This week's five highlights

Trump The Tariff Man

China/U.S. Trade War Again

Uncertain BoE MPC Signals It Needs to be Careful

U.S. January Non-Farm Payrolls Likely A slower month given bad weather

EZ HICP Headline Rises Amid Still Friendly Core Messages

Markets were whipsawed on Friday after a Reuters report suggested the tariffs would be postponed until March 1 before the White House shortly after stated they were going ahead. It now looks like the Reuters report came from reliable sources, but Trump was unhappy with the leak, needing to get the impression of concessions from Mexico and Canada, so went ahead with the announcement. Still, this is all speculation. It is possible the stock market reaction influenced him, though if so, it suggests it does not take that much from the markets to force policy changes. A more charitable interpretation of Trump’s thought process would be that Mexican and Canadian concessions on the supply of fentanyl impressed him, though it is unclear how much difference they will make, and it contrasts with Trump’s long-held aversion to trade deficits, on which Mexico and Canada have pledged little.

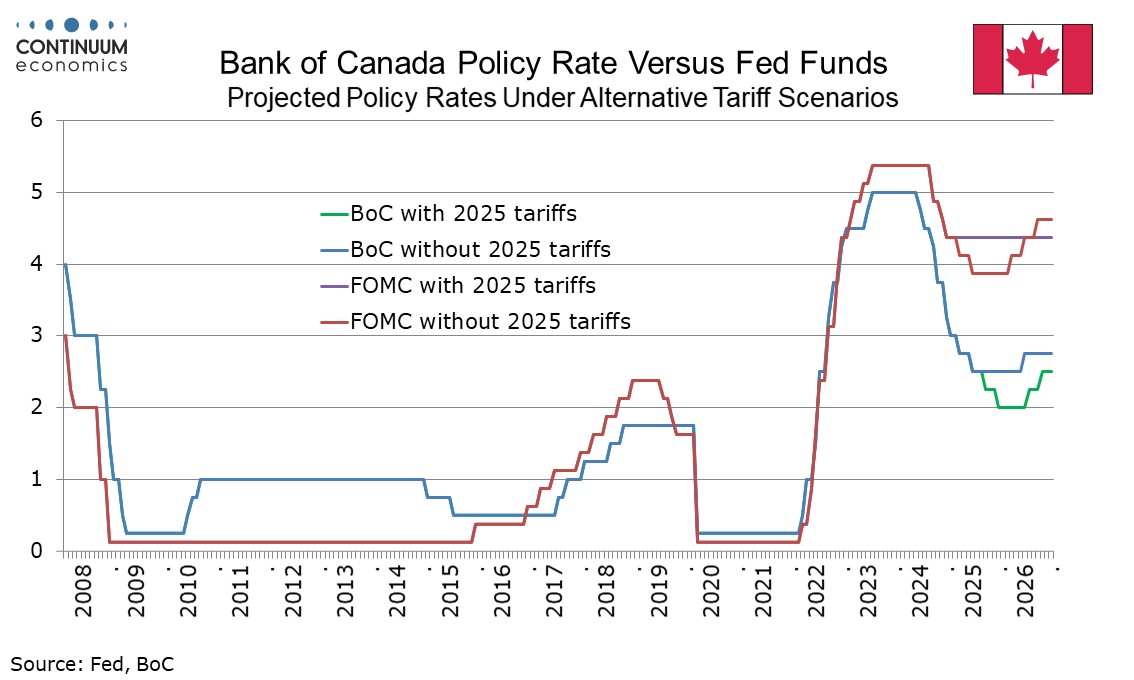

Little can be ruled out given Trump’s unpredictable nature, though we will return to predicting monetary policy on the assumption of no major tariffs this year. Before the tariff announcement we had two 25bps easing from both the FOMC and the BoC this year, rather than none from the FOMC and four from the BoC as we suggested under tariffs. However, without tariffs the risk is for less than two from each rather than more, though we will await Trump’s March 1 decision and data for early March before finalizing the call.

Our forecasts made in December had tightening from the FOMC in 2026 on an assumption that tariffs would come in that year (to pay for tax cuts) rather than 2025. That is still possible, though Trump’s apparent climbdown this time reduces the risk that tariffs will be introduced in 2026. The 2026 tightening call cannot be seen as a confident one, dependent on both policy and timing of policy to be decided by the highly unpredictable Trump.

