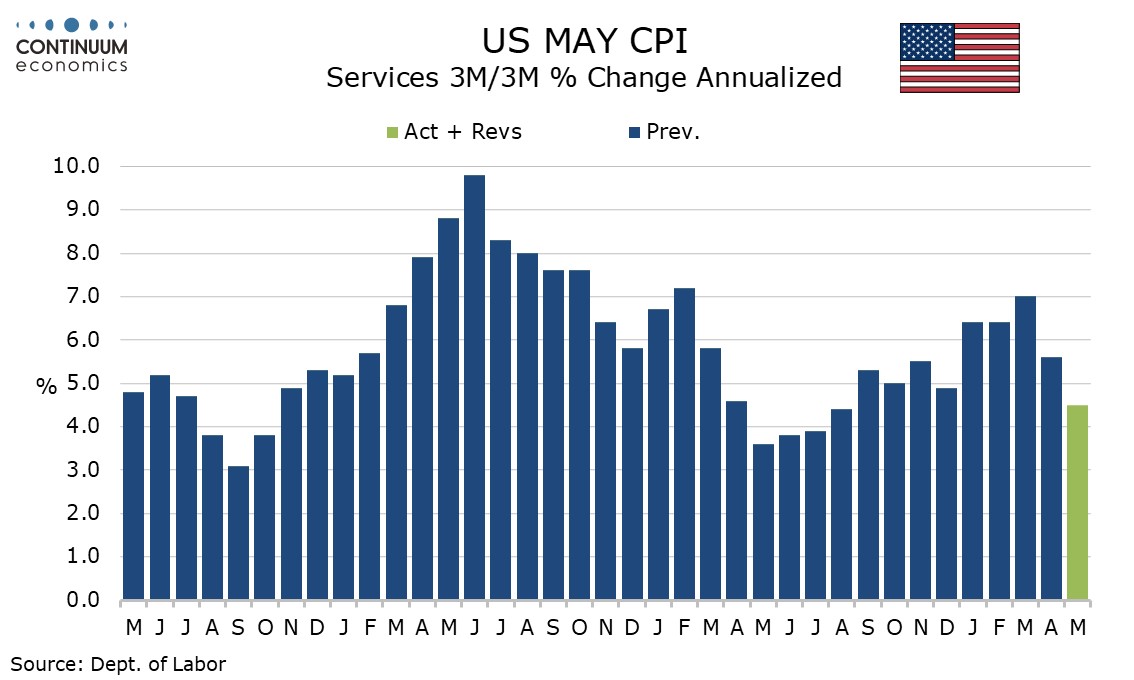

Looking into the detail, a 0.5% decline in transportation services stands out, this following gains of 1.0% or above in each month of Q1 and 0.9% in April. Services less energy services rose by 0.2%, well below recent trend.

Commodities less food and energy were unchanged, slightly stronger than two preceding marginal declines with used autos showing their first rise in three months. Gasoline corrected lower after three straight gains while food increased by a marginal 0.1%.

Transportation services were led lower by a sharp 3.6% fall in air fares which looks like feed through from lower energy prices. Motor vehicle services however were near flat after rising strongly in recent months, particularly in March.

Owners’ equivalent rent saw a fourth straight 0.4% increase and shelter saw a second straight gain of 0.4%. Most other components of services saw modest gains but recreation services fell by 0.2%.

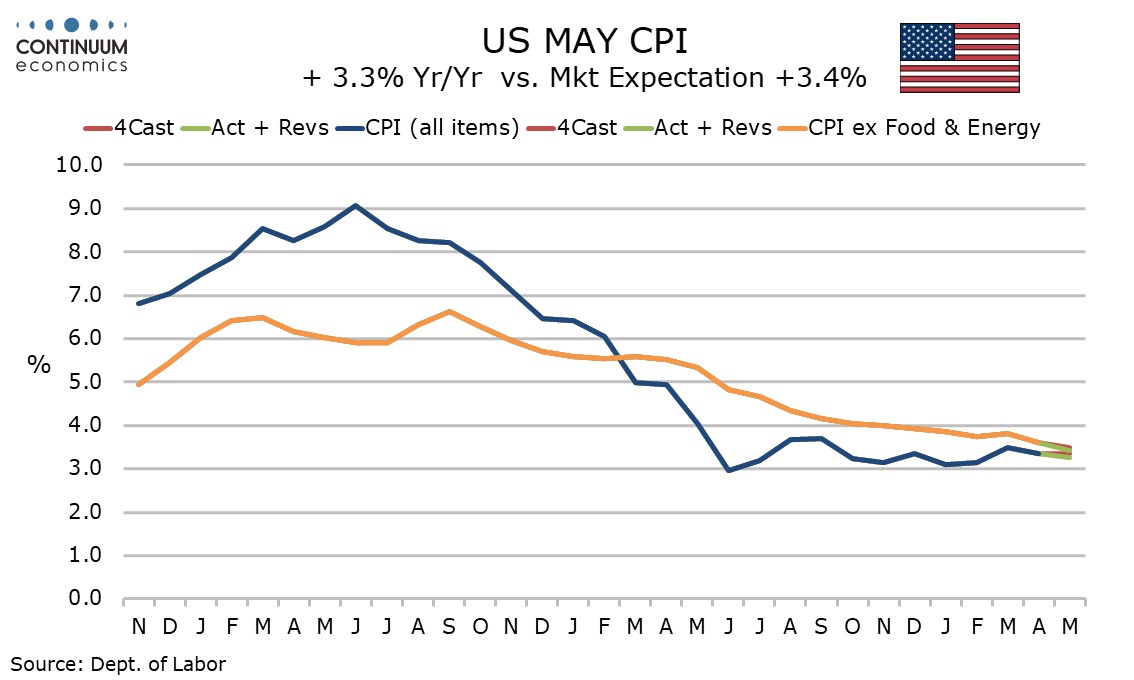

Yr/yr CPI fell to 3.3% from 3.4% while the ex food and energy pace fell to 3.4% from 3.6%, reaching its lowest since April 2021.

Caution needs to be seen after one encouraging month given the disappointing strength of the first four months of the year. However it has been our view that the 2024 data will show a similar pattern to 2023 when strength early in the year subsequently faded, and we expect the data in most months to be softer than the year ago data, seeing continued, if gradual, declines in the yr/yr pace.

Recent upside surprises, March in particular, have seen a significant influence from transportation services. The air fares drop of May is unlikely to extend much further, but signs that motor vehicle services are stabilizing after recent extreme strength are encouraging. We could even see this sector deliver some significant negatives in coming months as past strength is unwound.