USD, EUR, JPY flows: USD weakness dramatic

USD declines have been sharp and greater than suggested by yield spread moves. We may be seeing a sea change in sentiment

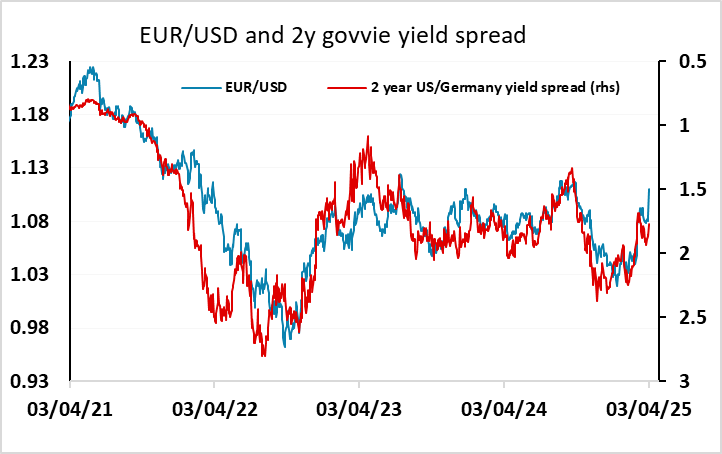

The USD has weakened dramatically in the aftermath of the US tariff announcement, with the EUR benefiting as much as the JPY in spite of the decline in equities and yields which would normally favour the more risk negative currencies. While the riskier currencies have generally underperformed, the EUR has outperformed, reflecting its status as the USD’s anti-pole or an alternative reserve currency. Having said this, the SEK has even outperformed the EUR, so this may be mostly about all the currencies with low yields outperforming, in part because there is less downside for yields from here.

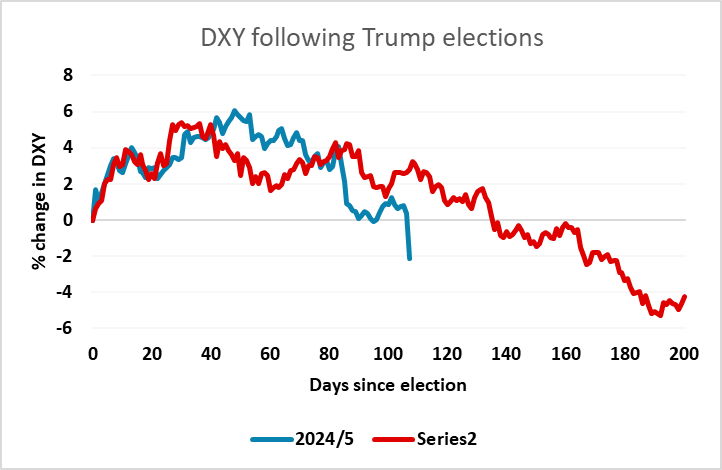

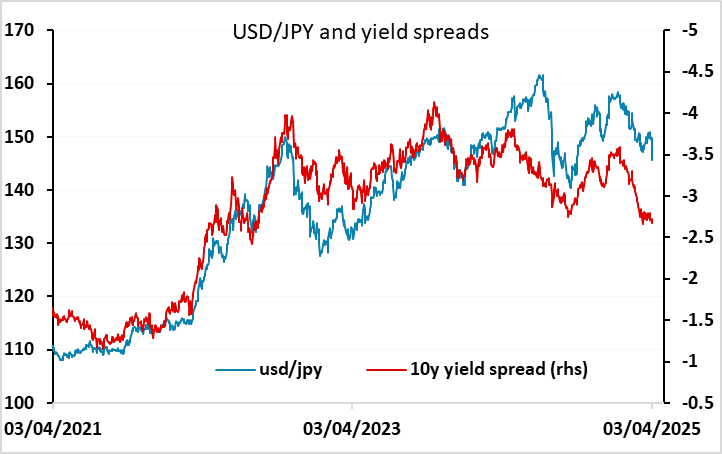

But the USD decline against the EUR is still much greater than a simple yield correlation suggests, while USD/JPY remains some distance above the level suggested by yield spreads. So this is not all about yield spreads, and there may be some shifting of reserves by central banks out of the USD taking place in response to the US tariff policy. There wasn’t anything surprising in today’s US data thus far, though we still have the ISM services survey to come. It’s rare for one day moves in the USD to be as much as 3%, so we are likely to be close to the bottom for the day, and could see some correction tomorrow. But from a big picture perspective this does look like something of a sea change for the USD, and to some extent mirrors what happened in the first Trump presidency, when initial USD strength gave way to dramatic USD weakness.