FX Weekly Strategy: February 10th-14th

Focus on Powell testimony and US CPI

Risks look to be towards higher US yields and a higher USD

JPY shoud continue to hold its own...

...but CAD still looks under threat

EUR and particularly GBP risks are on the downside

The focus will be on US CPI data and Powell’s testimony. It’s hard to see a major change in Powell’s tone, but the risks are on the hawkish side after the strong January US employment report. Despite the lower than expected January payroll number, the upward revisions to November and December, the strength of average earnings and the decline in the unemployment rate all suggests that there is quite limited scope for Fed easing at this stage. Of course, the market isn’t pricing in very much in the near term, with the first cut not priced until July, but the risk may now be that the market fully prices out the second cut in rates, which is around halfway priced in by year end.

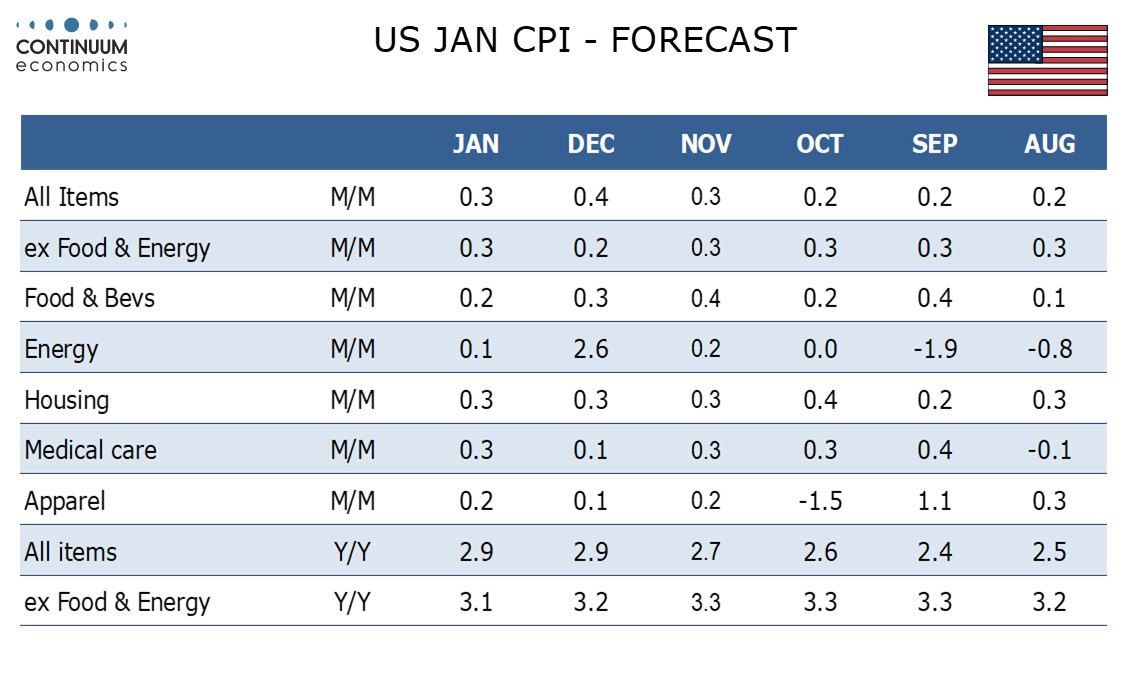

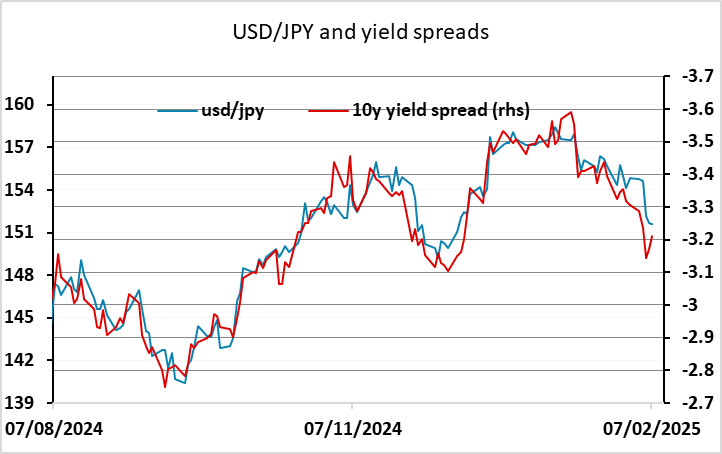

Of course, the big uncertainty for Fed policy is what sort of fiscal stance they are going to be faced with over the next couple of years. While we doubt that the DOGE efforts will result in really significant spending cuts, there is increasing uncertainty around whether Congress will allow the tax cuts that Trump wants to put through. If these cuts do start to look unlikely, there will be more scope for Fed easing than previously looked likely. However, this is a longer term story and the current data doesn’t really suggest substantial scope for further easing. The CPI data to some extent be a gauge of the Fed’s room to act, but monthly rises of 0.3% as we and the market are forecasting aren’t suggestive of a significant inflation slowdown. So the risks may be towards higher US yields, at least at the front end. This may also mean that the equity market struggles to advance. This all sounds USD positive versus the riskier currencies, but the JPY should continue to hold its own helped by smaller US yield rises at the long end and a less risk positive tone.

