Votes to Volatility: Potential Market Outcomes and Policy Directions Post Elections

As India’s month long 2024 General Elections are almost coming to a close, lower voter turnout has increased uncertainty despite expectations of a BJP victory. While we still expect a BJP victory, the markets are becoming increasingly cautious. A decisive BJP win would likely strengthen the rupee and boost equities, enabling significant reforms such as new farm laws and labor flexibility. Conversely, a weakened or opposition-led government could cause market volatility, currency weakening, and slower reform progress.

India is currently in the midst of its 2024 general elections, a significant political event unfolding in phases. The consensus leading up to these elections was strongly in favour of the incumbent Bhartiya Janta Party (BJP) government returning to power in June. However, lower voter turnout in the initial phases has introduced an element of uncertainty, even though the general expectation still leans towards a BJP victory. Irrespective of the result of the election, the markets are likely to be volatile in the near term. Financial market volatility is expected to persist throughout the election voting phase and after the result declaration on June 4 until the incoming government announces the full budget for FY25.

Election Progress and Current Scenario

So far, six of the seven election phases have been completed, with the first exit polls expected on June 1st, and official results to be announced on June 4th. Surveys prior to the elections indicated an increase in seats for the BJP and its allies (NDA) from approximately 330 to nearly 400. However, voter turnout has dipped by about 3-4 percentage points compared to 2019, raising concerns about potential anti-incumbency sentiments. Historically, there is no consistent link between voter turnout and election outcomes in India, making the current situation particularly complex. In the past, lower voter turnout has not affected the incumbent.

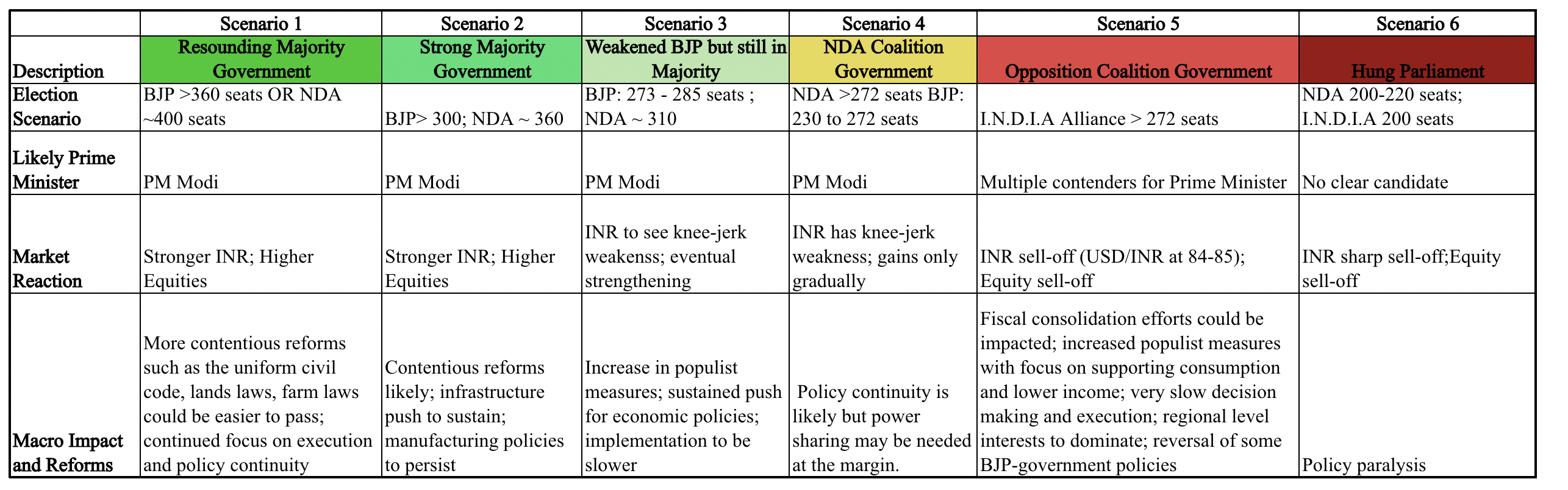

Scenarios and Market Reactions

Scenario 1: Strong Majority Government; BJP secures 360+ seats; NDA coalition hits 400

The BJP’s slogan for the election has been “Abkibaar 400 paar” meaning this time we cross 400. However, with reduced voter turnout, this outcome is appearing less likely. Nonetheless, this outcome is expected to see the INR get stronger in the near term and equities continue with the bullish trend. A majority of this scale would allow the BJP to pass contentious reforms such as new farm laws, a uniform civil code and a push for further privatisation. There will likely be a continued push for policy execution with a large focus on capital projects, infrastructure growth and digital economy initiatives.

