Preliminary Signals Look Solid For Q1 U.S. GDP

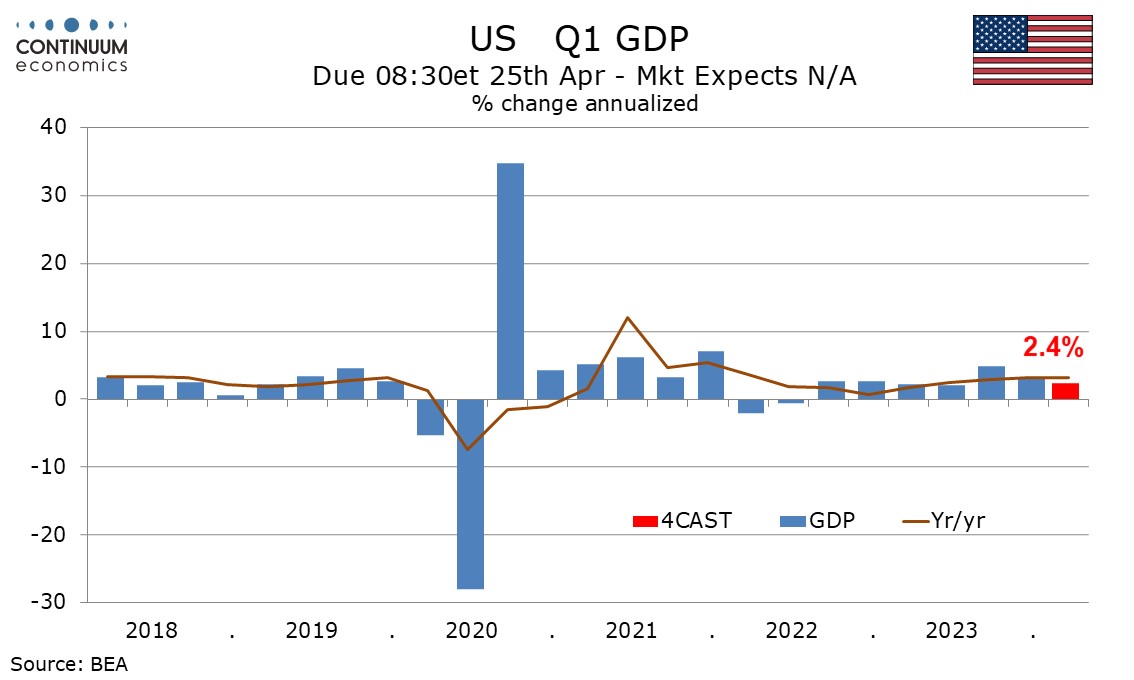

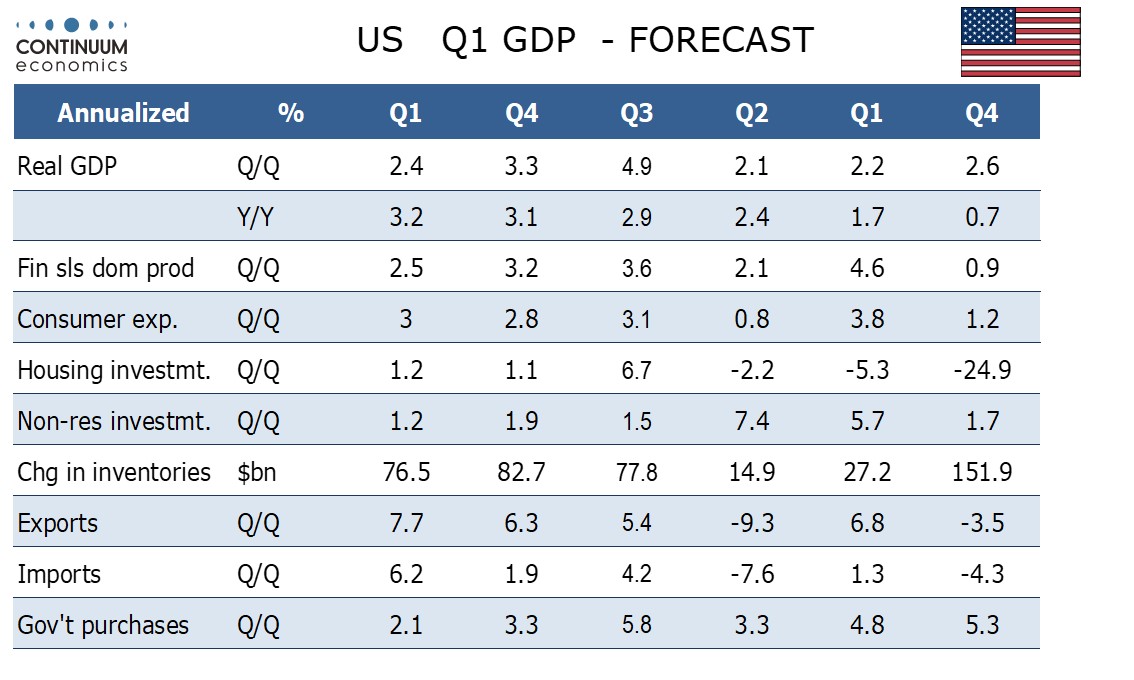

Signals on Q1 U.S. GDP are still limited with little data for January yet available. However current momentum suggests a weak quarter is unlikely. Our current estimate is for an annualized increase of 2.4%. The Atlanta Fed’s nowcast is stronger, at 3.4%, which would be similar to Q4’s 3.3%.

Our forecast does signal a slowing from two straight surprisingly strong quarters but would be similar to each of the four quarters ending in Q2 2023. January’s strong non-farm payroll increase provided mixed signals with a decline in the workweek leaving aggregate hours worked down. This has us forecasting some fairly subdued data for January, though the dip in the workweek may be more due to bad weather than any underling loss of momentum.

