JPY flows: Downside risks increasing for USD/JPY

Yield spreads suggest significant downside risks, while intervention threats cap the upside

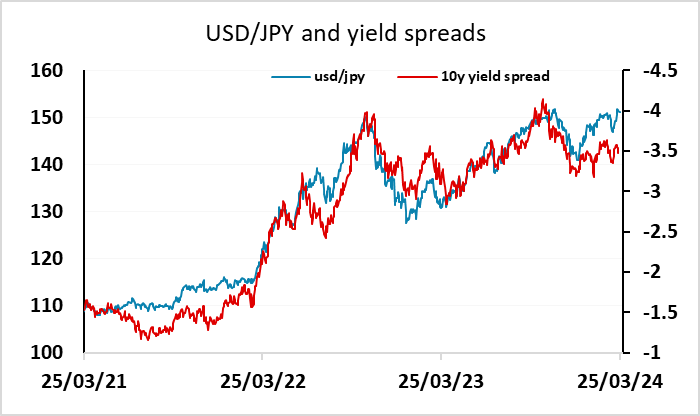

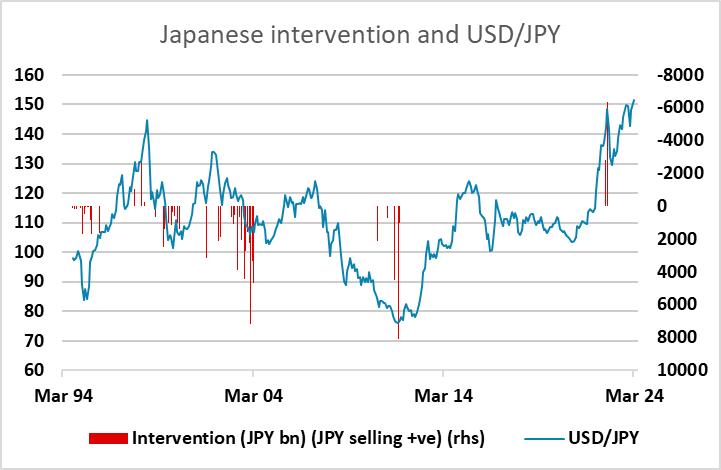

It’s a quiet start to what looks like being a quiet week for news, following a week of central bank decisions. Taking stock of the last week’s movements, it is increasingly hard to justify the strength of USD/JPY. Yield spreads have moved against the USD since the FOMC meeting, and the MoF’s Kanda was warning of potential FX intervention overnight, saying he was watching FX moves with a high sense of urgency. The MoF are more likely to intervene when USD/JPY gains are not supported by widening yield spreads, and USD/JPY is close to the 151.94 24 year high seen in October 2022. In reaching 151.86 on Friday USD/JPY has already hit a new real terms high for the floating era (starting in 1971), so there is every reason for a JPY recovery on value grounds.

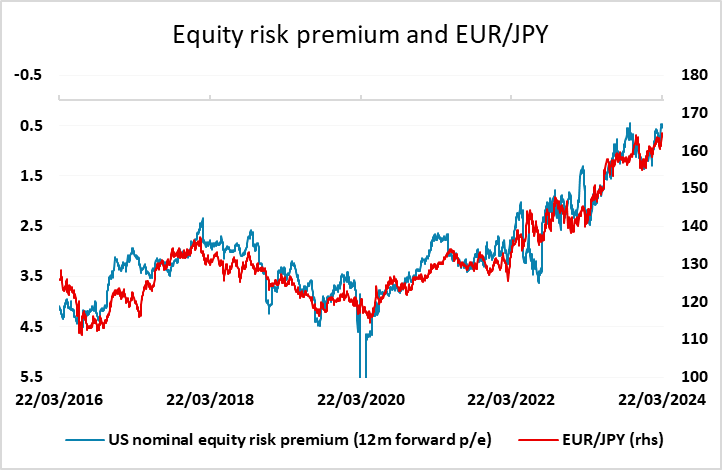

However, prospects for a JPY recovery continue to be limited by the risk positive market tone. The correlation of EUR/JPY with the US equity risk premium continues, and as long as risk sentiment is positive, carry traders will still favour high yielders in the current low volatility environment. Nevertheless, we would not expect this to continue indefinitely, and as western central banks move to cut rates in the coming months, the JPY is likely to be the main beneficiary.