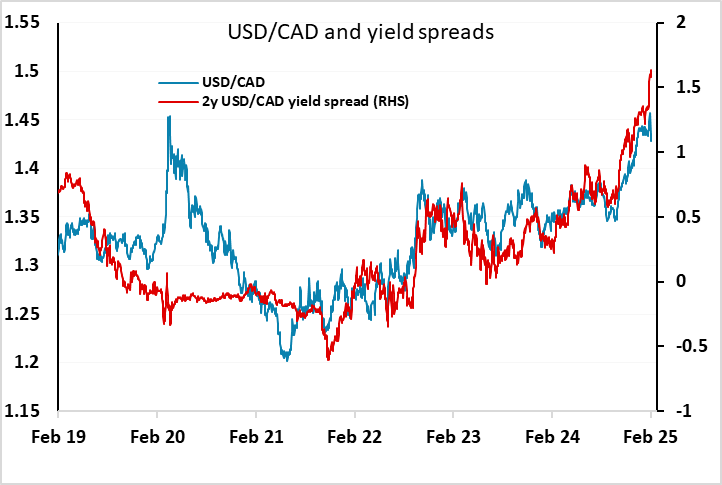

The Canadian January employment data was clearly strong and allowed USD/CAD to edge below 1.43 at the end of last week, following the withdrawal of the immediate tariff threat earlier in the week. But if Powell’s testimony indicates the Fed is less dovish, or at best that policy is unchanged, it’s still hard to see a case for CAD strength as yield spreads still point to USD/CAD at 1.45 or above. The CAD benefited from a sharp reversal in policy triggering stop losses, and positioning was already very short CAD. But the tariff threat hasn’t completely gone, so the risks may now be towards a retest of the USD/CAD upside.

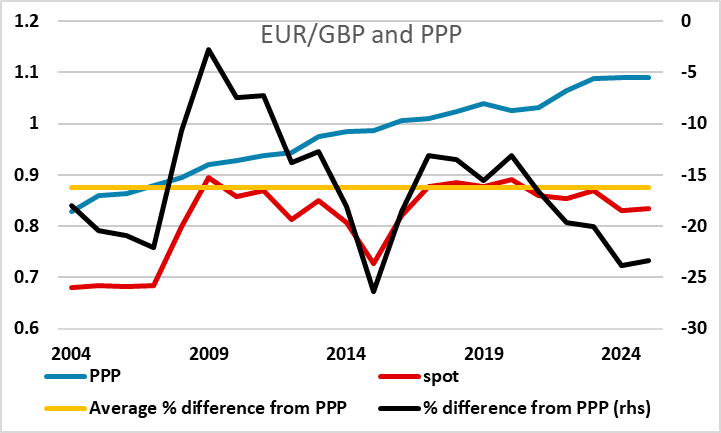

GBP should remain in focus this week with speeches from BoE governor Bailey and MPC hawk Megan Greene, as well as GDP data for December and Q4. The latter may make gloomy reading, but the Monetary Policy Report (MPR) released alongside the BoE decision last week suggested that despite a weaker growth projection, higher inflation numbers would prevent a rapid cut in UK rates. Even so, it’s hard to hold a positive GBP view in the face of such a negative growth/inflation mix, and it should be remembered that EUR/GBP in the 0.83-0.84 range is at very strong levels relative to history. While these are to some extent supported by the relatively high level of UK yields, we have seen in recent months that high UK yields can also undermine confidence in the UK public finances and consequently in GBP. So we see the risks for EUR/GBP on the upside, as it looks hard to sustain the case for a strong GBP valuation.