December data suggested strong momentum entering Q1, consumer spending in particular, and we expect consumer spending to rise by 3.0% in Q1, similar to the two preceding quarters. We expect business and housing investment to remain subdued, with gains of 1.2% in both, marginally weaker than in Q4. Government is also likely to lose some momentum. But the pace of 2.1% would be far from weak.

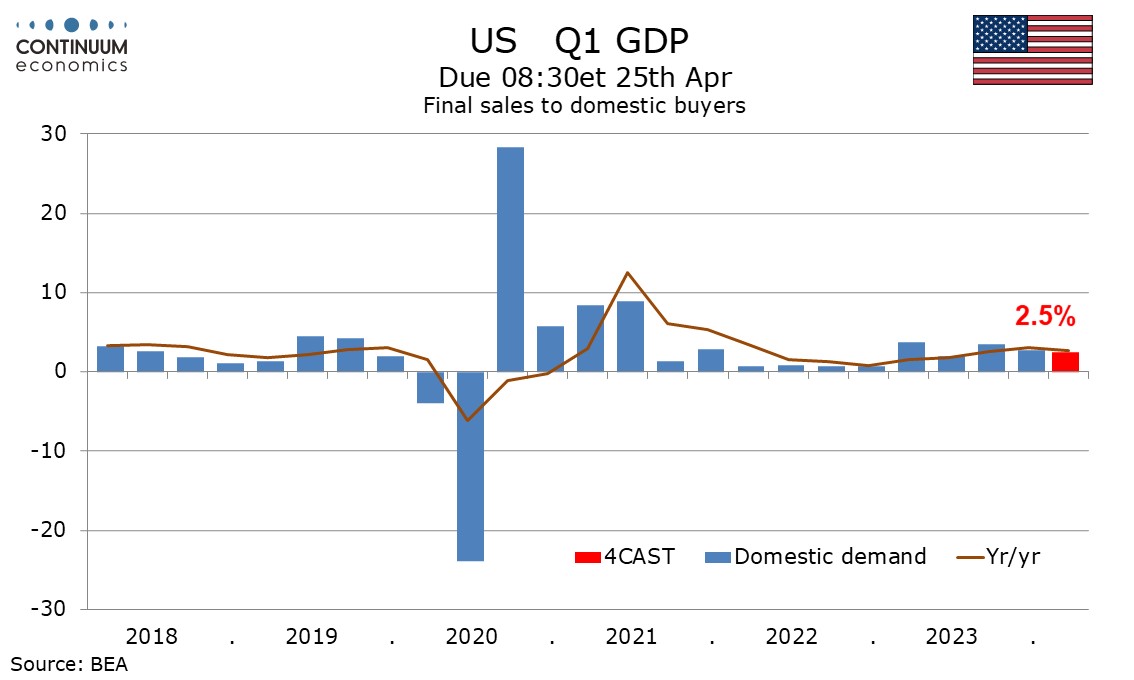

This would leave final sales to domestic buyers (GDP less inventories) up by 2.5%, similar to Q4’s 2.7%. We expect only marginal negatives from inventories and net exports. Inventories were a source of unexpected strength in Q3 and Q4 that may not be sustainable for long. However recovery from Q4’s auto strikes may provide continued support in Q1. Q4 GDP growth by 4.1% excluding autos. Both exports and imports finished Q4 with strong December gains.