Scenario 2: Moderate Majority Government; BJP Maintains a Strong Majority (BJP> 300 seats; NDA 370 seats)

BJP maintains a strong majority similar to Scenario 1. The second scenario allows for similar policy moves as expected under scenario, with the only exception that the BJP would secure lesser number of seats on their own. What is noteworthy is that this scenario aligns with the current betting market trends and would likely lead to positive market reactions due to anticipated policy stability and reform continuity. On the economic front a stable and potentially strong INR is expected and a sustained positive trend in equities is likely.

Scenario 3: Weakened BJP Government (BJP 272-285 seats; NDA 330 seats)

Scenario 4: Weak NDA Coalition (BJP+NDA secure 272-280 seats)

Under both these scenarios, the BJP vote share and number of seats is lower. The BJP-led NDA coalition will collectively form the government. In such a case slower implementation of contentious reforms is expected. The BJP will feel an increased need for consensus building and the focus will shift to maintaining majority in parliament. Aggressive reforms will most likely be avoided. On the market front, a weakening of the INR is expected and a mild decline in equities. Markets may react with caution due to perceived uncertainty and expectation of slower policy execution.

Scenario 5: Opposition Coalition

Scenario 6: Hung Parliament

The least likely of scenarios is that of an opposition coalition. Should the BJP plus allies not secure a clear majority, it’s likely that the opposition coalition will band together to keep BJP out should there be a hung parliament. On the policy front, it is expected that a majority of the reforms will shift to populist in nature. Slower implementation is expected of schemes started under the BJP-rule such as the production linked scheme, manufacturing initiatives. There is a chance of some BJP-initiated reforms to be rolled back. Markets may react negatively due to policy uncertainty and lack of a clear agenda from the opposition. There is also no clear prime ministerial candidate and therefore the opposition coalition will also find it challenging to arrive at consensus given different interest of all the regional parties. A sharp weakening of the currency and equity sell-off is likely. This would be the least favourable outcome for markets, reflecting significant instability and uncertainty.

Anticipated Reforms Under a BJP Government

In our view, the BJP is likely to maintain its vote share (scenario 2) and come back in power for a third term. The BJP is expected to lose some ground in urban centres given the high rate of inflation. However, governments have come back to power with higher inflation rates in India. Further, the rural economy has been shielded from the impact of food inflation owing to the government’s free food grain scheme that provides 80mn families across the rural sector with free food grains. As a consequence, what the BJP would lose in urban centres, it would have gained in rural India.

If the BJP returns to power with a strong majority, several new reforms are expected to be prioritised:

Uniform Civil Code: Implementation of a uniform civil code to streamline personal laws.

New Farm Laws: Reintroduction and modification of farm laws to boost agricultural productivity and market access.

Labor Reforms: Enhancements in labor laws to increase flexibility and promote job creation.

Privatisation: Accelerated privatisation of state-owned enterprises to improve efficiency and reduce fiscal burdens.

Digital Economy Initiatives: Expansion of digital infrastructure and policies to support the growth of the digital economy.

Infrastructure Development: Continued focus on large-scale infrastructure projects to enhance connectivity and economic growth.

Historical Market Performance Post-Elections

Historically, India's markets have shown significant volatility in the aftermath of elections, driven by the perceived stability / instability and policy direction of the new government:

2004 Elections: The unexpected loss of the NDA led by the BJP resulted in the Sensex falling 17% in one day, a 2% weakening of the INR against the USD over three months, and a 150bps increase in 10-year bond yields.

2009 Elections: The UPA's stronger-than-expected victory led to a 10% rise in the Sensex, a 2% strengthening of the INR, and a gradual increase in 10-year bond yields as markets reacted positively to the decisive mandate.

2014 Elections: The BJP's decisive victory saw a significant rally in equities and strengthening of the INR, reflecting market optimism about economic reforms and policy stability.

2019 Elections: The BJP's re-election led to a positive market reaction, with the Sensex and INR showing gains due to expectations of continued reforms and economic stability.

As India navigates through the 2024 General Elections, market reactions will hinge significantly on the strength of the government mandate. A strong BJP victory would likely be positive for markets, while a weakened government or an opposition coalition could introduce volatility and policy uncertainty. Historical precedents suggest that market reactions can be pronounced, underscoring the importance of these elections not just for political stability but also for economic and market confidence. The anticipated reforms under a BJP government further highlight the potential for significant economic transformation, making the election outcomes critically important for investors and market participants.