Bank of Canada to Leave Rates Unchanged on March 6, With a Cautious Statement

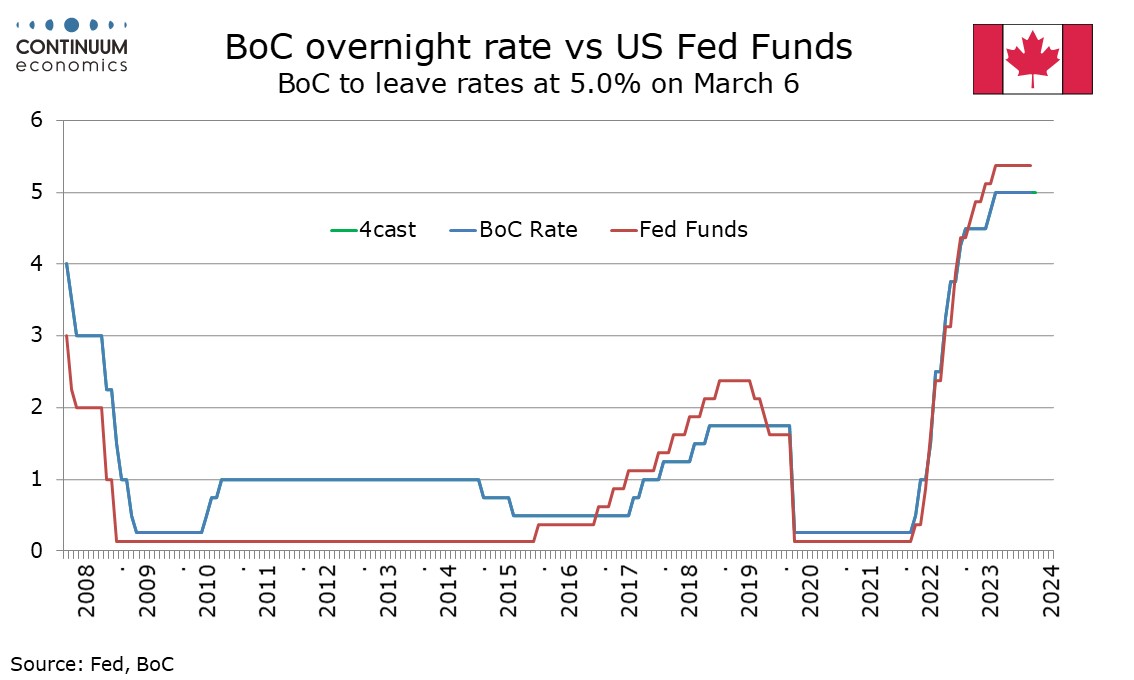

The Bank of Canada meets on March 6 and while any fine tuning to the statement is more likely to be dovish than hawkish, we doubt that views have changed much at the BoC since its last meeting on January 24. We expect rates to be left unchanged at 5.0% with few hints that easing is close to be given.

January 24 saw the BoC moving in a more dovish direction, dropping a tightening bias and seeing e economy as having moved into modest excess supply. Governor Tiff Macklem stated that discussion was moving from whether policy was restrictive enough to how long rates needed to remain at the current 5% level. However the BoC remained concerned about the outlook for inflation, particularly the persistence in underlying inflation, concerns which were made clear by minutes from the meeting released on February 7.

