JPY flows: JPY steady ahead of BoJ

JPY steady ahead of BoJ. Risk of tighter policy greater in April than in March, so modest JPY decline liekly on no policy change. Bigger JPY gains likely if BoJ tighten.

It’s looking like a quiet Monday ahead of the week’s central bank meetings, which start with the BoJ and RBA on Tuesday morning. AUD/USD and USDJPY were both fairly steady overnight. There is more focus on the BoJ than the RBA, with the RBA generally deemed unlikely to change anything since the last meeting. But there is a lot of speculation around the BoJ meeting, with some seeing a rise in the policy rate, some an official end to YCC and some no change at all.

The market is priced for around a 45% chance of the policy rate being raised to zero at this meeting, while a Reuters survey showed twelve of 34 economists, or 35%, expected a hike this month, with the majority (including ourselves) expecting a hike in April. Similarly, of 26 economists who predicted YCC's demise in total, 31% selected March and 62% picked April. Nearly all of the respondents said an end to negative rates would happen simultaneously in that respective month. Our view is therefore that there will be mild disappointment at the lack of action in March, but we expect a signal that rates will be raised in April which should mean any JPY decline is quite modest.

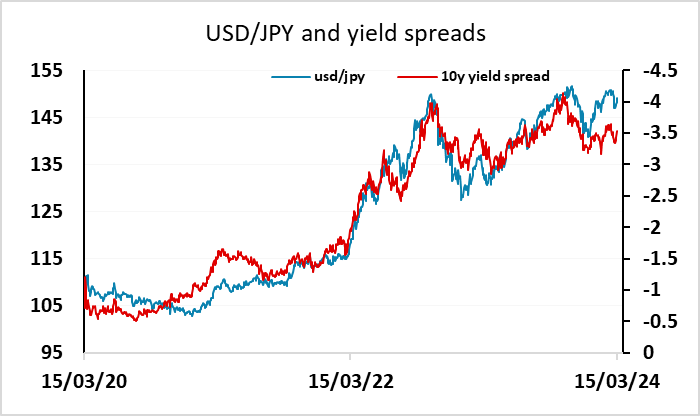

Overnight, the BoJ announced they would conduct an unscheduled bond buying operation. This could be interpreted as a signal that the BoJ expect yields to rise tomorrow, which some see as a hint that YCC will end, but it could easily be interpreted the opposite way. Bigger picture, we still see the main risks for USD/JPY as being on the downside, but if, as we expect, the rate hike and the end of YCC come in April rather than tomorrow, we may see a small rise in USD/JPY on the news tomorrow. A bigger decline could be expected if the BoJ pull the trigger.