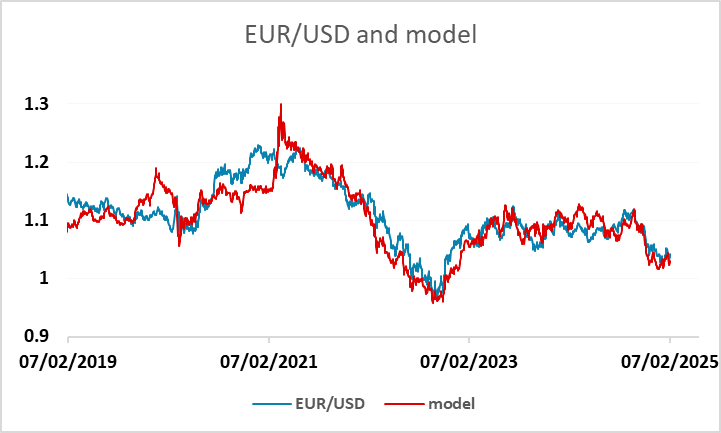

There isn’t much on the Eurozone calendar, but the risks are still on the EUR/USD downside due to the bias towards higher US yields and the brake that will tend to put on equity markets. Our model suggests that the risks is towards a break below 1.03 if the equity market stagnates near current levels and US yields edge higher, but unless we see something clearly negative from the Eurozone, we don’t see a near term test as low as parity.

Data and events for the week ahead

USA

Testimony from Fed Chairman Powell on Tuesday and January CPI on Wednesday will be the highlights of the US week ahead. Monday’s calendar is quiet. Tuesday sees January’s NFIB small business survey and Fed’s Hammack and Williams will speak, though focus will be on Powell’s testimony to the Senate. He is likely to echo the views of most recent Fed speakers that with downside labor market risks having faded, inflation still above target and policy uncertainty high the FOMC does not see any urgency to ease, though incoming data will be important for future decisions and nothing will be ruled out.

On Wednesday we expect 0.3% gains in January CPI, both overall and ex food and energy, though strong data a year ago will see the core rate dip to 3.1% yr/yr from 3.2%. Powell will deliver a follow up testimony to the House on Wednesday and will be able to respond to any CPI surprises. Also scheduled on Wednesday are Fed’s Bostic and January budget data.