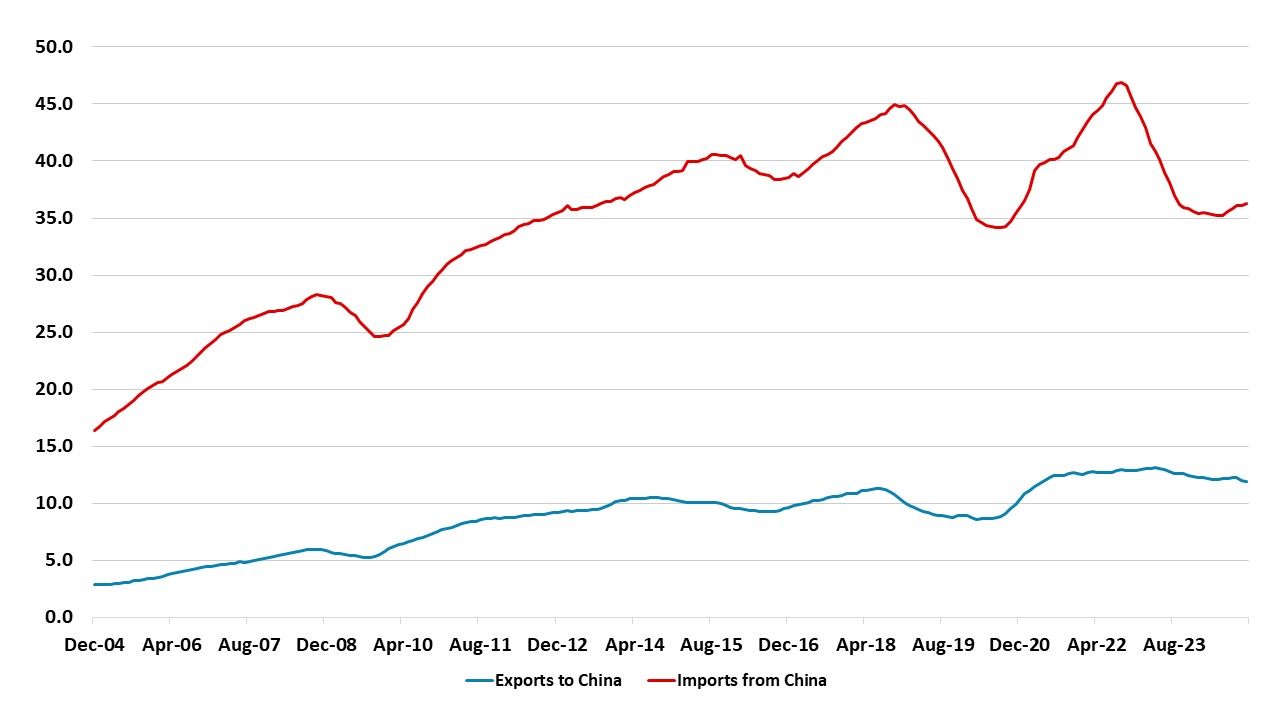

Figure: U.S./China Exports and Imports (12mth MA USD Blns)

China’s targeted and measured counter tariffs against the U.S. are designed to push the U.S. towards the negotiating table on the wider issue of the U.S./China trade deficit. Negotiating will likely start into the spring, but negotiating will be tough as the U.S. wants a phase 2 deal with new objectives to boost U.S. exports and penalties if goals are not achieved. China will likely be quick to make concessions on (needed) agricultural imports and illegal Fentanyl from China, but slow to concede on the idea of penalties. It will be a volatile road to an eventual deal late H1/early H2.

As planned the U.S. has imposed an extra 10% tariff on all China exports to the U.S. and China has announced targeted counter tariffs against the U.S. Key points to note are.

· China tariff increases to deescalate. China has not imposed an across-the-board tariff on exports from the U.S. but rather focused on oil/LNG/coal and agricultural products, alongside restriction on rare earth minerals exports from China to the U.S. State media are viewing this as a measured response, which avoid China losing face but opening a path to trade talks.

