JPY, EUR, CHF flows: JPY lower on Uchida comments

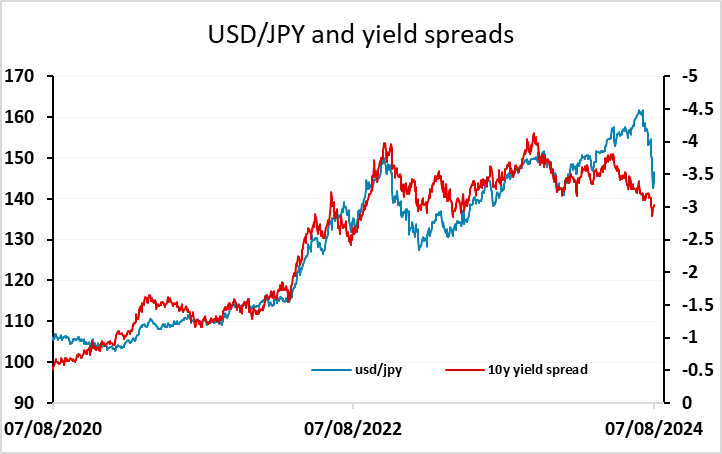

BoJ deputy governor Uchida's comments indicating that the BoJ would not tighten in unstable markets has helped USD/JPY correct higher. More corrective pressure may be seen today, but underlying picture remains JPY positive

The main news overnight is the rise in USD/JPY in the back of comments from BoJ deputy governor Uchida, who said the BoJ wont raise rates if the market is unstable. This triggered a sharp recovery in the Nikkei and a similarly sharp rise in USD/JPY, and we may see a further correction in the risk negative trades today, with the JPY leading the way. There is scope for USD/JPY to push up as far as 150 without undermining the new downtrend, while EUR/CHF can rally back to 0.95 without reversing the recent trend. The higher yielders also have some scope to recover, although they are mostly back to their levels seen on July 30 against the USD and EUR. From that point, GBP is somewhat weaker while the EUR and particularly the SEK are stronger against the USD.

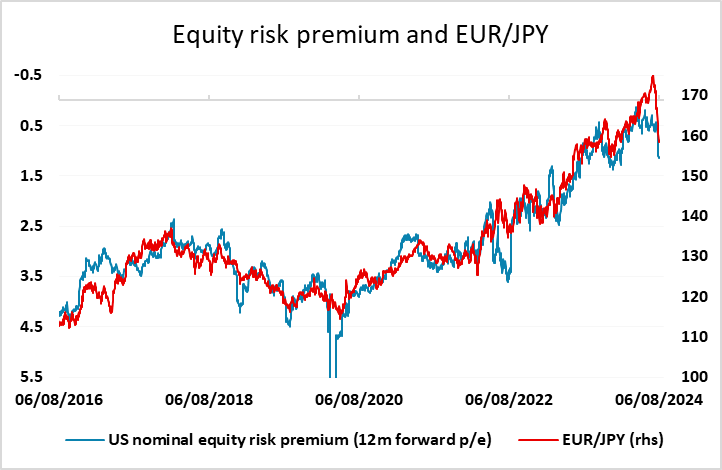

However, we would not regard Uchida’s comments as changing the underlying story. The BoJ is still likely to tighten going forward, and yield spreads still suggest downside risk for USD/JPY already. The JPY remains extremely cheap from a longer term perspective. The US equity market still looks expensive if we are seeing slowing US growth, and rising equity risk premia still suggest scope for JPY gains on the crosses. So while we may see an extended correction top recent JPY gains, longer term players are likely to be buying JPY before 150.

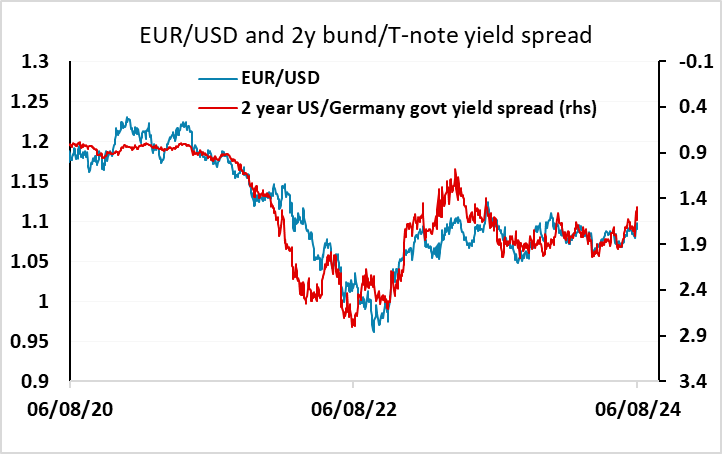

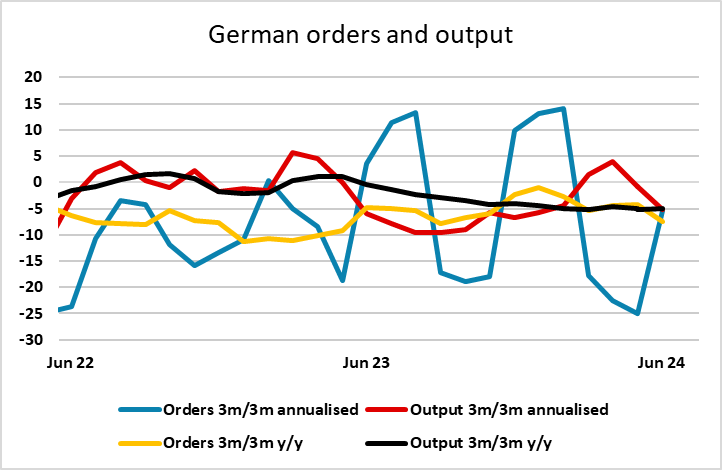

This morning’s German industrial production data was, like yesterday’s German orders data, a little stronger than expected, but the data doesn’t change the story that the underlying trend remains weak. EUR/USD looks a little low compared to current short term yield spreads, so there may be scope for a bit of an advance form 1.09, but we would still not expect any test of 1.10 short term with the European economic picture still very uncertain.