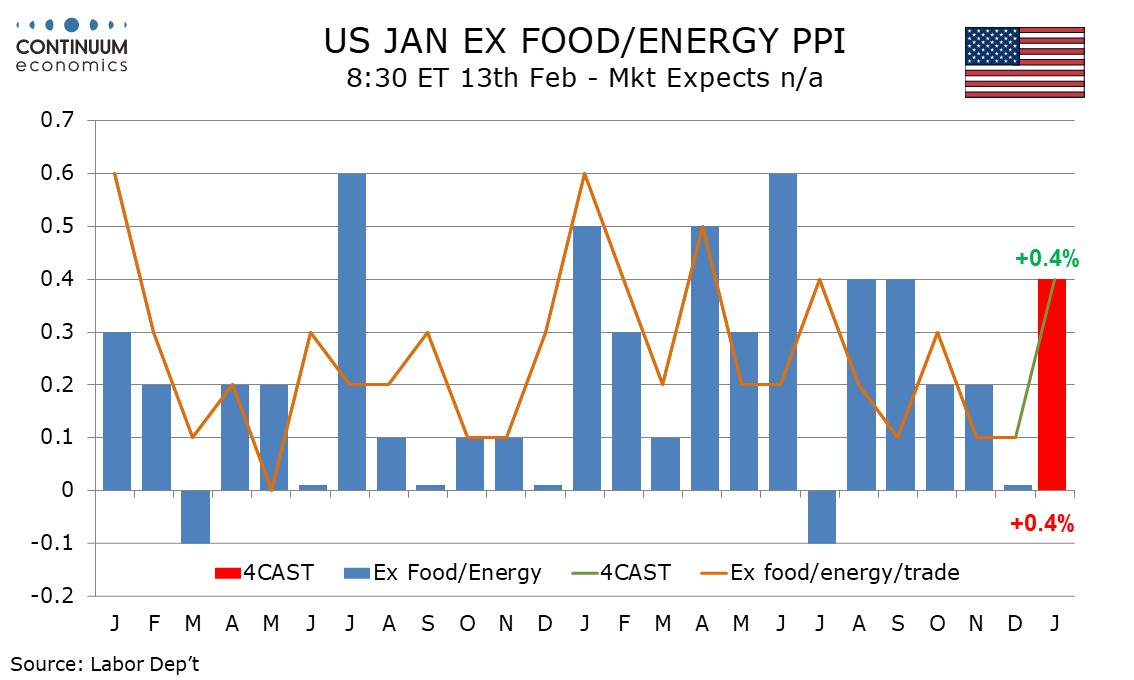

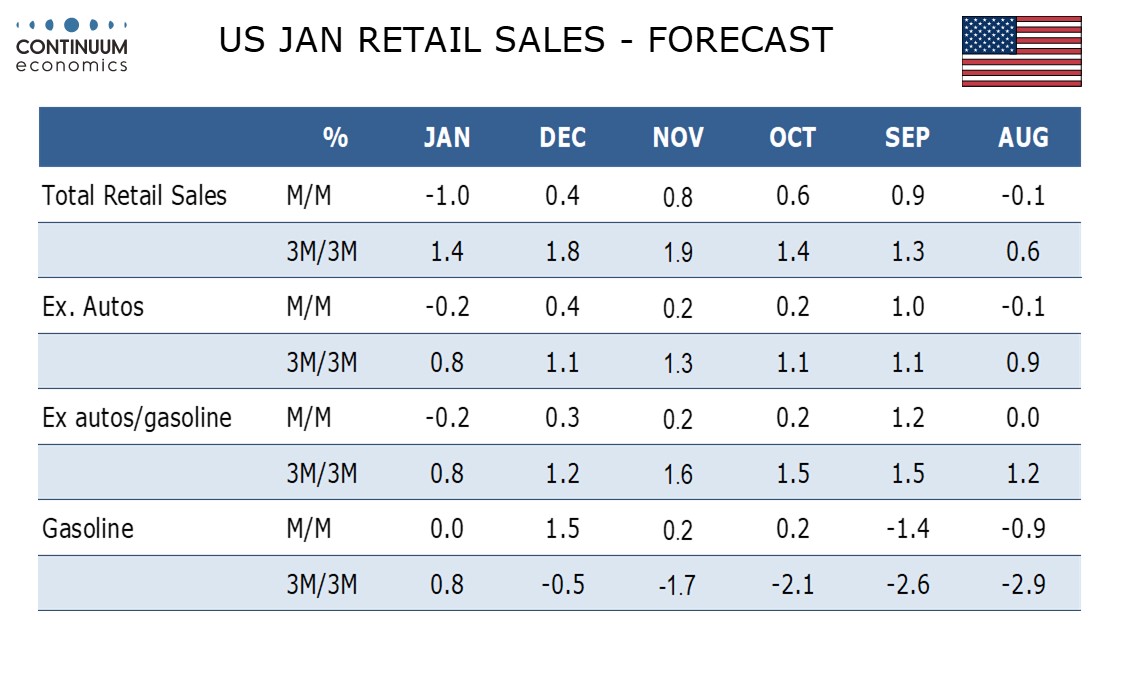

On Thursday we expect a 0.3% rise in January PPI with a stronger 0.4% increase ex food and energy. Weekly initial claims are also due. On Friday we expect a weak January retail sales report with a 1.0% decline overall with 0.2% decline ex autos, with bad weather likely to restrain demand. Also due are January import prices, followed by January industrial production and December business inventories.