· Next to phase 2 trade deal talks? China authorities could easily have made credible promises to stem the flow of illegal Fentanyl to the U.S., but appears willing to skip onto the main U.S. concern over the size of the U.S./China trade deficit. This is probably earlier than President Donald Trump planned, but is likely an attempt by China to force the U.S. to the negotiating table over a revised phase 1 deal or a new wider phase 2 deal. The April 1 review deadline under “America First Trade Policy” (here) executive order for the phase 1 2020 U.S./China trade deal will likely judge that it has failed to boost exports to China enough.

· Tough negotiations. While optimism could arise over the prospect of a quick trade deal, the reality is that negotiations could be tough. Firstly, Trump has the option of threatening or imposing more tariffs against China in response to China measured counter tariffs announced today – this was a tactic that Trump used in 2018-19. Secondly, Trump and the Republican party will want a phase 2 deal to have more enforcement and penalties should China fail to meet targets in a new trade deal. An increase in U.S. exports to China was the main goal of the phase 1 agreement, but China failed to deliver on this (Figure 1). Thirdly, the U.S. will want rules of origin to become tighter in a revised USMCA deal to curtail China using Mexico as an assembly area for their exports to the U.S. and this means parallel negotiations with Mexico and Canada on trade. The U.S. could also threat tariffs on Vietnam soon for the same reason. Fourthly, China officials will give way initial on increased imports from the U.S., especially China’s need for agricultural imports. Additionally, credible promises on illegal Fentanyl will also likely be offered by China. However, China will likely be initially reluctant to accept penalties if imports from the U.S. fail to meet targets. Finally, U.S. strategic hawks will also likely try to convince Trump to tighten U.S. control of technology exports to restrain China.

· Trade deal in late H1/early H2. It took 4 months from President Trump and Xi agree a trade truce in June 2019 to final agreement on a deal in October 2019. It could take a similar period, which would suggest a trade deal late H1 or early H2. This is unlikely to be a smooth process for markets to assume a trade deal will be smoothly delivered. Trump nature means that the talks will be volatile and it is worth remembering that Trump imposed extra tariffs after the truce to get a deal done.