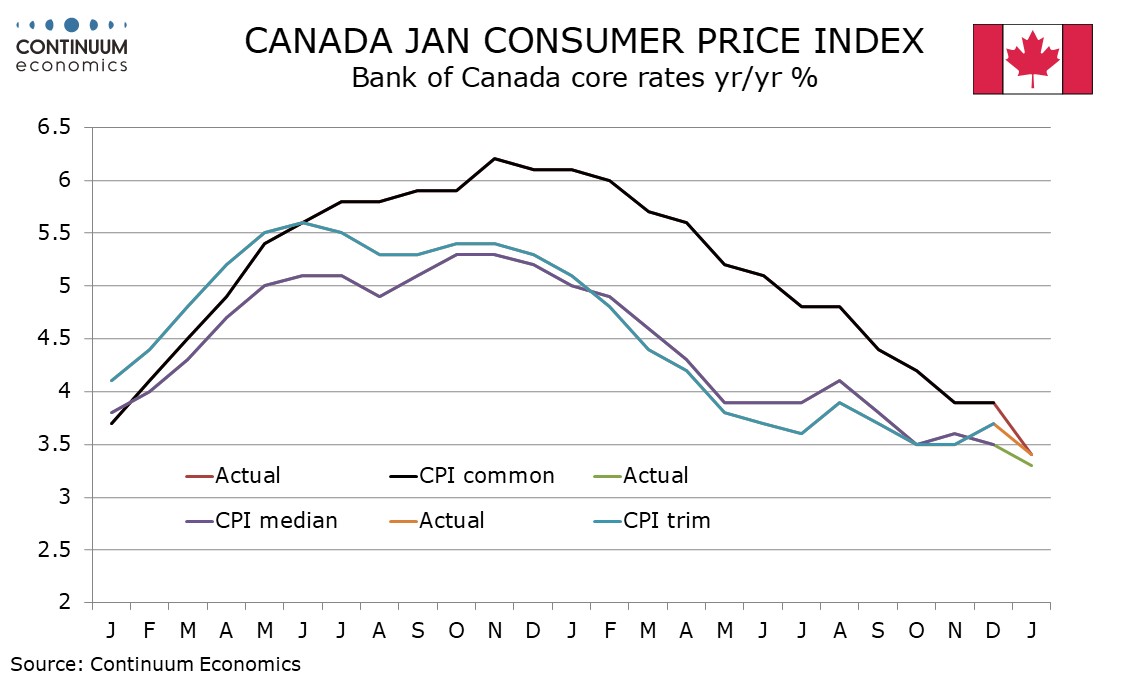

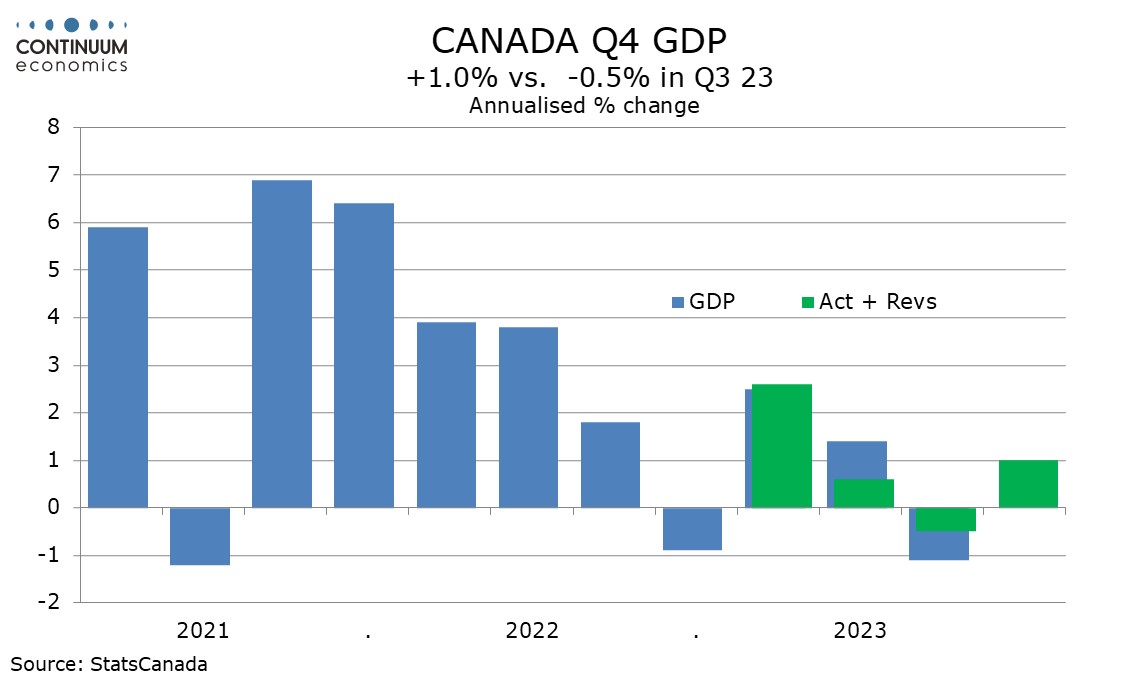

Since the last meeting the BoC will have seen an encouraging January CPI release, where the 2.9% yr/yr pace was below a January BoC forecast fir 3.2% in Q1, with dips in the BoC’s core rates seen too. However the January CPI, particularly in coming after a disappointing December, does not make a trend and all three core rates remain above 3.0%, while the BoC’s target is 2.0%. Q4 GDP at 1.0% annualized exceeded a flat BoC forecast made in January, though only due to a bounce in exports with domestic demand falling by 0.7%. The GDP gain is still slow enough to increase excess supply but suggests Canada is not heading into recession, particularly with preliminary indications for January being positive.

With progress on inflation still unconvincing and the economy holding up better than expected there appears to be little reason for the BoC to rush inti a policy change. The BoC will update its forecasts at its subsequent meeting on April 10 when a quarterly Monetary Policy Report is due and at that meeting the BoC may hint easing is close, data permitting. However, with no Monetary Policy Report scheduled at this meeting the BoC, having moved in a dovish direction in January, is likely to feel that it is prudent to wait for more data, and deliver a fairly cautious message at this meeting.

Our current view is that the first BoC easing will come in June, by 25bps, and the BoC will ease once in Q3 and twice in Q4, by when progress on inflation should be more convincing, for a total of 100bps in 2024.