Canada

Canada releases December building permits on Tuesday. Minutes from the January 29 Bank of Canada meeting are due on Wednesday. Friday sees December manufacturing and wholesale sales, for which preliminary estimates were for gains of 0.6% and 0.1% respectively.

UK

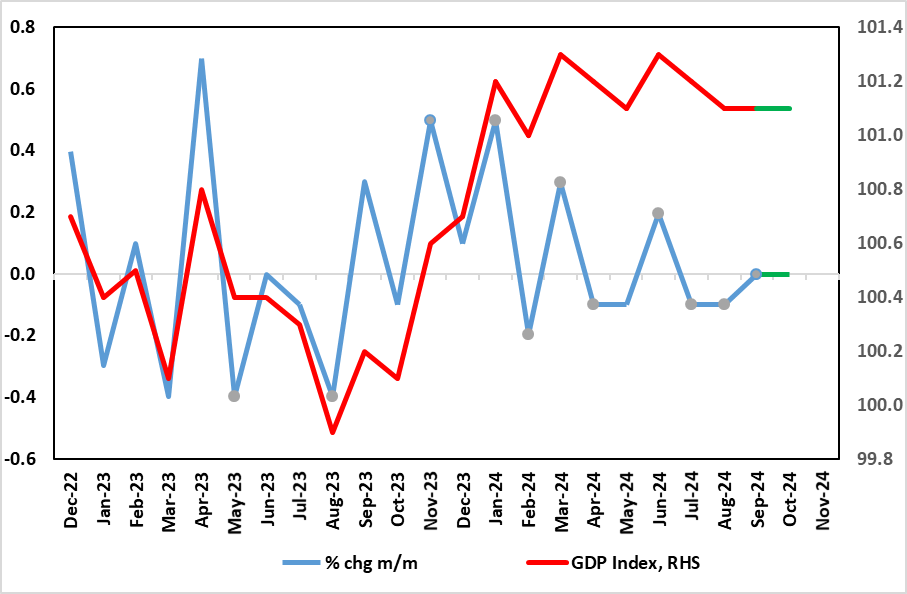

More BoE insight comes with a major speech from Governor Bailey (Tue) and MPC member Greene (Wed) although neither likely to deviate much from the mixed messages of the just published MPR. But economic weakness will be an issue, something that GDP data may highlight (Thu). As for December, we see a flat m/m reading but, combined with drops in the two previous months, should mean that Q4 numbers (released alongside) sees the first drop in five quarters at -0.1% q/q, a view the BoE now shares! Indeed, without revisions, December GDP needs to rise 0.2% to avoid a Q4 fall but where mild, wet and stormy weather (which may already have caused a drop in December retailing) argue against any such a rise. RICS housing survey data may add to that weak picture, echoing the sharp fall seen in construction PMI data of late.

UK growth momentum ebbing?

Momentum Ebbing?

Source: ONS

Eurozone

A middling weak with a few second-order ECB comments and the latest central bank bulletin (Thu). There is an update on Q4 GDP and employment (Fri) preceded (Thu) by December industrial production data which may have a fresh soft undertone.

Rest of Western Europe

There are few key events in Sweden, but Monday sees the monthly industrial production and orders data. Norway has high-profile CPI numbers (Mon) this also the case in Switzerland. For Norway, we see CPI-ATE y/y rate falling a notch to 2.6%, in line with Norges Bank’s forecast. As for Swiss CPI, base effects may lift the headline y/y rate a notch or so.

Japan

Little important release for Japan next week. PPI on Thursday will not change sentiment if it has been a poor indicator of CPI, nor the slate of tier two data on Monday.

Australia

Also a small week for Australia. We have private consumer confidence, business confidence and condition on Tuesday. There is also consumer inflation expectation on Thursday. None of this data will be market moving.

NZ

The key release for NZ next week is on Thursday when we have RBNZ inflation expectation. There are signs of a slight flare up of NZ inflation. If we see a significant revision, the OCR path may tilt towards less easing, though it is unlikely.