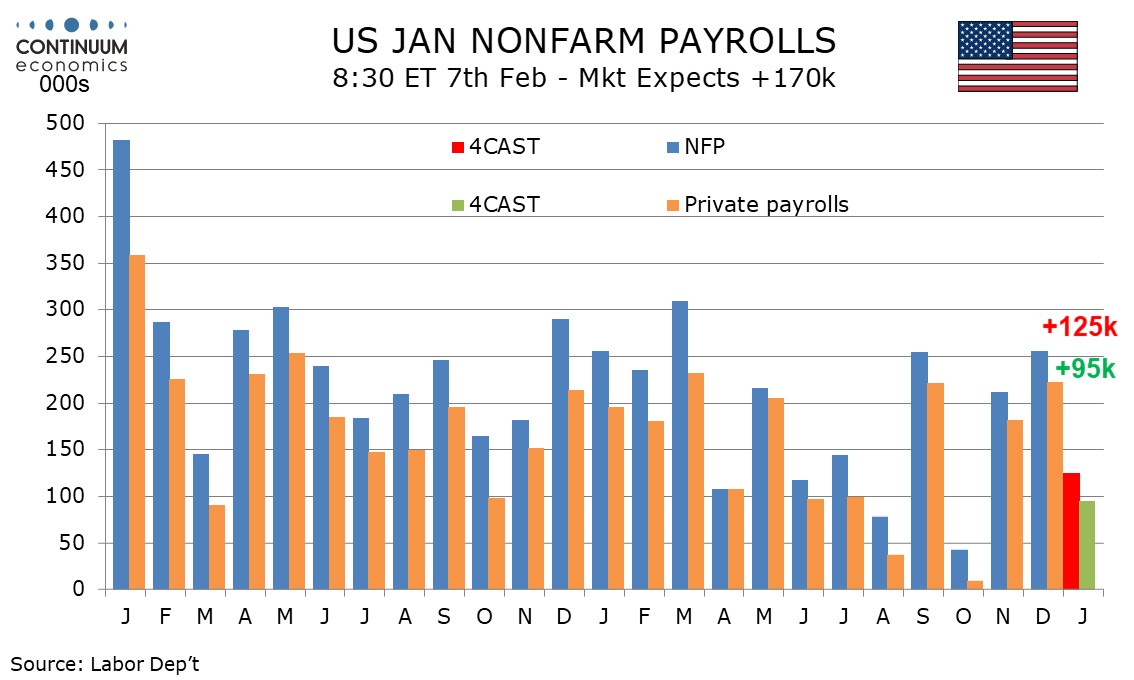

We expect a below trend 125k increase in January’s non-farm payroll, with a 95k rise in the private sector. The data is likely to be restrained by bad weather and a possible correction from an above trend December. The workweek is likely to fall on bad weather but we expect unemployment to be unchanged at 4.1% and a slightly above trend 0.4% increase in average hourly earnings.

Unusually cold weather in much of the country is likely to be the man restraint, outweighing the more localized destruction caused by the Los Angeles fires. The coldest weather however came before and after the survey week for January’s non-farm payroll rather than in the survey week itself. The underlying labor market picture still looks healthy as suggested by initial claims and the less weather-sensitive ADP report. We expect employment growth to regain momentum once weather improves.

December saw an above trend 256k increase that may have been inflated by continuing recovery from October’s weak 43k rise that was depressed by hurricanes and strikes. The 3-month averages of 170k overall and 138k in the private sector may better represent trend. Historical data will see annual revisions with the January report. The preliminary estimate for the March 2024 benchmark revision was significantly negative, at -818k.

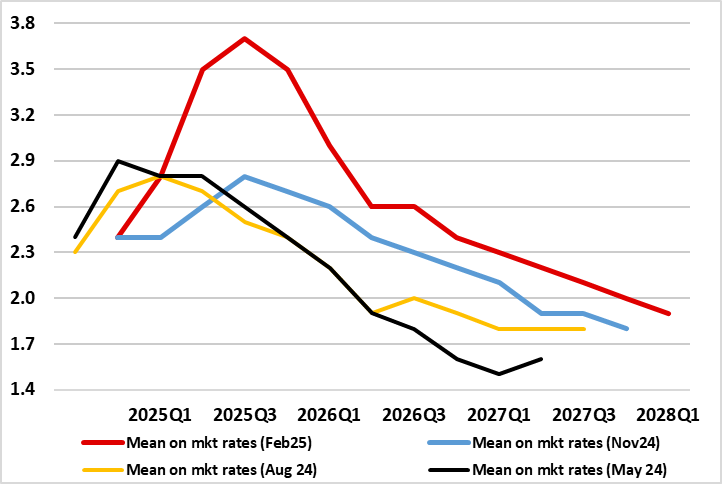

Figure: BoE Sees More Persistent Inflation

The latest set of BoE forecasts are notable for one major thing – an assumption that underlying growth has fallen, possible to under 1%. This does not explain all of the higher inflation profile (Figure) which now only delivers a below target outcome into 2028 – the higher rates projected this year reflect higher energy and regulated prices. But it does seem as if the MPC is not united on this outlook with two dissents in favor of a 50 bp move rather than the as-expected 25 bp the other seven members agreed. But the likely MPC divisions probably reflect increased uncertainty this enough for the BoE to stress the need for policy to be made carefully as well as gradually. The thrust of the Monetary Policy Report (MPR) therefore does not suggest recent market rate pricing is too pessimistic. However, we still think it is given softer underlying inflation signs with four moves from the current 4.5% on cards by year-end as we think the BoE remains too optimistic about growth and the extent of slack – particularly in the labor market.

Contrary to out expectation of a softer inflation profile, the latest Monetary Policy Report (MPR) sees a higher one, partly due to higher energy and regulated prices in the course of the next 2-3 quarters. But it then reflects the impact of weaker supply of the economy, largely due estimated potential productivity being seen to be now weaker than can be explained by previously identified factors such as the impacts of past shocks from Brexit and the pandemic. Indeed, the BoE asserts that some of the weakness could reflect increases in employment in health-related activities over recent years that have not been matched by a similar increase in measured output. For example, the MPR forecast incorporates a slowdown in four-quarter potential supply growth from around 1½% at the start of 2024 to around ¾% at the start of this year.

