Banxico Review: Hold Rates

Banxico's decision to maintain the policy rate at 11% reflects a cautious stance amidst rising inflation and a slowing economy. Despite external volatility, the MXN remains resilient. The main concern is services inflation being stickier. With a revised inflation forecast indicating a longer period for inflation convergence, Banxico anticipates maintaining a restrictive monetary policy for an extended duration.

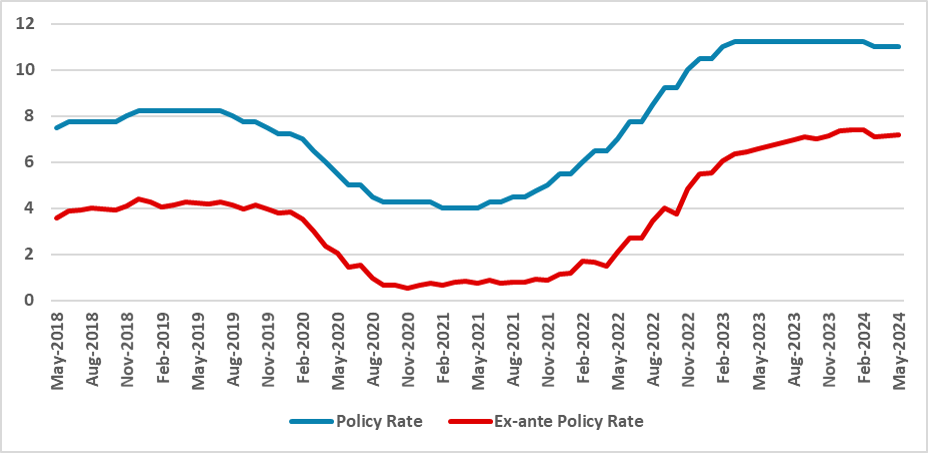

Figure 1: Mexico’s Policy Rate (%)

Source: Banxico, INEGI and Continuum Economics

The Mexico Central Bank (Banxico) has convened to decide the policy rate (Overnight). In a unanimous decision, the board has decided to leave the policy rate unchanged at 11% after cutting it by 25bps in March.

Although inflation rose in April due to an acceleration of non-core agricultural goods, the economy is slowing down, and we see room for Mexico to continue cutting in May. So what changes now? It is true that the MXN has shown some volatility in the aftermath of the FED delaying cuts, but so have many EM currencies, and most of this movement has already been reverted. The MXN continues to be strong this year, and the large spread with the Fed Fund warrants some buffer.

What has likely changed is the Banxico modeling on inflation. They are now seeing services inflation being stickier, and inflation only converging in the fourth quarter of 2025. In March, they believed this convergence would occur in the second quarter of 2025. This new scenario could have made some tweaks in the minds of the Banxico board members who now want to be more cautious with the cutting cycle. This could mean a higher policy rate for longer. Furthermore, Banxico has stated that monetary policy will be restrictive for the next two years to ensure that inflation converges. The board also gave no new forward guidance on the next steps of monetary policy, stating that the decision will be made according to the prevailing conditions.

We will gather more information once the minutes come out, but at the moment, it is possible that Banxico will put rates on hold, and once inflation falls back towards Banxico’s band (2%-4%), they could resume cutting. In the next months, headline inflation is expected to show some stickiness, although core CPI is expected to fall a bit. We will see whether Banxico members change their hawkish stance over inflation. It seems, for the moment, that although external volatility has limited effect on Mexico, Banxico is taking it into account, and maintaining the policy rate higher for longer is better than taking the risk of premature cuts, which could increase volatility in Mexican markets. However, rate cuts will extend towards the 7.5% level in 2025 as inflation fully converges to its target.