In other words, the BoE does not think that the downgrade in its GDP forecast to l0.75% (2025) is a reflection of weaker demand. Given that we share the 2025 overall outlook but where we also think the labor market is much weaker than the BoE is assuming (the MPR is still using possibly dubious official employment numbers and questionable assumption about productivity, we do not think so and would suggest that is the array of higher energy and regulated prices the BoE envisages proves accurate it will damage even further. We are also skeptical about the economy then recovery to 1.5% though both 2026 and 2027, not least given the added threat posed by a trade war.

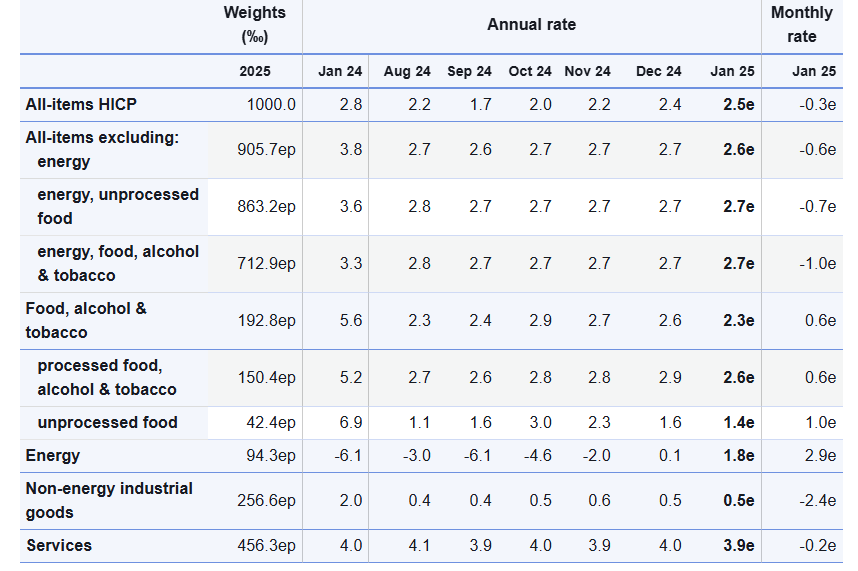

Figure: Headline Rises Again as Services Resilience Persists

There were mixed messages in the higher-than-expected January flash HICP numbers. For a third successive month, the headline but this time by ‘only’ 0.1ppt, to a six-month high of 2.5%, but where the core (again) stayed at 2.7%, partly due to what is seemingly relatively stable services inflation. Once again, higher energy costs, partly base effects (Figure 1). However, shorter-term price momentum data already suggest that core and even services inflation have slowed and are running around target and given sharp falls in wage tracker data (an update due later this week), we think headline y/y services inflation is succumbing, something backed up by surveys for the sector.

However, there are some signs in retailing surveys suggesting disinflation may have stalled. But this may be of increasing secondary importance to most of the ECB Council as a) inflation is already consistent with target and b) a fresh and more demand driven disinflation could be triggered by what seems to be weaker real economy backdrop that could also exacerbate financial stability risks.

Admittedly, the January headline HICP was a notch higher than expected, but this still sits easily with ECB thinking as set out after last week’s Council meeting. This was explicit in suggesting that the Council saw inflation fluctuating around its current level in the near term but then settling sustainably at around target. And with a stable core reading this time around, and consistent with target already in terms of adjusted short0term data (Figure 2), this also sits with ECB thinking that noted most underlying inflation indicators have been developing in line with a sustained return of inflation to target. It pointed to recent signals point to continued moderation in wage pressures and to the buffering role of profits.

But surely the dominant ECB issue now is the extent to which downside growth risks have turned into reality with it clear that growth worries have risen. Indeed, preserving growth does seem to have become the ECB policy priority and such worries may only be accentuated by the growing threat of tariffs and an ensuing trade war and possible dumping of goods to Europe by China. Moreover, these downside risks have other aspects, equally worrying, especially as, they could fan financial instability issues.